In a significant development, **KiloEx**, a decentralized exchange (DEX), has fallen victim to a sophisticated hacking incident that resulted in a substantial loss of **$7 million**. This article will elucidate the details of the breach, specifically focusing on the mechanics of the **price oracle manipulation attack** that facilitated this occurrence. Furthermore, it will examine the considerable repercussions for both the users and the exchange, including an analysis of the **regulatory** and **legal implications** stemming from the incident. Key lessons will be identified, and strategies to enhance **security measures** in order to safeguard against future threats will be proposed. This analysis aims to provide a comprehensive understanding of this critical incident within the realm of **decentralized finance**.

What Happened?

.jpg_00.jpeg)

The KiloEx decentralized exchange (DEX) recently experienced a significant security breach, resulting in the loss of approximately $7 million worth of digital assets. This hacking incident has raised critical concerns regarding the reliability of decentralized exchanges in managing user funds and maintaining market integrity. Consequently, both investors and users are left questioning the effectiveness of the security measures implemented to protect their assets in an increasingly precarious cryptocurrency market.

The breach not only undermines user trust but also casts a pall over the entire ecosystem of decentralized exchanges, which are frequently promoted as more secure alternatives to traditional cryptocurrency exchange platforms. Reports from users indicate challenges in accessing their accounts and retrieving stolen funds, exacerbating the anxiety among investors who are apprehensive about the potential for similar incidents to impact other DEXs.

In response to this event, there is a growing call for enhanced transparency and improved security protocols to safeguard digital assets. As the cryptocurrency market continues to evolve, this incident serves as a poignant reminder that, while decentralization offers numerous advantages, it is essential for these platforms to reinforce their defenses against cyber threats.

Impact of the Hack

The impact of the KiloEx hack has been substantial, resulting in considerable financial losses for users and a significant decrease in trading volume on the platform.

This incident has not only affected the immediate liquidity of KiloEx but has also undermined investor confidence throughout the cryptocurrency market.

As users navigate the consequences of this attack, market sentiment has rapidly shifted to a bearish outlook, indicative of widespread concerns regarding the security of their digital assets.

Losses Incurred by Users and the Exchange

Users of KiloEx have experienced significant financial losses as a result of a recent hacking incident, with numerous individuals reporting the loss of their user funds and exposure to trading risks on the exchange. This situation has prompted urgent inquiries regarding asset protection strategies and the effectiveness of liquidity pools during crisis scenarios in decentralized exchanges.

This breach has not only resulted in substantial monetary losses for users but has also highlighted the vulnerabilities associated with relying exclusively on centralized platforms for cryptocurrency trading. Many individuals who believed their assets were securely stored on KiloEx now find themselves without recourse, as hackers exploited existing vulnerabilities to abscond with millions in funds.

In the aftermath of this incident, users are left to consider the implications for their portfolios, raising questions about the effectiveness of current asset protection measures. The incident underscores a critical need for improved liquidity management practices to ensure that such exchanges can maintain stability and mitigate the risk of similar disasters in the future.

How the Hack Occurred

The KiloEx hack was carried out through a sophisticated manipulation of the price oracle, enabling the perpetrator to exploit vulnerabilities within the smart contracts that govern the exchange.

By meticulously analyzing transaction metadata, the attacker orchestrated a cyber attack that ultimately undermined the integrity of the trading platform, thereby raising significant concerns regarding the security protocols that were implemented.

