How Trump’s New Crypto Stance Could Reshape Finance

In a stunning turnaround, former President Donald Trump has emerged as an unexpected champion of cryptocurrency, declaring “I want crypto” in a recent NBC News interview. This marks a significant shift for a political figure who once dismissed Bitcoin as a “scam.” As blockchain technology continues to disrupt traditional finance, Trump’s newfound enthusiasm—coupled with his assertion that “crypto is important because if we don’t do it, China will”—signals potentially seismic changes for the digital asset landscape.

Meanwhile, controversy swirls around the TRUMP memecoin, which reportedly generated $900,000 in transaction fees linked to the former president. Despite blockchain evidence, Trump maintains he hasn’t profited from the token, comparing any potential cryptocurrency gains to his real estate investments. 💰 Could this represent a new chapter in the relationship between political power and digital currency? As the 2024 election approaches, Trump’s evolving position on cryptocurrency could dramatically reshape America’s approach to financial innovation, regulatory frameworks, and global economic competition.

Trump’s Evolving Cryptocurrency Position

Trump’s Recent Endorsement of Cryptocurrency

Donald Trump’s relationship with cryptocurrencies has undergone a remarkable transformation over the years. In July 2019, he openly criticized Bitcoin and other cryptocurrencies, claiming they were “not money” and facilitated illegal activities. His administration initially proposed stricter regulations for the crypto market.

However, between 2021 and 2023, Trump’s perspective began to shift dramatically. After leaving office, he engaged with the crypto world through various ventures, including launching his own Solana-based meme coin and multiple NFT collections. Notably, his wife Melania introduced a Solana-based NFT collection in late 2021, despite his earlier criticisms.

Trump’s subsequent NFT collections, minted on Ethereum’s Polygon and Bitcoin, achieved significant sales success. By his own admission, these ventures changed his perspective on cryptocurrency, transforming him from a skeptic to an advocate.

His Emphasis on Maintaining U.S. Leadership in Crypto

As Trump’s pro-crypto rhetoric intensified, he began making bold statements about making the United States the “crypto capital of the planet.” His 2024 presidential campaign featured promises to promote blockchain innovation and reduce regulatory barriers, positioning himself as potentially the “First Crypto President.”

The Republican Party’s draft platform during this period included explicit mentions of cryptocurrency support, signaling a broader shift within Trump’s political circle. His administration has introduced new regulatory frameworks, including the establishment of specialized cryptocurrency services and a Presidential Council on Cryptocurrencies to prioritize the integration of digital assets into the national economy.

Concerns About China’s Potential Dominance in the Space

Trump’s newfound enthusiasm for cryptocurrency appears partly motivated by geopolitical concerns, particularly regarding China’s growing influence in the digital currency space. He has discussed the establishment of a “strategic Bitcoin stockpile” for the United States, suggesting this as a counterbalance to potential Chinese dominance in the sector.

After returning to office, Trump established a Bitcoin reserve and signed crypto-friendly legislation, with his administration actively supporting the digital asset industry. This represents a strategic move to ensure American leadership in blockchain technology and prevent foreign competitors from gaining an advantage in this emerging financial frontier.

With Trump’s evolving stance on cryptocurrency established, we’ll next examine the controversial TRUMP memecoin launch and the questions it has raised about potential conflicts of interest in the cryptocurrency space.

The TRUMP Memecoin Controversy

Having explored Trump’s evolving stance on cryptocurrency, it’s important to examine the controversy surrounding the TRUMP memecoin that has gained significant attention in crypto markets.

