In 2023, over 15 billion GBP stablecoins were in circulation worldwide. This shows a big change in how we use money online. People are trusting digital assets linked to real-world currencies like the British pound more and more.

The growth of GBP stablecoins is changing how we make payments. It’s making cross-border transactions and everyday buys faster. It combines blockchain’s speed with the stability of traditional money.

Stablecoins bring together the safety of fiat currency and blockchain’s innovation. This means businesses and consumers can enjoy quicker, cheaper, and more reliable transactions. GBP stablecoins are leading the way in this digital payment revolution.

Key Takeaways

- GBP stablecoins merge cryptocurrency efficiency with the security of pounds.

- They enable cheaper, faster transactions compared to traditional banking methods.

- Over 15 billion GBP stablecoins now circulate globally, showing massive adoption.

- Blockchain technology drives their security and transparency.

- Uphold and other platforms are leading the charge in making these tools accessible.

Ready to trade stablecoins? Sign up for Uphold today and access a growing selection to power your digital asset strategy! Start here.

Introduction to GBP Stablecoins

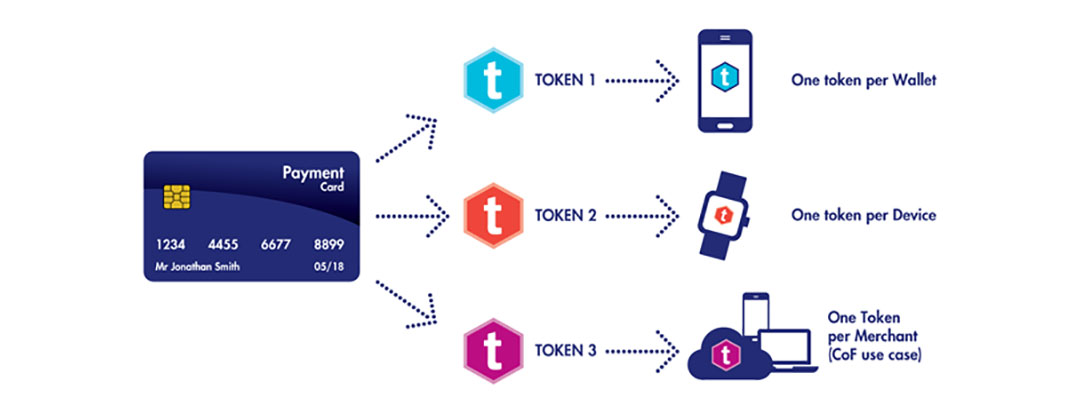

GBP stablecoins are a link between old finance and the new digital world. They keep their value steady, often tied 1:1 to the British pound. Understanding the fundamentals of stablecoin technology means knowing their main goal: to bring stability to shaky markets.

GBP stablecoins don’t have the price swings that cryptocurrencies like Bitcoin do. Their value stays tied to real assets, making them safe for daily use. They have key features:

- Backed by reserves (like GBP in bank accounts)

- Used for fast, low-cost cross-border payments

- Supported by blockchain networks for transparency

As digital payments become more common, stablecoins offer a safe choice. They let users, businesses, and global platforms make smooth transfers. For instance, a merchant in New York can accept GBP stablecoins without worrying about price changes.

Want to trade stablecoins? Sign up for Uphold today and start building your digital asset strategy. Begin securely at Uphold’s platform.