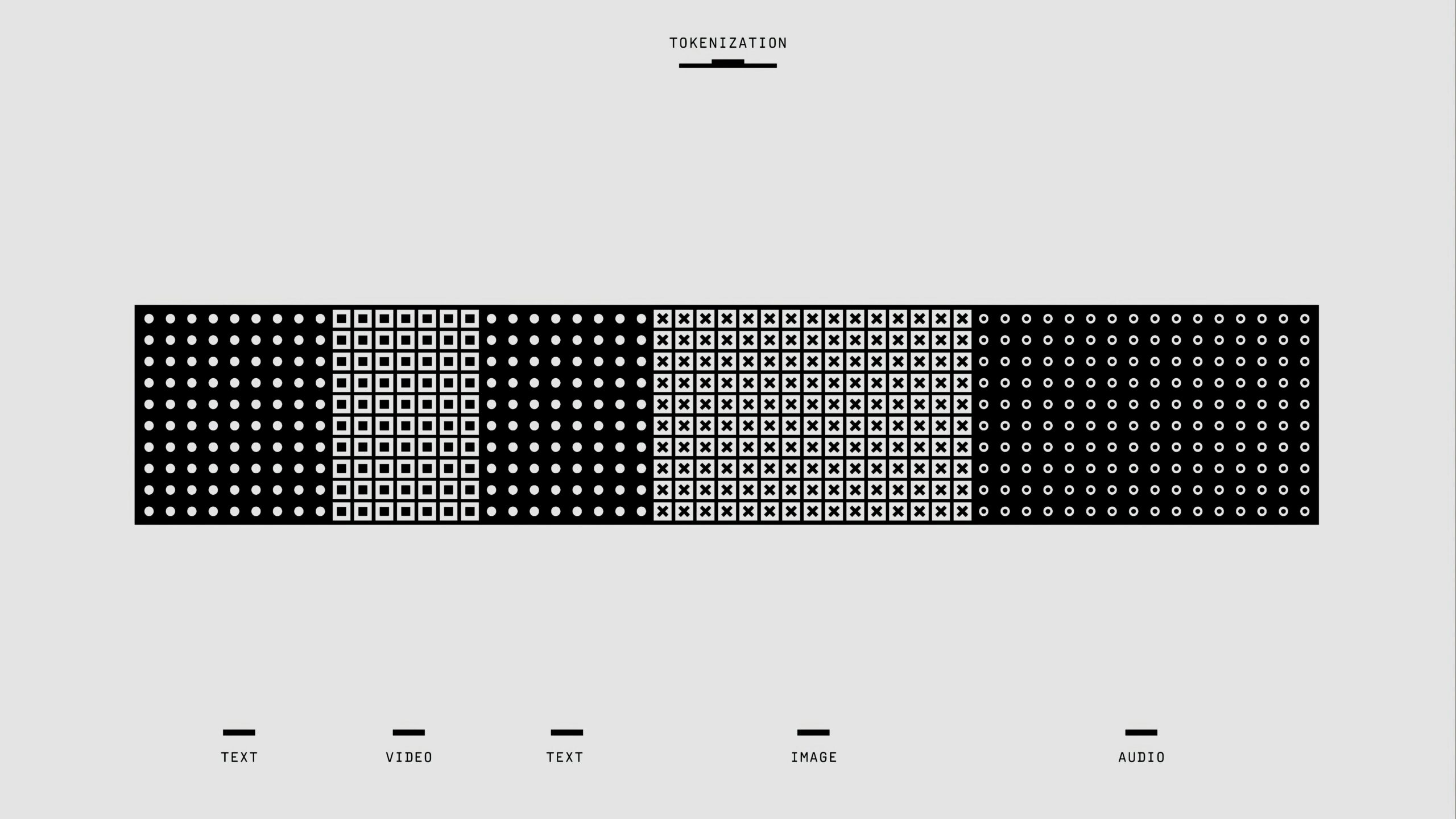

Explanation of Price Oracle Manipulation Attack

.jpg_01.jpeg)

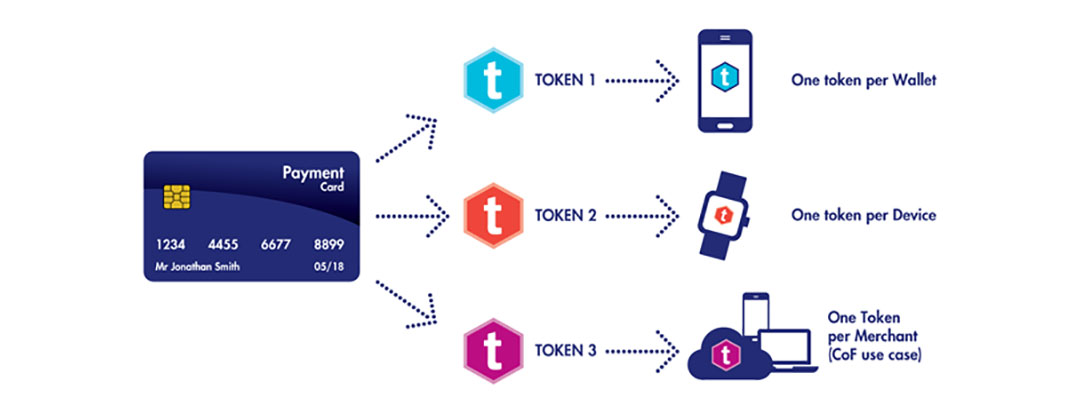

Price oracle manipulation is a technique employed by malicious actors to alter the perceived value of digital assets, thereby enabling them to execute trades that exploit vulnerabilities within smart contracts. In the KiloEx hacking incident, this manipulation facilitated the attacker in profiting from inconsistencies in token prices, resulting in substantial financial losses for both the exchange and its users.

This process typically entails intercepting the data feed that informs the smart contract regarding asset prices, which allows these malicious individuals to distort market perceptions. By doing so, they can engage in actions such as liquidating collateralized loans under misleading pretenses or obtaining trading advantages not supported by actual market conditions.

Such attacks not only lead to significant financial repercussions but also undermine trust in decentralized exchanges and their foundational blockchain technologies. Previous incidents, including the KiloEx case and others, underscore the urgent need for more robust oracle solutions and heightened scrutiny of data sources to protect against these manipulative practices that jeopardize the integrity of decentralized finance (DeFi).

