Are you tired of feeling powerless in the volatile world of cryptocurrency trading? 🎢 Traditional Automated Market Maker (AMM) systems often leave traders at the mercy of market fluctuations, limiting their control over trade execution. But what if there was a way to take charge of your trades and maximize your potential in the decentralized finance space?

Enter Carbon DeFi, a revolutionary platform that’s changing the game with its sophisticated limit order feature. Powered by the innovative Arb Fast Lane, Carbon DeFi’s built-in solver system sources liquidity from major DEXes, offering traders unprecedented precision and speed in executing their orders. 🚀 This game-changing approach moves beyond conventional pool-based execution, putting the power back in your hands.

In this post, we’ll dive deep into the world of Carbon DeFi’s limit orders, exploring how the Arb Fast Lane works and uncovering strategies to supercharge your trading potential. We’ll also peek behind the curtain to understand the powerhouse that is Carbon DeFi, developed by Bancor and governed by the Bancor DAO. Ready to revolutionize your trading experience? Let’s embark on this exciting journey together! 💪

Revolutionizing Trading with Carbon DeFi’s Limit Orders

A. Overcoming limitations of traditional AMM systems

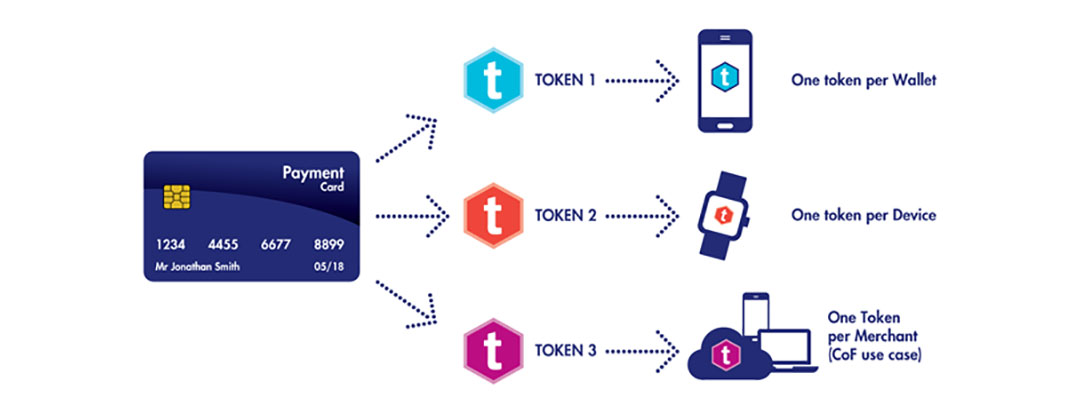

Carbon DeFi introduces a revolutionary approach to limit orders, addressing the shortcomings of traditional Automated Market Maker (AMM) systems. Unlike off-chain order systems that rely on opaque, permissioned nodes, Carbon’s on-chain limit orders offer:

- Full transparency

- Finality upon execution

- Protection against MEV attacks

- Positive contribution to market liquidity

This innovative model employs dual bonding curves for each liquidity position, eliminating the need for users to monitor their orders or depend on off-chain components. As a result, Carbon DeFi provides a more efficient and user-friendly solution for executing trades in the DeFi space.

B. Enhanced control and precision in trade execution

Carbon DeFi empowers traders with enhanced control and precision through its advanced order types:

- Single limit orders

- Range limit orders

- Automated recurring limit orders

| Order Type |

Description |

Benefit |

| Single limit |

Set a specific price for buy/sell |

Straightforward cost basis |

| Range limit |

Execute trades within price boundaries |

Efficient scaling of positions |

| Automated recurring |

Link trades across different tokens |

Seamless trading without immediate funds |

These order types allow makers to implement sophisticated trading strategies with ease. The platform’s “My Strategies” page enables users to manage their orders by:

- Modifying prices

- Adding or withdrawing funds

- Pausing or unpausing trading

- Deleting orders

C. Integration with Arb Fast Lane for optimal performance

Carbon DeFi’s limit orders are designed to work seamlessly with the Arb Fast Lane, maximizing trading potential and efficiency. Key features of this integration include:

- Zero trading fees for makers

- Adjustable order conditions without deletion

- Partial order filling capabilities

- Resistance to sandwich attacks

- Guaranteed quoted price without slippage

By combining these features with the Arb Fast Lane, Carbon DeFi ensures optimal performance for traders, allowing them to execute complex strategies with confidence and precision.

With this comprehensive understanding of Carbon DeFi’s limit orders and their revolutionary impact on trading, we’ll next explore the intricacies of the Arb Fast Lane in the following section, “Understanding the Arb Fast Lane.”

Understanding the Arb Fast Lane

Now that we’ve explored how Carbon DeFi is revolutionizing trading with its limit orders, let’s delve into the powerful mechanism behind these innovations: the Arb Fast Lane.

