Global Trade Tensions Cast Shadow on Germany’s Economic Outlook 🌍🇩🇪

In a surprising turn of events, Germany has revised its economic growth forecast for 2025 downward, citing ongoing global trade disputes as a key factor. This adjustment has sent ripples through the investment community, leaving many wondering about the future of their portfolios. As market uncertainty looms, investors find themselves at a crossroads, hesitant to make bold moves in an increasingly volatile landscape.

Enter ProPicks AI, a beacon of hope for cautious investors seeking clarity in these turbulent times. With its impressive track record of identifying high-potential stocks – including two that soared over 150% in 2024 alone – ProPicks AI offers a data-driven approach to navigating the complexities of today’s market. As we delve deeper into Germany’s economic forecast revision and its implications, we’ll explore how innovative solutions like ProPicks AI are reshaping investment strategies and providing a path forward in an era of global economic uncertainty.

Understanding Germany’s Economic Growth Forecast Revision

A. Factors influencing the lowered forecast for 2025

Germany’s economic growth forecast for 2025 has been revised downward due to several key factors:

- Weak domestic and foreign demand for manufacturing goods

- High uncertainty impacting investment

- Struggling construction sector due to labor shortages

- Low consumer sentiment leading to increased savings rate

Despite these challenges, some positive indicators suggest a gradual recovery:

- Easing inflation supporting real household income recovery

- Anticipated rebound in household consumption

- Expected growth in the construction sector from early 2025

- Projected increase in investment due to new tax incentives

| Year |

GDP Growth Forecast |

| 2024 |

-0.1% (contraction) |

| 2025 |

0.7% |

| 2026 |

1.3% |

B. Impact of ongoing global trade disputes

Global trade disputes continue to play a significant role in shaping Germany’s economic outlook:

- Unpredictable economic policies of the new U.S. administration

- Potential trade tensions with key partners

- Anticipated introduction of higher tariffs on imports from Mexico, Canada, and China

These factors are particularly impacting German exports:

- Exports to China, once a vital market, fell 23% from 2021 levels

- Manufacturing sector struggling to maintain competitiveness against rising Chinese competition

- Energy costs challenging the competitiveness of energy-intensive industries

Despite these challenges, domestic demand is forecasted to become the primary growth driver in 2025 and 2026. However, the negative contribution from net exports is expected to persist due to ongoing trade issues.

With this understanding of Germany’s economic growth forecast revision and the impact of global trade disputes, we’ll next explore “Investor Sentiment in Light of Economic Uncertainty” to gain insights into how these factors are influencing investment decisions.

Investor Sentiment in Light of Economic Uncertainty

Now that we have covered Germany’s economic growth forecast revision, let’s examine how investors are reacting to this economic uncertainty.

A. Hesitation towards stock investments due to high valuations

The recent downturn in German investor sentiment reflects a growing hesitation towards stock investments. In April 2025, the ZEW institute reported a significant decline in investor confidence, with sentiment plummeting by 65.6 points to minus 14. This sharp drop, the most substantial since the Ukraine conflict began, can be attributed to several factors:

- U.S. trade policy unpredictability

- Potential retaliatory measures

- Global economic uncertainty

- High market valuations

| Factor |

Impact on Investor Sentiment |

| U.S. tariffs |

Jeopardized recent economic recovery |

| Global uncertainty |

Adversely affected expectations for Germany’s economy |

| Market valuations |

Contributed to hesitation in stock investments |

Despite a slight improvement from March’s reading of minus 81.2 points, the overall sentiment remains negative. This cautious approach is further reinforced by the challenges faced by the German economy over the past two years, including:

- Weak export demand

- Fierce competition from China

- High energy prices

B. Seeking alternative investment strategies

In light of these economic uncertainties, investors are increasingly looking for alternative investment strategies. The hesitation towards traditional stock investments has led to a shift in focus towards:

- Diversification techniques

- Risk management strategies

- AI-driven investment solutions

Investors are seeking ways to protect their portfolios from the potential impacts of ongoing global trade disputes and economic challenges. This trend is evident in the growing interest in innovative investment approaches that can navigate the complexities of the current market dynamics.

With this in mind, next, we’ll explore how ProPicks AI offers a solution for cautious investors in these uncertain times.

ProPicks AI: A Solution for Cautious Investors

Now that we’ve explored investor sentiment in light of economic uncertainty, let’s examine how ProPicks AI offers a solution for cautious investors navigating these challenging times.

A. Access to proven portfolios with high-potential opportunities

ProPicks AI leverages Germany’s robust AI infrastructure and research to provide investors with access to proven portfolios. Drawing from the country’s National AI Strategy, which allocated €3 billion for AI research and development, ProPicks AI integrates advanced algorithms to identify high-potential investment opportunities. This approach aligns with Germany’s focus on enhancing AI applications across various sectors, including finance.

