Blockchain technology and Bitcoin have evolved from being seen as just digital currencies or assets to being recognized as powerful tools for enhancing security, transparency, and efficiency for governments and large organizations globally. There are several compelling reasons why adoption of Bitcoin and blockchain solutions is rapidly increasing among public and private sector institutions worldwide.

Enhanced Security and Reduced Fraud

One of the most crucial advantages that Bitcoin offers is radically enhanced security and reduction of fraud through its decentralized blockchain ledger. Unlike traditional databases or accounting systems, the Bitcoin blockchain is distributed across countless nodes on a peer-to-peer network secured by powerful cryptography. This makes it virtually impossible to hack or alter historical transaction data, offering governments a way to greatly minimize fraud or embezzlement of public funds.

Services like proof of reserves can also enable real-time auditing of reserves to ensure their validity. The immutable nature of the blockchain provides peace of mind for citizens that records like land registries or voting tallies cannot be altered after the fact by corrupt officials. Features like multi-signature addresses allow setting up wallets that require approval by multiple designated parties to access funds, ideal for public works projects.

Governments can also leverage the blockchain to issue official digital IDs to citizens that are extremely secure and reduce identity theft. The applications for improving security are immense for domains ranging from law enforcement to public healthcare and taxation systems.

Transparency and Auditability

The publicly verifiable Bitcoin ledger enables unprecedented transparency for financial transactions and activity by governments, charities, or any entity. Citizens can follow exactly where public funds are being allocated and track expenditures to reduce misuse of budgets and promote accountability. Donors can verify how charities use their monetary contributions down to the last cent without relying on third parties.

The transparency provided by the blockchain also facilitates auditing of operations to prevent issues like double spending without requiring centralized control. Regulators can independently verify company solvency or reserves as well. Furthermore, the transparency enables oversight of government operations by external bodies like journalists, activists and policy groups. This can work to minimize corruption and ensure equitable treatment of citizens.

Lower Fees for Cross-Border Transfers

Transferring money and assets across borders using traditional banking channels can be an extremely lengthy and expensive process loaded with fees at both ends. Governments and large international charities routinely need to send funds overseas for purposes like foreign aid or paying contractors. With Bitcoin, these transfers can be completed securely for a fraction of the fees and time.

This is done through wallets seamlessly exchanging currencies vs. wire transfers getting locked up for days while clearing numerous intermediary banks. Individual citizens also benefit tremendously from lower cost remittances using Bitcoin, being able to support families back home without losing a huge percentage to fees. Looking ahead, central bank digital currencies built on blockchain technology will likely offer similar advantages.

Financial Inclusion

One of the most revolutionary aspects of Bitcoin is that it enables financial inclusion by providing access to digital payments and assets to those without traditional bank accounts. There are billions worldwide who remain unbanked – unable to easily receive or send money digitally. Bitcoin smart contracts and apps provide the unbanked with financial autonomy.

Governments can use blockchain platforms to disseminate welfare or unemployment benefits, issue refunds, collect taxes, and much more without requiring citizens to set up bank accounts. All that is needed is a digital wallet. Citizens in remote towns and villages can gain access to lending, savings and other facilities that centralized banking excludes. Countries with unstable currencies ravaged by inflation or corruption stand to benefit greatly from adopting digital currency alternatives.

Preservation of Value

In countries suffering from hyperinflation, government mismanagement, or economic instability, Bitcoin offers citizens a way to preserve their wealth and savings against devaluation. Bitcoin acts as a hedge against inflation and currency debasement. While local fiat currency may become worthless, Bitcoin retains its value due to the decentralized fixed supply that cannot be manipulated by any central authority.

The ability to store value in Bitcoin empowers citizens globally to protect earnings and accumulate capital even in unfavorable conditions by simply adopting a robust digital alternative to weak local tender. El Salvador became the first country to declare Bitcoin legal tender in 2021, a forward-thinking move considering their previous reliance on the USD amidst high inflation.

Revenue Generation and Tech Innovation

While governments can benefit tremendously by leveraging Bitcoin’s advantages, widespread adoption and integration also provides opportunities to generate revenue through taxation and fostering technological innovation.

