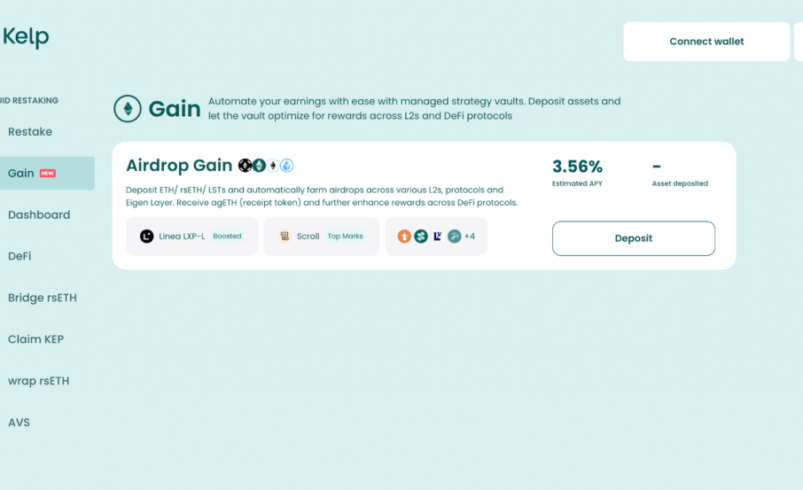

What if there was a way for you to maximize your returns in the ever-evolving landscape of decentralized finance (DeFi)? With the introduction of Kelp’s new product, “Gain,” there are compelling opportunities at your fingertips. This yield optimizer not only simplifies the process of yield farming but also opens doors to participating in airdrops across Layer 2 networks. Let’s break this down together!

What is Kelp’s Gain Yield Optimizer?

Kelp, a protocol renowned for its innovative approaches in the DeFi space, has launched a new automated yield optimizer called “Gain”. This service is thoughtfully designed to help you maximize your yields from liquid staking tokens (LSTs) and its unique liquid restaking token (LRT), known as rsETH. The ease of use provided by Gain is striking; you can essentially sit back and let the platform do the heavy lifting.

Understanding Liquid Staking Tokens (LSTs)

Before diving deeper into Gain, let’s clarify what liquid staking tokens are. When you stake cryptocurrencies, you typically lock them up for a certain period, which can be a hurdle if you want to utilize those assets elsewhere. Liquid staking, however, allows you to stake your tokens while still providing you with liquid tokens that you can trade or utilize in other DeFi engagements.

With Gain, you’ll deposit these LSTs (like rsETH) into specialized vaults. This setup facilitates yield farming across various Layer 2 networks, where your assets are smartly deployed for maximum returns.

How Does Gain Work?

Understanding how Gain optimizes your returns can empower you to make the most of this innovative product. Here’s a detailed breakdown:

Depositing into Gain

When you choose to use Gain, you start by depositing supported assets, including rsETH. This deposit is not just a mere transfer; it’s a strategic maneuver that positions your assets across multiple partnered Layer 2 networks.

Optimized Yield Farming

Gain is engineered to employ sophisticated strategies in yield farming. By utilizing pools across different platforms, your assets work round the clock to generate returns. The goal is not only to earn rewards but also to accumulate points that can lead to potential token airdrops when governance tokens are issued.

Liquid Token Rewards

One of the standout features of Gain is the issuance of fungible tokens, like agETH. This liquid token represents your share of the deposits within Gain’s vaults. You can either hold onto agETH, which continues to earn rewards, or sell it on the open market if you want to exit your position.