Key features of ProPicks AI’s portfolio access:

- Utilizes AI technologies developed under Germany’s AI for Climate Action Initiative

- Incorporates ethical AI guidelines established by German regulatory bodies

- Leverages data from the GAIA-X project for secure and reliable market insights

B. Strong performance record in 2024

ProPicks AI has demonstrated a strong performance record in 2024, benefiting from Germany’s continued investment in AI research and development. The platform’s success can be attributed to several factors:

| Factor |

Impact on Performance |

| Increased AI funding |

Enhanced algorithmic capabilities |

| Ethical AI framework |

Improved investor trust and compliance |

| Industry 4.0 integration |

Better insights into manufacturing and logistics sectors |

ProPicks AI’s performance in 2024 has been particularly noteworthy due to:

- Integration of AI standards for industrial applications

- Collaboration with academia and industry partners

- Adaptation to new EU AI Act regulations

- Leveraging Germany’s leadership in Industry 4.0 for market analysis

As we move forward, we’ll explore the diversification strategies offered by ProPicks AI, which further enhance its appeal to cautious investors in uncertain economic times.

Diversification Strategies Offered by ProPicks AI

Now that we’ve explored how ProPicks AI can be a solution for cautious investors, let’s delve into the diverse strategies it offers for portfolio diversification.