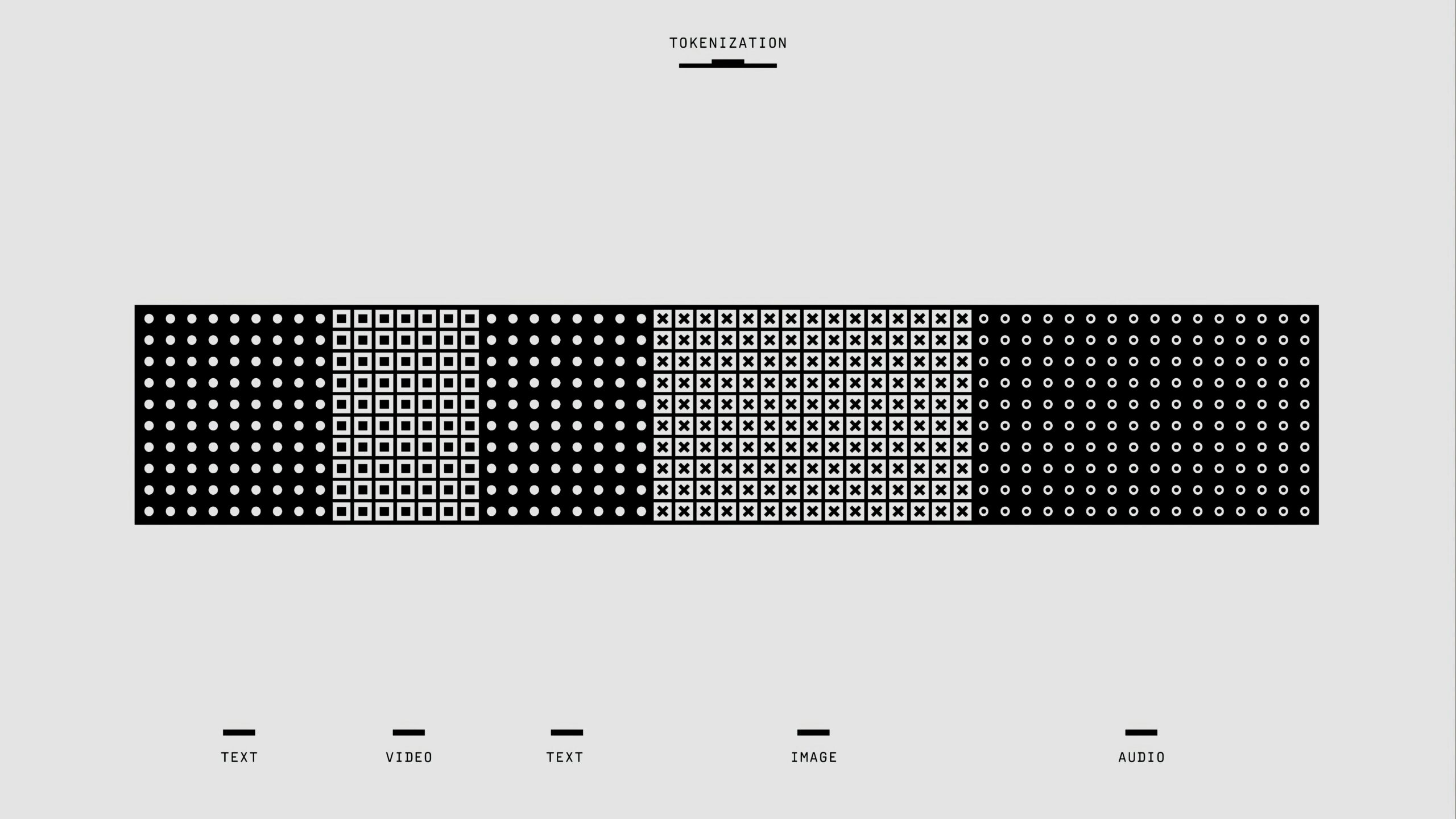

Built-in solver system for rapid execution

At the heart of Carbon DeFi’s Arb Fast Lane lies a groundbreaking built-in solver system that dramatically enhances execution speed. This system boasts a remarkable 200x improvement in execution speed compared to previous algorithms, setting a new standard for DeFi trading efficiency. The solver achieves extraordinary precision, with accuracy down to 15 decimal places, effectively eliminating slippage and ensuring optimal pricing for traders.

Sourcing liquidity from major DEXes

The Arb Fast Lane’s power extends beyond its speed, leveraging a vast network of liquidity sources:

- Integrations: 90+ across 10 blockchains

- Total Volume: Over $609 million

- Transactions: 1.9 million

- Total Arbitrage Value: Nearly $1 million

This extensive network allows Carbon DeFi to tap into deep liquidity pools, enhancing trade execution and minimizing price impact for users.

