What if you could invest your money and see significant returns in just a couple of days? Sounds tempting, right? But before you jump in, let’s take a thorough look at the platform in question—Robincapitaltrader.com—and uncover what lies beneath its glossy exterior.

Understanding Robincapitaltrader.com

Robincapitaltrader.com positions itself as a sophisticated cryptocurrency trading and investment service. It claims to cater to high net worth individuals, institutional clients, and family offices with personalized wealth management solutions. From the outside, it may look appealing, but it’s essential to dig deeper into what they actually offer.

Investment Plans Offered

The platform presents a range of investment plans with various projected returns. Here’s a breakdown of what they offer:

| Investment Plan | Return Rate | Min Investment | Max Investment | Referral Commission |

| Basic Plan | 5% after 24 hours | $150 | $899 | 8% |

| Premium Plan | 10.5% after 48 hours | $900 | $4,999 | 8% |

| Master Plan | 11% after 48 hours | $5,000 | $9,999 | 8% |

| VIP Plan | 15% after 48 hours | $10,000 | Unlimited | 8% |

While these return rates might seem enticing, they are alarmingly unrealistic when you consider standard investment practices.

Key Concerns with Robincapitaltrader.com

Even though the platform portrays itself as a reliable investment opportunity, several red flags indicate potential risks. Let’s explore these concerns to understand why you should be cautious.

Unrealistic Return Promises

One of the biggest warning signs in the investment world is unrealistic return promises. When a platform guarantees returns like 5% after just 24 hours or 15% after 48 hours, it often signifies questionable practices. High-Yield Investment Programs (HYIPs) are notorious for making such claims, frequently leading to financial loss.

Lack of Transparency

Transparency is vital for any investment platform. Robincapitaltrader.com veils itself in ambiguity with little to no verifiable information regarding its ownership or physical location. The absence of a clear line of communication can be troubling. If you were to face any issues, would you know how to seek help?

Moreover, it’s concerning when you find that the content on a website appears to be lifted from other reputable sources, as this suggests a lack of original insight or expertise.

Negative Reviews and User Experiences

User experiences often reveal the underlying truth about a platform. From various online reviews, some investors have reported serious issues. Instances of accounts being blocked after withdrawal requests have surfaced. This is a common tactic used in many fraudulent schemes to retain funds and prevent users from accessing their earnings.

Low Trust Scores

Independent review websites have assigned Robincapitaltrader.com low trust scores. If you consider that these scores are often based on user feedback, expert analysis, and the presence of red flags, low scores should make you reconsider any potential investment. High-risk platforms exemplify characteristics common to scams.

The Red Flags You Should Notice

It’s essential to identify some specific red flags that may signal trouble with Robincapitaltrader.com. Let’s take a closer look at these alerts.

Absence of Regulation

A significant concern is the lack of regulatory oversight. Without proper regulation, there’s little accountability for the platform’s operations. Legitimate investment firms operate under strict regulatory bodies to protect their clients. If a company is not registered or regulated, you should proceed with extreme caution.

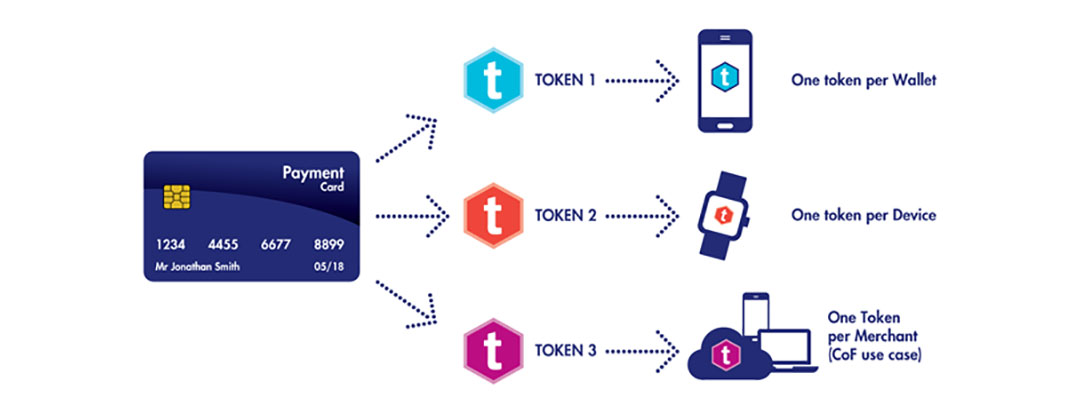

Limited Payment Options

When it comes to conducting transactions, variety often breeds trust. If a platform only accepts a limited range of payment methods or focuses solely on cryptocurrencies, it could be an issue. Diversified payment options usually indicate transparency and cater to investor security.

Pressure Tactics

If you ever feel hurried or pressured to invest your money, that’s a massive red flag. A trustworthy platform allows you to take your time, do your research, and make informed decisions. High-risk platforms often utilize pressure tactics to drive immediate investments without thorough consideration.

Lack of Client Support

Robincapitaltrader.com claims to offer 24/7 support, but the effectiveness of that support matters most. Users have reported poor responses or complete lack of assistance when seeking help. Reliable platforms pride themselves on having robust support systems in place.

Conclusion: Is Robincapitaltrader.com Worth It?

Given all the red flags and concerns highlighted, moving forward with an investment in Robincapitaltrader.com could prove risky. The combination of unrealistic return promises, a lack of transparency, negative reviews, and low trust scores paints a troubling picture of its operations.

Your Best Option: Safer Investments

If you’re looking to invest your hard-earned money, it’s vital to seek out well-regulated, trustworthy platforms. Focus on those that provide consistent, realistic returns and transparent operations. Always conduct thorough research and consider consulting financial professionals before making investment decisions.

Instead of following the allure of high returns with platforms like Robincapitaltrader.com, consider building a diverse investment portfolio with established brokers and firms that prioritize client safety and regulatory compliance.

Final Thoughts

You deserve to invest your money in a secure and trustworthy environment. Keep your financial interests safe by being vigilant and informed. Always think twice before jumping on opportunities that look too good to be true. Your financial wellbeing is paramount, so prioritize transparency, credibility, and a solid track record in your investment choices.