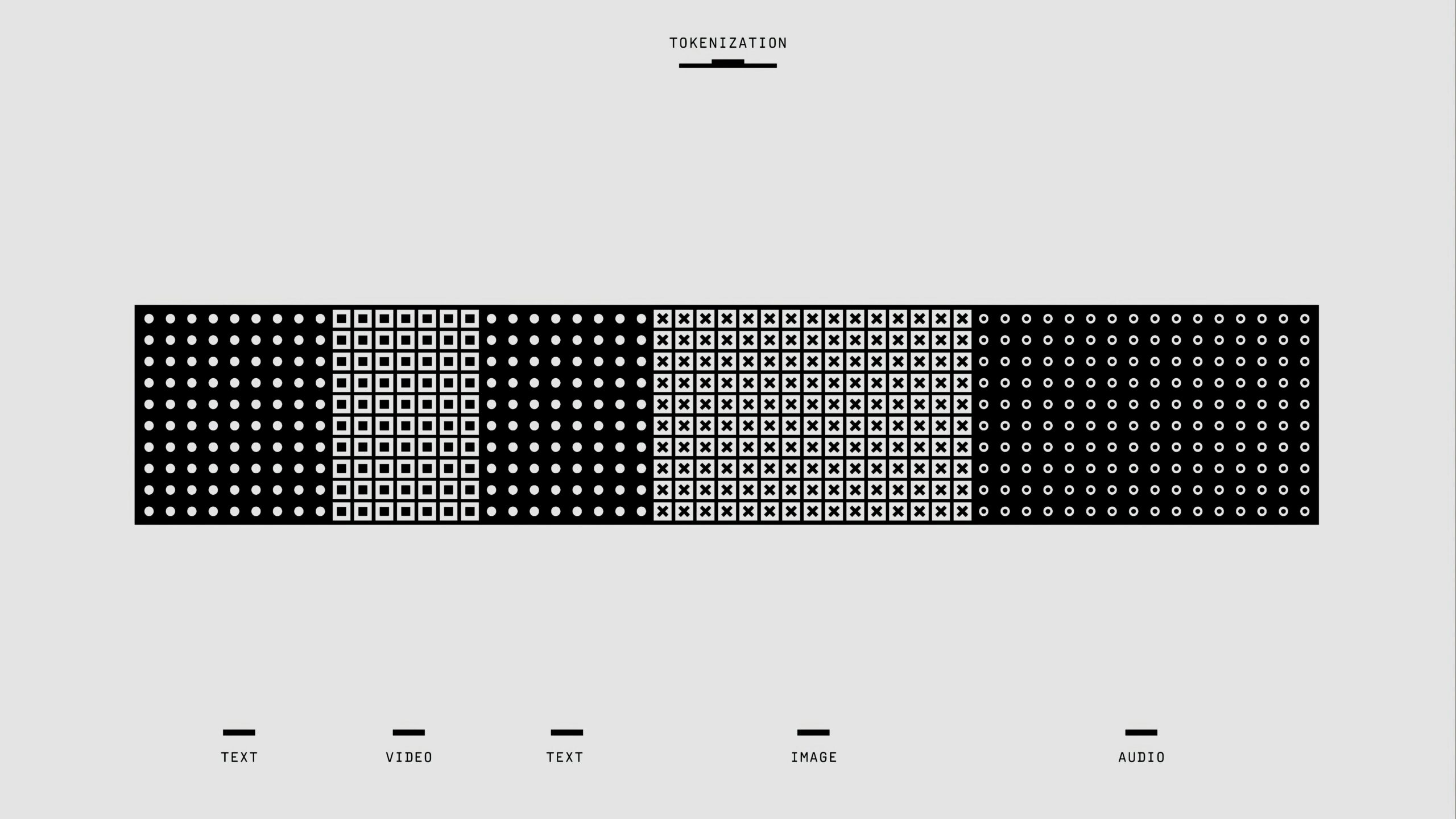

A. Tailored portfolios for various sectors

ProPicks AI excels in providing tailored strategies that cater to different investor preferences and risk levels. By leveraging advanced machine learning and artificial intelligence, the platform analyzes thousands of companies and adapts to market fluctuations. This approach allows investors to mitigate emotional biases in stock selection and make more informed decisions.

ProPicks offers six key strategies, each designed to target specific sectors and investment goals:

- Dominate the Dow

- Beat the S&P 500

- Tech Titans

- Top Value Stocks

- Mid-Cap Movers

- Best of Buffett

These strategies are updated monthly, guiding users to optimal buying opportunities across various sectors of the market.

B. Options for Dow, S&P, Tech, and Mid Cap stocks

ProPicks AI provides impressive options for investors looking to diversify their portfolios across different market segments:

| Strategy |

Focus |

Performance |

| Dominate the Dow |

Top-tier Dow Jones Industrial Average companies |

452% outperformance over benchmark in last decade |

| Beat the S&P 500 |

Top 20 performers in S&P 500 |

670.7% excess return over same period |

| Tech Titans |

15 major tech companies |

1183% increase versus benchmark |

| Mid-Cap Movers |

Promising mid-cap stocks |

345% outperformance |

Additionally, the “Top Value Stocks” strategy identifies undervalued companies with strong growth potential, outpacing its benchmark by 621%. For those interested in following investment legends, the “Best of Buffett” strategy tracks Warren Buffett’s investment choices, exceeding its benchmark by 150%.

ProPicks enhances these offerings with advanced screening tools and in-depth historical financial data, empowering investors to explore a variety of wealth-building strategies with confidence.

With these diversification strategies in place, investors can better navigate the current market dynamics, which we’ll explore in the next section. The AI-driven approach of ProPicks provides a robust framework for adapting to changing economic conditions and global trade uncertainties.

Current Market Dynamics

Now that we’ve explored the diversification strategies offered by ProPicks AI, let’s delve into the current market dynamics to provide a clearer picture of the investment landscape.

A. Trending stocks and their performance

In the German equities market, we’re seeing significant movements across various indices. The Xetra DAX, a key indicator of the German stock market’s performance, currently stands at 21,900.75. Meanwhile, the M-Dax and TecDAX Performance Index are at 27,706.97 and 3,548.63 respectively. These figures reflect the overall health of the German market amidst global economic uncertainties.

| Index |

Current Value |

| Xetra DAX |

21,900.75 |

| M-Dax |

27,706.97 |

| TecDAX Performance Index |

3,548.63 |

The Euro’s performance against major currencies is also worth noting:

- EUR/GBP: Fluctuating, impacting trade relations with the UK

- EUR/USD: A critical pairing for international trade

- EUR/JPY: Reflecting economic ties with Japan

- EUR/AUD, EUR/CAD, EUR/CNY, EUR/CHF: Providing insights into broader global economic trends

B. Examples of notable stock movements

Within the Xetra DAX, several companies have shown remarkable performance:

- Infineon Technologies

- Adidas AG

- Symrise AG

These market movers have experienced significant price changes and trading volumes, indicating investor interest and market sentiment. However, it’s crucial to note that this data is delayed and should be used for general information purposes only, not as investment advice.

The German market’s dynamics are further influenced by:

- Equity fund country flows, with cumulative weekly equity movements in and out of Germany

- GDP growth rates across various sectors, including:

- Agriculture

- Construction

- Manufacturing

- Public administration

- Services

Additionally, factors such as employment rates, inflation data, and trade statistics play a crucial role in shaping the current market landscape. The balance of trade, current account statistics, and foreign direct investment levels all contribute to the overall economic picture, directly impacting stock performance and market trends.

Germany’s revised economic growth forecast for 2025 reflects the ongoing challenges posed by global trade disputes. This uncertainty has led to cautious investor sentiment, prompting the need for innovative solutions in wealth-building strategies.

ProPicks AI emerges as a valuable tool for investors navigating these uncertain times. By offering access to proven portfolios and highlighting high-potential investment opportunities, the platform has demonstrated its effectiveness in identifying stocks with significant growth potential. With tailored portfolios across various sectors and a strong performance record, ProPicks AI provides investors with diverse options to explore and potentially mitigate risks associated with economic uncertainties. As market dynamics continue to evolve, tools like ProPicks AI can help investors make informed decisions and capitalize on emerging opportunities in this challenging economic landscape.