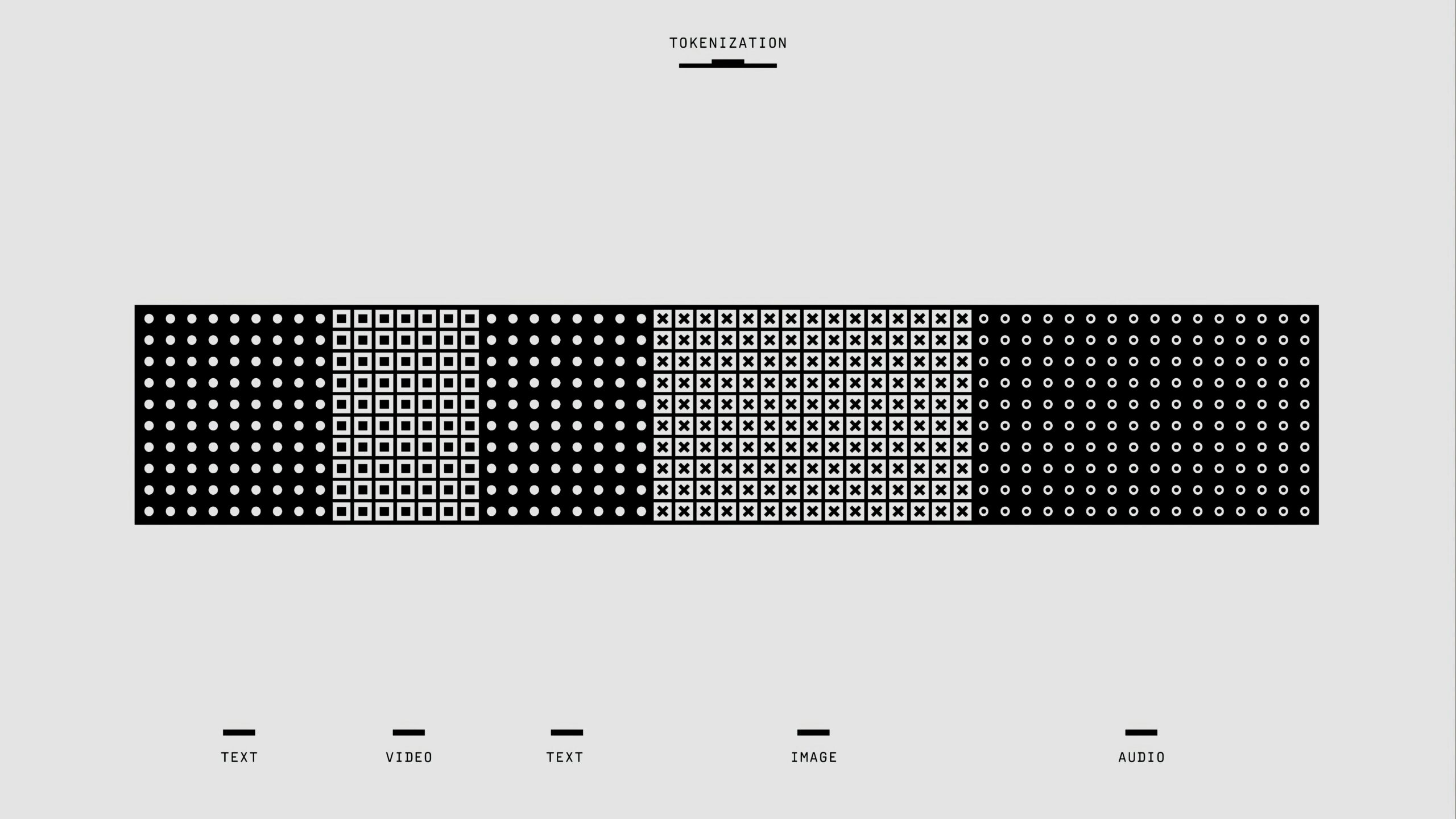

Evolution of Digital Payments and Stablecoin Technology

For centuries, Historical Developments in Payment Systems changed how we trade value. From coins to digital payments, each step built on the last. Today, blockchain-based stablecoins like GBP-pegged tokens keep this tradition alive, blending old with new.

- Cash and barter systems laid the groundwork.

- Banknotes and checks standardized value storage.

- 1970s: Credit cards enabled electronic transfers.

- 2010s: Cryptocurrency and blockchain introduced decentralized options.

Blockchain technology solved trust issues in Historical Developments in Payment Systems. It made transactions transparent and secure. Stablecoins now combine the stability of fiat with blockchain’s speed and security.

Today’s payment systems focus on making things easy for everyone. GBP stablecoins are a great example. They offer the reliability of pounds with the quickness of digital payments. This means users can enjoy fast, borderless transactions without losing value.

Want to see this future in action? Join Uphold’s platform to trade stablecoins and stay ahead. Start your journey at Uphold.

How GBP Stablecoins are Shaping the Future of Payments

GBP stablecoins are changing how we handle money. They make everyday financial transactions faster and cheaper. Unlike old systems, they settle instantly, skipping long bank waits.

- Lower fees for global transfers

- 24/7 transaction availability

- Transparent fee structures

Think about paying bills or sending money abroad. GBP stablecoins make these tasks easy. Merchants see cost cuts and happier customers. For example, online shops can process payments instantly, avoiding credit card issues.

| Traditional Methods | GBP Stablecoins |

|---|

| 3-5 day settlement | Instant settlement |

| Hidden currency conversion fees | Fixed 1:1 GBP value |

| Limited access hours | Operate 24/7 worldwide |

More platforms using this tech means bigger changes. Businesses and people get control over money with clear, safe systems. Ready to see these benefits? Try Uphold, a top digital asset service. Sign up now to get GBP stablecoins and change your financial future.