Moving beyond pool-based execution

Carbon DeFi’s Arb Fast Lane represents a paradigm shift in DeFi trading, moving beyond traditional pool-based execution methods. Here’s how it compares to conventional approaches:

| Feature |

Traditional Methods |

Carbon DeFi’s Arb Fast Lane |

| Optimization Approach |

Convex optimization |

Root-finding problems |

| Market Adaptability |

Limited |

Dynamic, real-time adaptation |

| Arbitrage Modes |

Limited |

Single, multi-pairwise, triangular |

| Execution Speed |

Slower |

200x faster |

| Precision |

Lower |

Up to 15 decimal places |

The Arb Fast Lane’s Multi-Triangle strategy maximizes capital efficiency across various Carbon DeFi curves, addressing critical issues in DeFi networks:

- Liquidity fragmentation

- Inefficient price discovery

- Low liquidity velocity

By tackling these challenges, Carbon DeFi ensures dynamic price equilibration, fosters sustained market engagement, and optimizes capital utilization within its ecosystem.

With this powerful foundation in place, we’ll next explore how traders can maximize their potential on Carbon DeFi, leveraging these advanced features to enhance their trading strategies and outcomes.

Maximizing Trading Potential on Carbon DeFi

Now that we’ve explored the Arb Fast Lane, let’s dive into how traders can maximize their potential on Carbon DeFi.

A. Placing limit orders effectively

Carbon DeFi’s innovative platform allows users to place limit orders with precision. By setting specific price points for buying or selling assets, traders can automate their strategies and capitalize on market movements. To place effective limit orders:

- Analyze market trends

- Set realistic price targets

- Consider order size and timing

- Monitor and adjust as needed

B. Exploring advanced trading strategies

Carbon DeFi’s integration of orderbook-like features enables users to implement sophisticated trading approaches:

| Strategy |

Description |

| Grid Trading |

Automate buy/sell orders across price ranges |

| Momentum Trading |

Capitalize on asset price trends |

| Pegged-Asset Arbitrage |

Exploit price differences between pegged assets |

C. Scaling in/out with range orders

Range orders on Carbon DeFi allow traders to distribute their positions across a price spectrum. This strategy helps in:

- Minimizing risk exposure

- Capturing profits at various price levels

- Adapting to market volatility

Users can create overlapping liquidity strategies, moving beyond traditional concentrated liquidity models and actively participating in market-making.

D. Automating buy low, sell high trades

Carbon DeFi’s recurring orders feature emulates grid trading bots, enabling users to:

- Set up continuous buy and sell orders

- Capitalize on market volatility automatically

- Resist sandwich attacks through complex trading strategies

By leveraging these automated features, traders can execute sophisticated strategies without requiring advanced technical skills.

With these powerful tools at their disposal, users can navigate market complexities more effectively, transforming themselves into active market makers. As we transition to exploring “The Power Behind Carbon DeFi,” it’s clear that the platform’s commitment to user empowerment and innovative features is redefining standards in decentralized finance.

The Power Behind Carbon DeFi

Developed by Bancor

Carbon DeFi’s robust foundation stems from its development by Bancor, a pioneer in the DeFi space. Bancor’s expertise in decentralized exchanges and automated market makers has been instrumental in shaping Carbon’s innovative features.

Key Contributions from Bancor:

- Advanced liquidity protocols

- Smart contract optimization

- Security-first approach

| Bancor Feature |

Benefit to Carbon DeFi |

| AMM Technology |

Enhanced liquidity pools |

| Token Standards |

Seamless ERC20 integration |

| Cross-chain Solutions |

Expanded trading options |

Governed by Bancor DAO

The decentralized governance model of Carbon DeFi ensures that the platform evolves according to the needs of its community. The Bancor DAO plays a crucial role in decision-making processes, from protocol upgrades to new feature implementations.

DAO Governance Benefits:

- Community-driven development

- Transparent decision-making

- Aligned incentives for long-term growth

Commitment to user-friendly trading solutions

Carbon DeFi’s dedication to accessibility is evident in its intuitive interface and innovative trading tools. By simplifying complex DeFi concepts, Carbon empowers traders of all levels to participate in advanced trading strategies.

User-Centric Features:

- One-click limit orders

- Visual grid trading setup

- Real-time market data integration

This commitment to user experience, combined with Bancor’s technological prowess and decentralized governance, positions Carbon DeFi as a powerful force in the evolving landscape of decentralized finance. As we look ahead, these foundational elements will continue to drive Carbon’s innovation and growth in the DeFi ecosystem.

Carbon DeFi’s innovative limit order feature, powered by the Arb Fast Lane, revolutionizes trading in the decentralized finance space. By sourcing liquidity from major DEXes and integrating an advanced arbitrage system, Carbon DeFi offers users unprecedented control over their trades. This sophisticated platform moves beyond traditional AMM systems, allowing traders to execute precise orders and maximize their trading potential.

As you explore the world of decentralized trading, consider leveraging Carbon DeFi’s powerful tools to enhance your strategy. Whether you’re scaling in and out with range orders or automating buy low, sell high trades, Carbon DeFi provides the resources and functionality to support your trading goals. Take advantage of this user-friendly platform, developed by Bancor and governed by the Bancor DAO, to elevate your trading experience and unlock new possibilities in the ever-evolving DeFi landscape.