Repercussions of the Hack

The repercussions of the KiloEx hack go beyond immediate financial losses, prompting regulatory agencies to assess their response to the incident and contemplate new financial regulations aimed at enhancing security for digital assets.

An official incident report is anticipated, which will outline the events and the community’s response. This report may serve as a catalyst for comprehensive security audits across similar trading platforms.

Regulatory and Legal Implications

The KiloEx hack presents significant regulatory and legal implications for decentralized exchanges, as authorities are likely to examine the incident closely to determine appropriate actions for asset recovery and the establishment of more stringent financial regulations. The outcomes of this examination will likely have a lasting impact on user trust and the future of decentralized finance (DeFi) platforms.

Regulatory bodies may propose stricter compliance measures that could fundamentally alter the operational landscape for these exchanges, necessitating the implementation of advanced security protocols and enhanced transparency practices.

Such a potential shift may compel decentralized platforms to adopt traditional financial standards, potentially resulting in a hybrid model that merges the advantages of decentralization with regulatory oversight.

As users become increasingly cognizant of security vulnerabilities, their trust in the cryptocurrency market may diminish unless firms demonstrate a robust commitment to safeguarding assets and personal information.

Ultimately, the manner in which the sector adapts to these challenges will either reinforce or undermine the principles of decentralization that many users initially sought.

Lessons Learned from the Hack

The KiloEx hack presents a significant lesson for all stakeholders within the decentralized finance ecosystem, underscoring the urgent requirement for improved security measures and preventive strategies to safeguard user funds and digital assets.

By adopting comprehensive risk management practices and enhancing user education regarding wallet security, platforms can substantially reduce potential vulnerabilities.

Improving Security Measures for Decentralized Exchanges

.jpg_10.jpeg)

Enhancing security measures for decentralized exchanges is essential in light of incidents such as the KiloEx hack, which has highlighted the critical need for robust incident response protocols and asset protection strategies.

The implementation of technologies like multi-signature wallets, digital wallets, and cold storage can significantly secure user funds and improve overall market integrity against potential cyber threats.

Decentralized exchanges should prioritize the establishment of stringent security protocols, including regular security audits and vulnerability assessments. This proactive approach will allow them to identify and address weaknesses in their systems before they can be exploited.

Furthermore, by adopting advanced user authentication methods, such as two-factor authentication, these exchanges can provide additional protection for individual accounts against unauthorized access and phishing attacks.

Well-defined incident response protocols are imperative; in the event of a security breach, users must be promptly informed, and remedial measures should be activated without delay.

These focused security initiatives not only enhance user confidence but also strengthen the reputation of the exchange within the decentralized finance sector, thereby preventing reputation damage.

Frequently Asked Questions

1. What is KiloEx DEX and how was it hacked?

KiloEx DEX is a decentralized cryptocurrency exchange. It was hacked through a price oracle manipulation attack, where the attacker was able to manipulate the price of a cryptocurrency on the exchange and exploit it for their own gain, highlighting the need for robust security protocols.

2. How much money was lost in the KiloEx DEX hack?

According to reports, approximately $7 million worth of cryptocurrency was lost in the KiloEx DEX hack.

3. How did the attacker manipulate the price oracle on KiloEx DEX?

.jpg_11.jpeg)

The attacker was able to manipulate the price oracle by exploiting vulnerabilities in the code of the oracle, highlighting a severe protocol vulnerability. They engaged in price manipulation to change the price of a specific cryptocurrency on the exchange, demonstrating sophisticated hacking methods. This allowed them to buy or sell digital currency at a manipulated price, illustrating significant market manipulation.

4. Is this the first time KiloEx DEX has been hacked, affecting the DeFi space and raising regulatory implications?

No, this is not the first time KiloEx DEX, a key player in the DeFi ecosystem, has been hacked, impacting community trust. The exchange has previously been targeted by cybercrime and hackers, but this $7M theft represents the largest attack to date, affecting their crypto assets and financial stability.

5. Will users be able to recover their lost funds?

Unfortunately, it is unlikely that users will be able to recover their lost funds, due to the lack of robust recovery strategies and asset safeguarding measures in place. Decentralized exchanges, unlike centralized exchanges, lack certain security practices and asset tracking capabilities, making it difficult to recover stolen funds. The incident highlights the necessity for improved investor protection and forensic analysis in the DeFi sector.

6. What steps are being taken to prevent future hacks on KiloEx DEX, enhance trading security, and ensure data integrity?

KiloEx DEX is working on implementing stronger security measures to prevent future hacks, including enhancing their security practices and incident management. This includes improving the code of their price oracle, conducting smart contract auditing to ensure the digital footprint is secure, and engaging in thorough security audits to identify and fix any vulnerabilities. Other measures include enhancing customer support and fraud detection systems, while also considering decentralized governance to strengthen their defense against future attacks.

.jpg_00.jpeg)

.jpg_01.jpeg)

.jpg_10.jpeg)

.jpg_11.jpeg)