The Rise of GBP stablecoins Unlocking the future of digital payments

Market trends show a move towards quicker, global transactions. E-commerce and remittance services use GBP stablecoins to cut costs and speed up payments. Big names like Amazon and Walmart are testing blockchain payments. Also, businesses across borders prefer stablecoins for their stable value.

These digital assets are becoming more versatile. More investors use them for stable portfolios, and small businesses use them to protect against currency changes. Here are some key areas where GBP stablecoins are being used:

| Sector | Adoption Rate (2023) |

|---|

| Retail | 28% |

| Finance | 45% |

| Technology | 32% |

Platforms like Uphold make trading easy, allowing quick conversions of GBP stablecoins. Experts think their use for international deals will grow 15% each year by 2025. As central banks look into digital currencies, stablecoins are a bridge between old and new finance.

“Stablecoins offer the stability of fiat with blockchain efficiency,” says a fintech analyst. “Their role in global trade is expanding rapidly.”

Investors can start by signing up at Uphold to access GBP stablecoins and explore their possibilities. With gbp cryptocurrency now on big platforms, both businesses and people are seeing the benefits of this new world.

Blockchain Technology and Its Role in GBP Cryptocurrencies

Blockchain technology is key to modern digital currency systems. It makes GBP stablecoins work securely and openly. It keeps track of transactions on a shared ledger, cutting out middlemen. This means lower costs and faster transactions.

Every deal made on blockchain is locked in forever. This builds trust in the system.

“Blockchain’s transparency ensures every transaction is visible to participants, fostering accountability without sacrificing privacy.”

- Decentralization: No single entity controls the network, preventing fraud.

- Immutability: Transaction records cannot be altered, maintaining integrity.

- Speed: Instant transfers eliminate delays seen in traditional banking.

Blockchain’s security makes GBP stablecoins reliable. They are directly linked to real money like the British pound. Platforms like Uphold use this tech for easy access to these assets.

Blockchain helps with everything from paying invoices to making international payments. It makes financial tasks easier.

Want to trade stablecoins? Sign up for Uphold today. You’ll get access to more options for your digital asset strategy! Start here.

Embracing Digital Currency: Opportunities and Challenges

Using digital currencies like GBP stablecoins has many Benefits of Adopting Digital Currency. They make transactions faster and cheaper. Thanks to blockchain, money moves quickly and safely, without bank delays.

This is great for businesses. They can make payments across borders easily and save money.

But, there are also challenges. Rules about digital money are not the same everywhere. This makes it hard to use them widely.

There’s also a worry about hacking and fraud. To overcome these, we need strong security measures. Working together, creators and lawmakers can find solutions.

| Opportunities | Challenges |

|---|

| Global accessibility for unbanked populations | Need for uniform international regulations |

| Real-time settlement systems | Technical infrastructure gaps |

“Digital currencies could reshape global finance, but only if trust and standards are prioritized.” – BIS Annual Report 2023

Platforms like Uphold help with this change. They support stablecoins and other assets. This makes it easier for people to use new payment systems.

Want to try trading stablecoins? Sign up for Uphold today. See how digital currencies can improve your money management: Start here.

Uphold’s Role in Trading Stablecoins

Uphold is a leader in giving seamless access to a growing selection of stablecoins. This lets users trade with confidence. Their platform is both innovative and simple, making digital asset management easy for everyone.

Whether you’re looking to diversify your portfolio or send money across borders, Uphold makes it secure and efficient. Every transaction is handled with care.

- Instant access to over 35+ digital assets, including major stablecoins

- 24/7 customer support and multi-layered security protocols

- Low fees and real-time price updates for informed decisions

Uphold’s use of stablecoin technology makes trades quick and clear. Users can see their assets in one place, moving between fiat and crypto easily. The platform focuses on being easy to use, with guides for new users.

Ready to trade stablecoins? Sign up for Uphold today and explore a growing selection to enhance your digital asset strategy! Start at Uphold’s website.

Innovations Driving Digital Payment Strategies

New technologies are changing how we make payments. GBP stablecoins are key, making transactions faster and safer. Blockchain and real-time settlement are leading the way in digital payments.