Early-adopter countries are discovering new income streams by taxing Bitcoin mining operations, exchange trading, or BTC-based incomes. Governments invested in growing their innovation sectors look to become hubs for blockchain development talent and enterprises. Setting up special regulatory zones to test blockchain and crypto technologies can attract investment and talent.

Mainstream adoption of blockchain-based apps also has follow-on effects spurring IT spending, training, and jobs. Becoming pioneers in effectively using Bitcoin for public services makes countries more appealing for human capital in tech fields and young innovators as opposed to lagging with antiquated systems. Prioritizing agile integration of blockchain is the future.

Conclusion

Bitcoin’s digital currency innovation has progressed far beyond speculative volatility into a mature asset class and powerful decentralized network for enhancing security, transparency, accessibility and efficiency for institutions worldwide. The blockchain revolution empowers governments to serve citizens better by fixing chronic problems with modernization, accountability and fraud reduction.

Beyond governmental usage, global charities, corporations and organizations stand to benefit immensely as well from harnessing Bitcoin and blockchain technology. The advantages range from increased transparency and auditability to lower overhead costs and accelerated innovation. Despite misconceptions and negativity, Blockchain technology including Bitcoin is here to stay and rapidly changing the fabric of finance and society for the better.

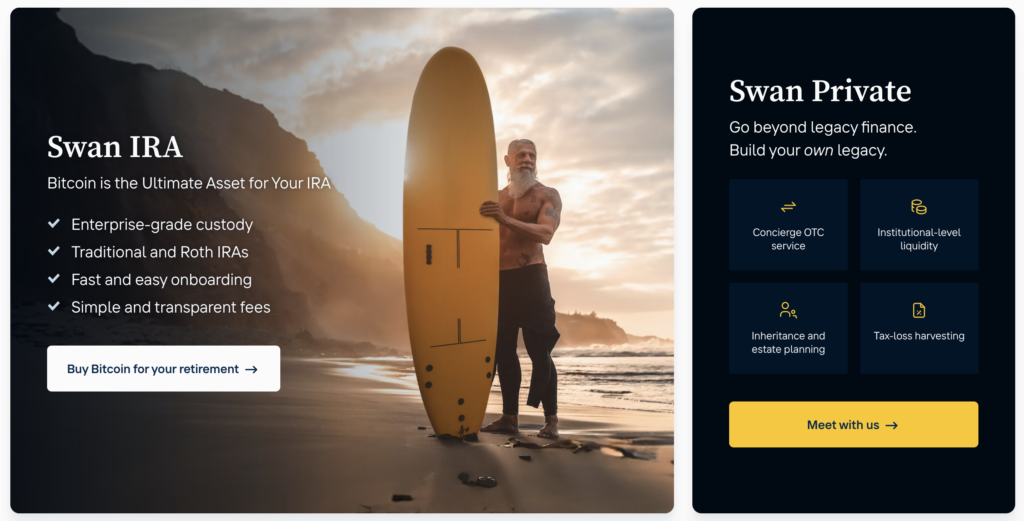

Experience True Financial Freedom with Bitcoin – Join Swan Today!

Tired of high fees and lagging transfer times from traditional banks? Concerned about the devaluation of fiat currencies due to reckless inflation? Looking for an alternative way to securely grow your wealth?

Then it’s time you joined Swan Bitcoin – the premier platform for easily auto-accumulating Bitcoin with industry-low fees and 24/7 dedicated support.

Swan makes entering the world of Bitcoin investing simple and accessible for everyone. Let go of antiquated banking and take control of your financial future by harnessing the power of blockchain technology.

With customizable recurring purchases, deep cold storage security, and transparent fees – Swan is the trusted solution for first-time buyers and blockchain veterans alike.

Don’t get left behind in the digital currency revolution. Become a part of the future of finance today by signing up with Swan Bitcoin.

Take the first step towards independence from traditional finance – join Swan now and start auto-accumulating Bitcoin into a new era of personal finance!