Russia’s Crypto Revolution: Exclusive Exchange for Elite Investors

In a surprising move, Russia is set to launch a groundbreaking cryptocurrency exchange – but not for everyone. 🚀 Finance Minister Anton Siluanov’s recent announcement has sent shockwaves through the crypto world, revealing plans for a platform exclusively catering to “super-qualified investors.” This bold initiative marks a significant shift in Russia’s approach to digital assets, promising to bring cryptocurrency transactions into the legal spotlight while maintaining strict control.

But here’s the catch: only the crème de la crème of investors need apply. 💼 With eye-watering qualification criteria, including investments exceeding ₽100 million or annual incomes over ₽50 million, this exchange is clearly not for the average crypto enthusiast. As Russia treads carefully into the crypto realm, balancing regulation and innovation, many questions arise. How will this exclusive platform impact the broader cryptocurrency landscape? What options remain for those who don’t meet the stringent criteria? And most importantly, is Russia on the cusp of a crypto revolution, or is this just another cautious step in a long regulatory dance?

Whether you’re an experienced investor or just starting out, you can explore the world of cryptocurrency with Crypto.com. Click here to learn more and begin your investment journey today!

Russia’s New Cryptocurrency Exchange Initiative

A. Announcement by Finance Minister Anton Siluanov

In a significant development for Russia’s cryptocurrency landscape, Finance Minister Anton Siluanov recently unveiled plans to establish a crypto exchange targeted at “highly-qualified” investors. This announcement, made during a ministry board meeting, signals a pivotal shift in Russia’s approach to digital assets. Siluanov emphasized that this initiative aims to “legalize crypto assets and bring crypto operations out of the shadows,” highlighting the government’s intent to regulate and integrate cryptocurrencies into the formal financial system.

B. Part of broader digital asset regulation strategy

This new cryptocurrency exchange initiative is not an isolated effort but part of a comprehensive strategy to regulate digital assets in Russia. The plan involves collaboration between the Finance Ministry and the Central Bank, two entities that have historically held divergent views on cryptocurrency regulation. This cooperation represents a notable shift in priorities, driven by:

- Geopolitical pressures

- The need for alternative cross-border transaction channels

- A desire to enhance Russia’s financial technology ecosystem

| Aspect | Previous Stance | New Approach |

|---|

| Central Bank | Strict regulations | Collaborative oversight |

| Finance Ministry | Push for legalization | Implementation of controlled exchange |

| Overall Strategy | Divergent views | Unified approach to digital asset regulation |

C. Focus on “super-qualified investors”

The proposed crypto exchange is specifically designed for a select group of investors, referred to as “super-qualified” or “highly-qualified” investors. This targeted approach is defined by stringent criteria:

- Investments over 100 million rubles (approximately $1.2 million)

- Annual incomes exceeding 50 million rubles ($600,000)

The exchange will operate under an experimental legal regime (ELR), proposed by the Central Bank in March. This framework aims to:

- Provide a secure environment for crypto trading

- Maintain government control over the digital asset market

- Prevent illicit activities

- Potentially allow access to derivatives and securities linked to digital assets

With this new initiative in place, Russia aims to reduce its investors’ reliance on foreign platforms for cryptocurrency transactions, while also positioning itself as a potential hub for regional crypto innovation.

Now that we have covered Russia’s new cryptocurrency exchange initiative, we’ll explore the legal framework and restrictions that will govern this groundbreaking development in the next section. Interested in investing in crypto? Crypto.com makes it accessible for everyone, regardless of your experience level. Click the link to discover how easy it is to get started!

Legal Framework and Restrictions

Now that we’ve explored Russia’s new cryptocurrency exchange initiative, let’s delve into the legal framework and restrictions surrounding this development.

A. Experimental legal context for cryptocurrency transactions

Russia’s approach to cryptocurrency regulation is evolving through an experimental legal framework. The State Duma has passed two significant bills that will shape the future of digital currency transactions in the country:

- Effective November 1, 2024: Legalizes cryptocurrency mining

- Effective September 1, 2024: Creates an experimental regime for cross-border transactions

These bills establish a structured environment for crypto activities while maintaining strict oversight. The Bank of Russia will play a crucial role in supervising cross-border transactions in digital currencies, allowing companies to apply for participation in this framework.

B. Prohibition on domestic payments using cryptocurrencies

Despite the progress in regulation, Russia maintains a clear stance on the use of cryptocurrencies for domestic transactions:

| Prohibited | Allowed |

|---|

| Payments for goods and services | Buying and holding as financial instruments |

| Advertising of cryptocurrency | Trading under Central Bank supervision |

This prohibition aims to mitigate public investment in high-risk financial products and maintain financial stability within the country.