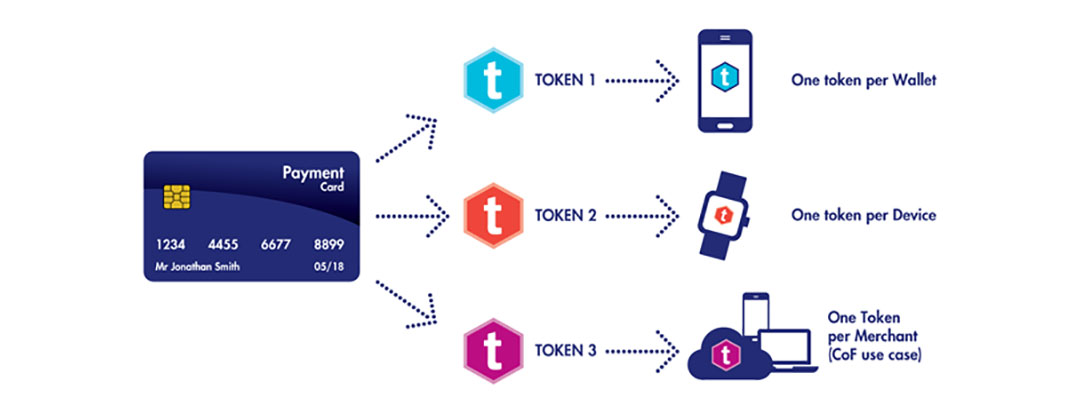

A. Trump’s claims regarding personal involvement

The TRUMP memecoin has experienced remarkable market performance, with a 194% increase in value reaching $54.62 after being listed on major exchanges including Coinbase and Binance. Amid this surge, questions have emerged about Trump’s direct involvement with the token. Public Citizen, a U.S. nonprofit watchdog, has highlighted that Trump is effectively the principal owner of the memecoin through CIC Digital LLC, an affiliate of The Trump Organization, controlled by the Donald J. Trump Revocable Trust, of which Trump is the sole beneficiary.

During this period, speculation about a potential “USA coin” emerged, which Eric Trump quickly dismissed as unfounded, further complicating the narrative around the Trump family’s involvement in crypto ventures.

B. Analysis of the $900,000 transaction fee earnings

The TRUMP token has generated substantial trading activity, with Bitget leading at $864.9 million, followed by MEXC and KuCoin. This coincided with increased activity in the Solana ecosystem, where Raydium, its largest decentralized exchange, generated $25.07 million in fees. The GMGN trading tool processed $153 million in transactions on Solana, while the Moonshot crypto platform reported nearly $400 million in volume over just 12 hours.

U.S. lawmakers, including Senator Elizabeth Warren and Representative Jake Auchincloss, have expressed concerns about the memecoin’s price volatility, which reportedly increased Trump’s wealth by $58 billion in a matter of days, raising serious questions about market manipulation and conflicts of interest.

C. Trump’s statements about not monitoring his crypto investments

The Bitcoin community has vocally criticized the TRUMP memecoin as opportunistic and contrary to Bitcoin’s foundational principles. Key figures have characterized it as a “get-rich-quick scheme” that transfers wealth from younger generations to older ones.

Public Citizen has formally requested an investigation into Trump’s promotion of the token, citing potential violations of the Constitution’s Emoluments Clause. Their concerns stem from allegations that Trump’s promotion could be interpreted as soliciting money without providing anything in return, potentially breaching federal ethics laws.

Regulatory authorities now face mounting pressure for action, indicating a pressing need for clear guidelines on cryptocurrency ventures involving public figures, especially as we move toward examining Trump’s broader investment philosophy on digital assets.

Trump’s Investment Philosophy on Digital Assets

Now that we’ve examined the controversy surrounding the TRUMP memecoin, let’s explore how the former president’s broader investment philosophy applies to digital assets.

His perspective on asset appreciation versus active profit-taking

Donald Trump appears to be embracing a long-term appreciation strategy with cryptocurrency investments rather than seeking immediate profits. This approach is evidenced by his family’s recent ventures, including the World Liberty Financial project, which has reportedly raised at least $550 million. His evolving position suggests a belief in the sustained growth potential of digital assets, marking a significant shift from his previous cryptocurrency skepticism.

Comparison to his approach with traditional real estate investments

Trump’s crypto investment strategy mirrors his well-established real estate philosophy in several ways. Just as he favors developing landmark properties with long-term value appreciation potential, his cryptocurrency ventures show similar characteristics:

- Focus on substantial investments with high visibility

- Preference for branded assets (like the USD1 stablecoin through World Liberty Financial)

- Leveraging international partnerships, as demonstrated by the $2 billion investment from Abu Dhabi’s MGX

- Building infrastructure rather than simply trading (creating financial platforms versus merely buying existing tokens)

These parallels suggest Trump is applying his traditional investment principles to this new asset class, viewing digital currencies as another form of property development rather than speculative trading.