- Smart contracts automate agreements, reducing manual errors and delays.

- Decentralized exchanges make it easy to get GBP stablecoins without middlemen.

- Mobile wallets now support stablecoins, making transfers easy between people.

These changes let businesses handle global payments quickly. For example, cross-border payments with GBP stablecoins are as fast as local ones. Retailers using these tools save up to 40% compared to old methods.

Companies using these innovations can stay ahead in digital markets. Platforms like Uphold give users direct access to GBP stablecoins. Start using these tools today—sign up for Uphold to build your digital asset strategy.

Navigating Regulatory Landscapes in Digital Payments

GBP stablecoins are becoming more popular, but they face many regulatory challenges. Governments and banks are working to set rules for these digital assets. They must follow anti-money laundering laws and deal with rules for moving money across borders.

- Global regulations vary, forcing issuers to adapt to different standards.

- Transparency requirements demand clear proof of reserve holdings.

- Unclear tax guidelines complicate adoption for businesses and individuals.

New policies are trying to make things clearer. The U.S. Treasury and SEC have suggested how to classify digital assets. This affects how GBP stablecoins work. Regulators want to protect users while also supporting new ideas.

The Financial Conduct Authority (FCA) in the UK now requires stablecoin providers to share risks and how they manage reserves. This helps users understand the situation better.

Uphold makes it easier for users to comply with changing rules. With real-time updates and access to GBP stablecoins, the platform helps users stay on top. Start trading today at Uphold to confidently navigate these changes.

Secure and Efficient Transactions with Stablecoin Technology

Stablecoin technology is changing digital payments for the better. It mixes the stability of fiat currencies with blockchain’s security. Transactions with GBP stablecoins are safe and fast, thanks to blockchain.

Every transfer is checked and encrypted, making fraud less likely. Unlike old systems, these transactions are clear but private. You don’t need middlemen to slow things down.

- Encryption ensures data cannot be altered during transfers.

- Blockchain networks process transactions in minutes, not days.

- No hidden fees—costs remain predictable and low.

Users get their money right away, unlike banks. Businesses get their funds quicker and save money. Platforms like Uphold make managing these transactions easy. They let you handle many stablecoins in one place.

Want to start trading stablecoins? Sign up for Uphold today. You’ll get access to more stablecoins to boost your digital asset strategy! Start here.

Impact on Traditional Finance and Global Markets

GBP stablecoins are changing how finance works. They are making traditional banking systems rethink their ways. Now, banks and other financial groups are looking to use these digital assets.

They want to keep up with the fast pace of the market. This means they need to be quick and open in their dealings. The old banking ways just can’t keep up anymore.

Working together is key for fintech and old banks. For instance, Uphold makes it easy to trade GBP stablecoins. This helps connect the old and new financial worlds.

This change makes payments faster and opens up new ways for businesses to make money. It’s a big step forward.

- Lower transaction costs for international trade

- Increased adoption of decentralized payment networks

- Enhanced real-time settlement capabilities

Today, the world wants things to move fast. Places like London and New York are trying to keep up. They’re figuring out how to make these new systems work together smoothly.

Want to try trading stablecoins? Sign up for Uphold and see how it works.

Adoption Trends in the United States and Beyond

Adoption of gbp cryptocurrency is on the rise, with the U.S. at the forefront. It’s leading the way in stablecoins tied to the British pound. Now, both retailers and investors use these digital assets for making payments across borders and protecting against market changes.

- Over 40% of U.S. fintech platforms now offer gbp cryptocurrency integration.

- Emerging markets like Southeast Asia report 200% growth in GBP stablecoin transactions year-over-year.

- Institutional investors favor these assets for low-fee international settlements.

“The stability of GBP-pegged tokens makes them ideal for businesses managing multi-currency operations,” said a blockchain analyst at Chainalysis. “Their adoption reflects demand for reliable alternatives to traditional banking systems.”

More businesses are adopting gbp cryptocurrency as a payment option. Platforms like Shopify and Stripe are now accepting it. Central banks in the EU and Asia are also exploring these technologies to make cross-border payments more efficient.

For individuals, apps like Uphold make it easy to buy and hold gbp cryptocurrency. They handle over $1 billion in daily stablecoin transactions. This shows how useful these assets are beyond just speculation.

As more countries regulate digital assets, the focus is on making them work together. This opens up new opportunities for both consumers and businesses. They’re looking for faster, more transparent financial tools.