C. Allowance for buying and holding digital assets

While domestic payments are restricted, Russia does permit certain activities related to digital assets:

- Buying cryptocurrency through reputable exchanges

- Holding digital assets as financial instruments

- Trading foreign digital financial assets under Central Bank supervision

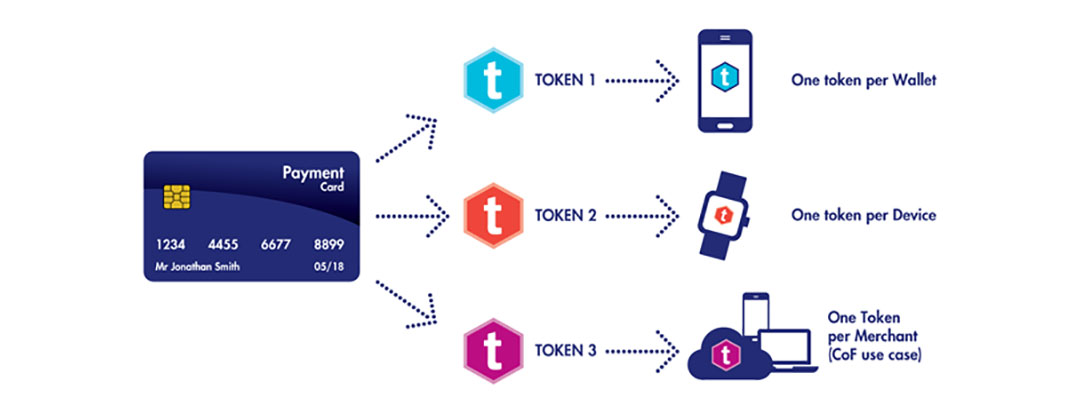

The process of acquiring cryptocurrency in Russia typically involves:

- Selecting a reputable exchange

- Completing KYC verification

- Funding an account

- Securing purchased assets in a wallet

It’s important to note that the Central Bank retains the authority to restrict specific cryptocurrencies deemed harmful to financial stability. This cautious approach balances the potential benefits of digital currencies with the associated risks.

With this legal framework in mind, next, we’ll explore the investor qualification criteria for participating in Russia’s new cryptocurrency exchange.

Investor Qualification Criteria

Now that we’ve covered the legal framework and restrictions surrounding Russia’s new cryptocurrency exchange initiative, let’s delve into the specific criteria that investors must meet to participate in this exclusive market.

A. Minimum investment threshold of ₽100 million

The Central Bank of Russia has proposed stringent requirements for investors seeking access to the state-backed crypto exchange. At the forefront of these criteria is a substantial minimum investment threshold of 100 million rubles, which is approximately $1.1-1.2 million. This high bar ensures that only investors with significant financial resources can participate in the exchange.

B. Annual income requirement of ₽50 million

In addition to the investment threshold, potential participants must also demonstrate a considerable annual income. The current proposal sets this requirement at 50 million rubles, roughly equivalent to $550,000-$600,000 per year. This dual approach of assessing both assets and income aims to further narrow the pool of eligible investors.

C. Ongoing review of qualification thresholds

It’s important to note that these criteria are not set in stone. The Finance Ministry and Central Bank are engaged in ongoing discussions with stakeholders, which may lead to modifications of these thresholds. This flexibility allows for potential adjustments based on market conditions and regulatory objectives.

| Criteria | Requirement | Approximate USD Equivalent |

|---|

| Minimum Investment | ₽100 million | $1.1-1.2 million |

| Annual Income | ₽50 million | $550,000-$600,000 |

These stringent requirements effectively limit participation to what officials term “super-qualified” or “highly-qualified” investors. The rationale behind these high thresholds includes:

- Ensuring financial stability of participants

- Limiting exposure to potential market volatility

- Facilitating better regulatory oversight

- Aligning with the experimental legal regime (ELR) framework

With these investor qualification criteria in mind, we’ll next explore alternative access to cryptocurrency markets for those who don’t meet these high thresholds, including options like crypto-linked derivatives and other financial products tied to digital asset values.

Alternative Access to Cryptocurrency Markets

Now that we have covered the investor qualification criteria for Russia’s new cryptocurrency exchange, let’s explore alternative access to cryptocurrency markets for those who may not meet these requirements.