Reluctance to donate crypto earnings

While the reference material doesn’t explicitly mention Trump’s approach to charitable giving from crypto profits, his business-focused announcements about World Liberty Financial and partnerships with entities like Binance and Tron suggest profit maximization remains the priority. The emphasis on commercial applications—such as making the USD1 coin widely usable in retail settings—indicates a focus on business development rather than philanthropic endeavors.

With this investment philosophy in mind, next we’ll examine how Trump’s evolving stance might reshape U.S. cryptocurrency policy should his influence on the regulatory landscape increase.

Potential Impact on U.S. Cryptocurrency Policy

Now that we’ve explored Trump’s investment philosophy on digital assets, let’s examine how these views could translate into concrete policy changes for the cryptocurrency landscape in the United States.

A. Implications for regulatory frameworks

Trump’s administration appears poised to implement significant regulatory shifts in the cryptocurrency sector. After his attendance at a Bitcoin conference in June 2024, where he pledged to make the U.S. the “crypto capital of the planet,” concrete steps are already underway. The nomination of Paul Atkins to lead the SEC signals a departure from Gary Gensler’s enforcement-heavy approach toward a more accommodating regulatory environment.

The SEC’s stance on digital asset classification is reportedly evolving, with a potential shift toward viewing many cryptocurrencies as commodities rather than securities—aligning more closely with the CFTC’s perspective. This reclassification would substantially reduce regulatory burdens on crypto companies. The appointment of Brian Quintenz as CFTC head further reinforces this pro-crypto regulatory direction.

B. Possible shift in government stance toward digital currencies

Trump’s executive order creating a working group focused on digital assets marks a dramatic reversal from previous regulatory directives. The Presidential Working Group on Digital Asset Markets aims specifically to reduce regulatory obstacles and encourage innovation in the space.

Notably, Trump has shown resistance to a central bank digital currency while expressing support for stablecoins, indicating a preference for private sector solutions over government-controlled alternatives. His energy policies could also benefit U.S. cryptocurrency mining operations, which currently account for 37% of global Bitcoin mining activity.

C. What this means for cryptocurrency markets and investors

The initial market response to Trump’s pro-crypto stance has been positive, with Bitcoin’s value reportedly rising by 40% since his election. The total cryptocurrency market now exceeds $1 trillion, reflecting growing investor confidence in a more favorable regulatory environment.

However, caution remains necessary. While cryptocurrency-specific policies appear supportive, analysts warn that broader economic policies—particularly regarding tariffs—could negatively impact the industry. Global economic uncertainty could still trigger a “crypto winter” despite regulatory improvements.

The proposed Bitcoin Act of 2024, which seeks to create a strategic reserve of Bitcoin, could significantly increase U.S. holdings and potentially provide price stability. Industry executives report improved dialogue with regulators, resulting in fewer enforcement actions against crypto firms.

For investors, these policy shifts could reverse the trend of digital asset companies relocating overseas due to regulatory hostility, potentially bringing innovation and capital back to U.S. markets.

Trump’s shifting stance on cryptocurrency represents a significant development in the political landscape of digital finance. His assertion that “crypto is important” and that America must lead in this space to prevent Chinese dominance signals a potential sea change in Republican policy positions. Despite controversies surrounding the TRUMP memecoin and questions about his personal profits from crypto assets, his public endorsement could substantially influence future regulatory frameworks.

As cryptocurrency continues to evolve as both an investment vehicle and a geopolitical consideration, Trump’s perspective adds another dimension to the ongoing debate about digital assets’ role in America’s financial future. Investors and policy makers alike should closely monitor these developments, as they may foreshadow significant shifts in how cryptocurrencies are regulated and integrated into the mainstream financial system. The intersection of politics and cryptocurrency appears increasingly consequential for the future of finance.