Comparing GBP Stablecoins with Other Cryptocurrencies

When looking at digital currencies, Differences in Security and Transaction Speed are key. GBP stablecoins are different from Bitcoin or Ethereum because they’re tied to real assets like the British pound. This makes them more reliable and useful for everyday spending.

| Feature | GBP Stablecoins | Bitcoin | Ethereum |

|---|

| Security | Backed 1:1 with GBP reserves | Decentralized blockchain | Smart contract-based |

| Transaction Speed | Seconds per transaction | 10–15 minutes | 2–5 minutes |

| Market Volatility | Near-zero | High | Medium |

Investors often look for transaction speed for quick payments. GBP stablecoins are faster than Bitcoin or Ethereum, making them great for daily use. Their security comes from being backed by fiat, reducing risks from crypto market swings.

Uphold’s platform makes it easy to use GBP stablecoins. These assets mix the stability of traditional money with blockchain’s benefits. For those who value reliability over speculative gains, the choice is clear.

“Stablecoins offer a bridge between old and new finance.”

See how GBP stablecoins compare today. Sign up at Uphold to start using secure, fast digital payments.

The Future Outlook of GBP Stablecoin Integration

Financial systems are moving toward faster, more transparent transactions. Blockchain technology will keep playing a key role as GBP stablecoins become common in global trade. New features like real-time settlements and DeFi platforms are changing how money is handled.

- Smart contracts automating payments

- Merchant integration in everyday transactions

- Regulatory clarity boosting trust

| Current Use | Future Potential |

|---|

| Limited retail adoption | Widespread merchant acceptance |

| Slow cross-border transfers | Instant global payments |

| Selective user base | Mainstream consumer adoption |

Financial institutions are exploring new models like programmable money. This allows for automatic payments for bills or loans. As digital payments trends grow, stablecoins might soon replace traditional wire transfers. Companies like Uphold are already creating tools to meet this need.

Want to trade stablecoins? Sign up for Uphold today and explore a growing selection. It’s a great way to enhance your digital asset strategy! Start http://uphold.sjv.io/jr0kOM.

Conclusion

GBP stablecoins and stablecoin technology are changing how we do digital transactions. They make payments faster and clearer, keeping traditional currency values stable. Platforms like Uphold help us move into this new world safely.

As rules and tech get better, stablecoins will become key for everyone. More people want reliable digital money, thanks to new ideas that mix innovation with trust. This change helps trade across borders and brings more people into the financial world.

Uphold lets you use stablecoin tech now. Visit Uphold to see digital assets for yourself. Don’t wait—start using digital money in new ways today.

FAQ

What are GBP stablecoins?

GBP stablecoins are digital money tied to the British Pound. They mix the stability of traditional money with crypto’s new features. This makes them great for digital payments.

How do GBP stablecoins work?

GBP stablecoins are backed by British Pounds, keeping their value steady. They use blockchain for secure, fast transactions. This lets users send money worldwide without crypto’s usual ups and downs.

What role do GBP stablecoins play in the future of payments?

GBP stablecoins are changing payments by making them simpler and faster. They offer security that old payment methods can’t match. They help speed up money transfers and connect digital and traditional banking.

Are GBP stablecoins safe to use?

Yes, GBP stablecoins are safe. They’re backed by the British Pound and use secure blockchain. But, users should use reputable platforms to stay safe.

How can one purchase GBP stablecoins?

You can buy GBP stablecoins on exchanges like Uphold. First, set up an account and verify it. Then, choose the stablecoin you want to buy with fiat or other cryptos.

What are the benefits of using GBP stablecoins for digital payments?

Using GBP stablecoins can save you money and time. They’re secure and let you make global payments without traditional banking limits.

Can GBP stablecoins be used for everyday purchases?

Yes! More merchants are now accepting GBP stablecoins. This makes them a good choice for daily shopping.

What challenges do GBP stablecoins face?

GBP stablecoins face rules, awareness, and adoption issues. They also need to keep digital wallets safe and overcome doubts about digital money.

How do GBP stablecoins compare to other cryptocurrencies?

GBP stablecoins are more stable than other cryptos because they’re tied to a traditional currency. This makes them safer for those who want to avoid crypto’s ups and downs.

What is the future outlook for GBP stablecoins?

GBP stablecoins have a bright future. They’re becoming more accepted and might find new uses. As people and businesses look for better payment options, GBP stablecoins will likely be key.

Explore a range of stablecoin opportunities! Sign up for Uphold today and start trading with the stability you need.