A. Derivatives linked to crypto asset prices

For investors seeking exposure to cryptocurrency markets without direct ownership, derivatives offer a viable alternative. These financial instruments derive their value from underlying crypto assets, providing a way to participate in the market’s movements. Here’s a breakdown of popular crypto derivatives:

| Derivative Type | Description | Key Advantage |

|---|

| Futures | Contracts to buy/sell crypto at a future date | Price speculation |

| Options | Right to buy/sell crypto at a set price | Limited risk exposure |

| Swaps | Exchange of crypto-related cash flows | Hedging strategies |

Deribit, a prominent cryptocurrency derivatives exchange, reported a staggering $1.1 trillion trading volume in 2024, marking a 95% increase from the previous year. This surge in derivatives trading underscores the growing interest in these financial instruments as an alternative to direct crypto ownership.

B. Options for investors not meeting qualification criteria

For those who don’t meet the stringent requirements of Russia’s new cryptocurrency exchange, several options remain available:

- Centralized exchanges: In December 2024 saw record-breaking combined spot and derivatives trading volumes on centralized exchanges, indicating their continued popularity.

- Decentralized finance (DeFi) platforms: These offer access to various crypto assets without strict KYC requirements.

- Crypto-linked investment products: ETFs or trusts that track cryptocurrency prices without direct ownership.

- Peer-to-peer (P2P) trading: Platforms that facilitate direct transactions between buyers and sellers.

It’s important to note that while these alternatives provide access to cryptocurrency markets, they may come with their own set of risks and regulatory considerations. Investors should conduct thorough research and consider seeking professional advice before engaging in any crypto-related investments.

With this in mind, next, we’ll explore the implementation timeline and challenges facing Russia’s new cryptocurrency exchange initiative, including potential regulatory hurdles and market adoption issues.

Implementation Timeline and Challenges

Now that we’ve explored alternative access to cryptocurrency markets, let’s delve into the implementation timeline and challenges facing Russia’s new cryptocurrency exchange initiative.

Launch date yet to be finalized

The exact launch date for Russia’s experimental crypto exchange remains uncertain. While the Central Bank of Russia and the Finance Ministry are actively preparing for this initiative, the timeline is still in flux. This cautious approach reflects the complexity of establishing a regulated cryptocurrency platform in a country where digital assets have faced significant scrutiny.

Estimated timeframe beyond six months

According to Finance Minister Anton Siluanov, the development and launch of the exchange are expected to take at least six months. This extended timeline allows for:

- Thorough regulatory framework development

- Technical infrastructure setup

- Security measures implementation

- Investor vetting processes establishment

| Phase | Estimated Duration |

|---|

| Regulatory Framework | 2-3 months |

| Technical Setup | 3-4 months |

| Security Implementation | 1-2 months |

| Investor Vetting Process | Ongoing |

Central Bank’s opposition to cryptocurrency as legal tender

A significant challenge facing the implementation of this exchange is the Central Bank of Russia’s stance on cryptocurrencies. The bank does not recognize digital assets like Bitcoin, Ethereum, or XRP as legal tender, which creates a complex regulatory environment. This opposition has led to the following compromises:

- The exchange will focus on “highly qualified investors” with substantial portfolios or high incomes

- Investments will be limited to settlement-based securities and derivative financial instruments

- Direct cryptocurrency delivery will not be permitted

These restrictions aim to balance the potential benefits of cryptocurrency investments with the Central Bank’s concerns about volatility and risks associated with digital assets. As the implementation progresses, navigating this regulatory landscape will be crucial for the success of Russia’s cryptocurrency exchange initiative.

Russia’s cautious approach to cryptocurrency regulation is evident in its new initiative to establish a cryptocurrency exchange for select, highly qualified investors. This move reflects the country’s attempt to balance the potential of digital assets with strict oversight and control. While the exchange offers a legal avenue for cryptocurrency transactions, it remains exclusive, with stringent qualification criteria limiting access to a small pool of wealthy investors.

As Russia navigates this experimental legal framework, the cryptocurrency landscape in the country continues to evolve. For those unable to participate directly in the new exchange, alternative options like crypto-linked derivatives may provide exposure to the market. As the implementation timeline unfolds and regulatory challenges are addressed, it will be crucial for investors and industry observers to stay informed about developments in Russia’s cryptocurrency regulations and their potential impact on the global digital asset ecosystem. No matter your experience, you can invest in cryptocurrencies with Crypto.com. Click the link to learn how to take your first steps into the crypto market!