What would you do if you found out that a sudden market shift could wipe out over $100 million in Ethereum positions? It might sound alarming, but that’s the current state of affairs in the crypto market, especially with the recent volatility sparked by tariff policies.

This image is property of img.particlenews.com.

Understanding the Current Situation

Ethereum, one of the leading cryptocurrencies, recently suffered a significant drop in price. As of April 7, 2025, the price plummeted by about 16%, landing around $1,490. If this trend continues and drops another 15%, we could see an even more drastic impact, placing $100 million in leveraged ETH positions at risk of liquidation. Let’s unpack what this means.

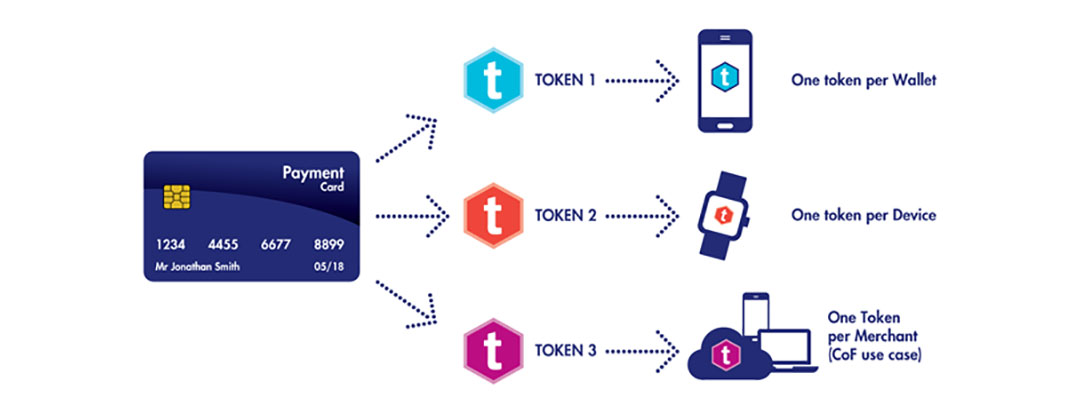

The Mechanics of Liquidation

When you trade with leverage, you’re essentially borrowing funds to open larger positions than you might otherwise afford. This can amplify your gains but also increases your risk significantly. In the case of Ethereum, if prices fall to $1,274, many positions could face liquidation.

Risk Thresholds

A fall of 15% from the current price would not just be a bad day for traders; it could trigger $100 million in liquidations. It’s crucial to understand how this works: if the market doesn’t recover fast enough, forced selling can create a domino effect, driving prices down even further.

The Spot Market Domino Effect

Unlike traditional financial markets, where investors can hold their positions during downturns, the on-chain liquidations in DeFi require immediate action. For example, MakerDAO auctions off liquidated collateral at a discount, which can flood the market with supply and push prices down further. This creates a negative feedback loop, exacerbating the overall decline in Ethereum’s value.

Regional Market Reactions

The ripple effect of this market instability is being felt across various regions. In Asia, Monday’s trading session saw significant losses, particularly for lending protocols.

Asian Traders Hit Hard

The figures don’t lie—many lending protocols in Asia saw a decline of around 17%. Traders are worried that many of these positions are over-leveraged, which only adds to the fear and uncertainty in the market.

U.S. Market Fears

Back in the U.S., analysts are cautioning that Wall Street’s opening could lead to even more pronounced losses. The looming uncertainty related to tariffs adds another layer of complexity to this already volatile situation. They suggest that traders should brace for potential fallout as the market adjusts to these macroeconomic changes.

Vulnerabilities in DeFi Protocols

Decentralized Finance (DeFi) has transformed the way we think about financial transactions, but with great innovation comes significant risks. Some protocols might be more vulnerable than others in times of distress.

MakerDAO’s Liquidation Process

One of the standout protocols in this space, MakerDAO, has its liquidation process that could unintentionally contribute to market instability. When collateral is liquidated, it gets auctioned off to the highest bidder—a process that often sees it resold at a premium, leading to added supply in the market. This has played a role in Ethereum’s dropping prices, contributing to the 13% decline noted in the CoinDesk 20 Index recently.

Wallet-Level Mitigation Strategies

Despite the turmoil, some traders are finding ways to manage their risks effectively. One notable wallet managed to avoid liquidation by reducing its Ethereum exposure and paying down some of its DAI debt. This kind of proactive management can be crucial during periods of high volatility.

The Macroeconomic Catalysts

The current situation isn’t happening in a vacuum. A key factor here is the geopolitical environment influenced by Trump’s tariffs.

Tariff Policies and Market Jitters

Tariff policies can shake up global markets, and they have obviously added to the jitters in the cryptocurrency space. Crypto often acts as a risk-on asset, meaning it is susceptible to shifts in global economic sentiment. As tariffs disrupt global trade, we see a tighter correlation between Ethereum and more traditional risk assets, causing instability that can ripple across markets.

Implications for the Crypto Market

What does all of this mean for traders and investors? The immediate implication is a potential tightening of regulations around crypto leverage and lending protocols due to the tariff-driven volatility. Traders need to understand that their investments may now be under more scrutiny.

SEO-Optimized Insight

The prospect of $100 million in liquidations poses not just a risk for leveraged traders but also a potential stress test for Ethereum’s broader DeFi ecosystem. It raises several important considerations for the market.

Regulatory Scrutiny Ahead

As the markets face this kind of volatility, you can expect regulators to take a keen interest. Stricter oversight may come into play for crypto leverage and lending protocols. As a trader, being aware of such possibilities is essential for adjusting strategies.

Investor Behavior Shifts

The sell-off, particularly in Asian markets, could lead to a significant reduction in participation in high-risk DeFi strategies. Understanding regional market sentiment can give you an edge in your trading decisions.

Protocol Resilience

For projects like MakerDAO, there’s a balancing act to manage. They need to handle liquidations efficiently while ensuring that their processes don’t contribute to broader market instability. This resilience will be vital to maintaining user trust and market balance.

The Tools You Need

For anyone involved in trading, having the right tools is essential, especially in turbulent times.

On-Chain Analytics

Tools like DeFiLlama’s on-chain analytics provide real-time insights into collateral health and liquidation triggers. Being able to monitor these factors can significantly impact your trading strategy and help you make informed decisions.

This image is property of www.tronweekly.com.

The $1,490 Survival Point

At this juncture, Ethereum’s ability to hold above the $1,490 mark is critical. It could determine if the market can stave off a more serious cascading effect. The next few days will be telling, and if ETH can stabilize, it may avoid a full-blown crash.

Keeping an Eye on the Market

Considering everything we’ve discussed, staying informed is your best defense. The crypto world is notoriously volatile, and shifts can happen in the blink of an eye. Following financial news, staying updated on tariff impacts, and being active in your trading community are all steps that can keep you prepared.

Conclusion

In the unpredictable world of crypto, the current situation surrounding Ethereum highlights the necessity of understanding both market mechanics and broader economic factors. This period of heightened volatility, driven in part by tariffs, serves as a reminder that staying informed is key. Whether you’re a seasoned trader or new to the space, remember that knowledge is power—and in the world of finance, it might just save your investments from hefty losses.

As you navigate the complexities of this market, don’t hesitate to leverage the tools available to you and keep a watchful eye on the developments ahead. Will Ethereum bounce back, or are we in for a longer struggle? Only time will tell, and your readiness may just make all the difference.

This image is property of blog.blockchainff.com.