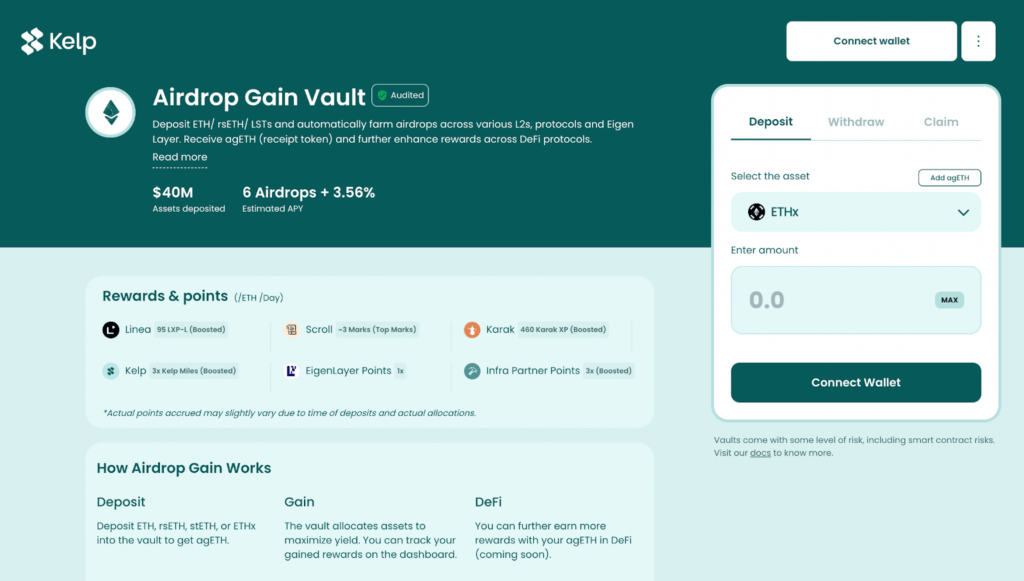

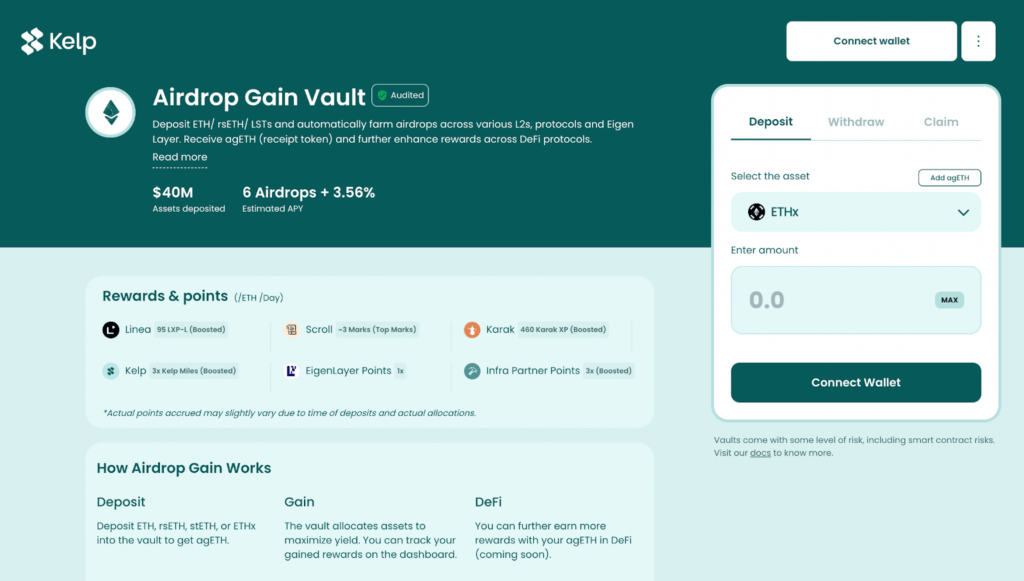

The Airdrop Gain Vault

Let’s look closely at one of Gain’s flagship products, the Airdrop Gain Vault. This component is particularly exciting for anyone looking to benefit from airdrops while managing their assets effectively.

How to Participate in Airdrops

Within the Airdrop Gain Vault, you can deposit tokens such as ETH, stETH, ETHx, and rsETH. Your deposits will then be pooled into a diversified strategy that allocates resources to various projects.

| Token Type |

Allocation Percentage |

| Linea |

45% |

| Scroll |

35% |

| Karak |

20% |

The vault also deducts a modest 2% of the rewards earned by users, which is a fair trade-off given the potential for higher returns.

Benefits of the Airdrop Gain Vault

Participating in the Airdrop Gain Vault is beneficial as it streamlines your entry into multiple airdrop opportunities. With just one action, you’re diversifying your portfolio while optimizing returns. It’s a great way to engage with emerging Layer 2 networks that are ripe for exploration.

Strategic Partnerships

The development of Gain has not been done in isolation. Kelp has partnered with notable players in the industry to enrich the product’s offerings.

Key Partners

- August (formerly Fractal Clearing): This partner provides the underlying infrastructure that facilitates Gain’s operations.

- Tulipa Capital: This company is responsible for optimizing vault strategies to ensure that users maximize their returns.

- LayerZero: This partner aids in ensuring smooth interoperability across various Layer 2 networks.

Integration with Other DeFi Platforms

Moreover, Gain seamlessly integrates with well-known DeFi platforms such as Pendle, Balancer, and Uniswap. This integration allows you to leverage agETH in various yield strategies, ultimately enhancing your earning potential.

The Importance of DeFi Yield Optimization

Rethinking traditional finance, decentralized finance presents several opportunities for yield generation that may not exist elsewhere. Yield optimization, particularly through innovations like Kelp’s Gain, helps you navigate these waters more effectively.

Why Optimize Your Yields?

Yield optimization isn’t just about enhancing returns; it’s about maximizing value from the assets you already possess. With the volatile nature of cryptocurrencies, having strategies in place for yield farming and reward acquisition can act as a buffer against market fluctuations.

Conclusion: Why You Should Consider Kelp’s Gain

In a space that is continuously evolving, Kelp’s Gain gives you a unique edge by allowing you to participate in the DeFi ecosystem more effectively. As you engage with multiple Layer 2 networks, you create opportunities not only for yield farming but also for receiving future airdrop rewards.

Imagine a scenario where your assets work tirelessly while you focus on future endeavors. With Gain, that scenario becomes a reality. By effectively utilizing liquid staking tokens and participating in diversified vault strategies, you’re well on your way to optimizing your DeFi yields.

About Kelp

Understanding the foundation from which Kelp operates can help you appreciate the meticulous design of Gain. Kelp is a liquid restaking protocol, boasting a total value locked (TVL) of over $700 million.

Functions of Kelp

Kelp allows you to maximize staking rewards by restaking popular tokens like ETH, stETH, and ETHx on EigenLayer. Your stakes are represented in the form of rsETH, which not only participates in the liquidity of DeFi but also enhances your staking rewards.

Engaging with Other DeFi Applications

The liquid restaking capabilities provided by Kelp facilitate better liquidity and swaps within DeFi. This integrated approach ensures you have optimal flexibility and access to a broader range of financial strategies.

Final Thoughts

As you ponder ways to maximize your crypto investments, Kelp’s Gain emerges as a promising avenue. It streamlines the complexities of yield farming and opens doors to potential rewards that can seem daunting in the decentralized finance landscape. By leveraging this tool, you can enhance your crypto experience while participating in innovative strategies across Layer 2 networks.

Stay informed, and take charge of your financial future with the help of cutting-edge DeFi solutions like Kelp’s Gain. With this newfound knowledge, you’re certainly better equipped to make informed decisions in your cryptocurrency journey.