What if a major Nasdaq-listed company made a significant move into the world of cryptocurrency? Would that change your perception of how traditional finance interacts with blockchain technology?

Groundbreaking Developments in Crypto

In an unprecedented twist, Janover, a publicly traded fintech firm previously focused on commercial real estate lending, has announced its acquisition of the Solana blockchain and is undergoing a total rebranding. This shift demonstrates a bold commitment to embracing blockchain technology at a time when such innovations are rapidly transforming industries.

The Strategic Shift: From Real Estate to Crypto

Janover’s decision to pivot from commercial real estate to the blockchain sector marks a significant transformation in its business model. By acquiring Solana, Janover is not only investing in a major Layer-1 blockchain network but also positioning itself at the forefront of a new financial paradigm. This strategic shift indicates a keen understanding of the growing relevance of cryptocurrency and blockchain technologies in modern finance.

Previously, Janover earned its reputation in the real estate market by facilitating loans for commercial properties. Now, the firm is focusing on utilizing Solana’s robust infrastructure. This ambitious endeavor illustrates an increasing trend for established firms to pursue opportunities within the cryptocurrency space, signaling a shift in how business operations could be conducted in the future.

Solana’s Future: A Comprehensive Acquisition

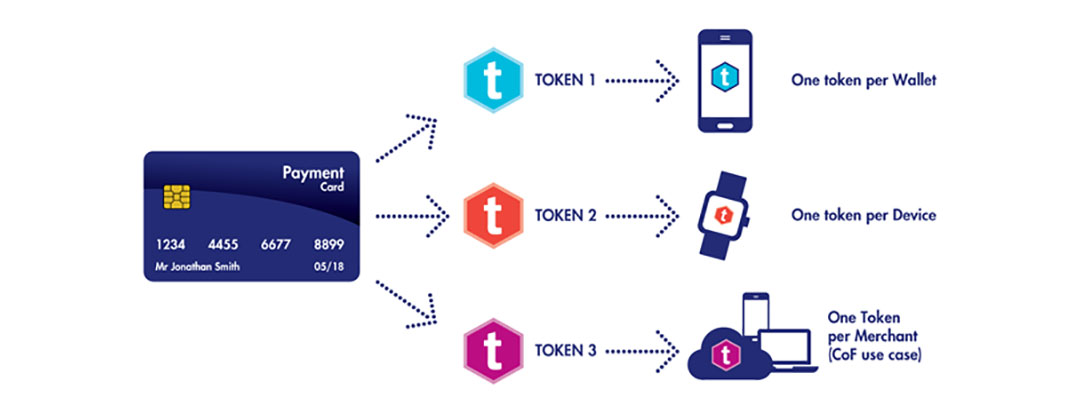

Janover’s acquisition includes all core technology and developer resources associated with the Solana blockchain. This move offers the firm complete access to the innovation and potential inherent in this rapidly growing network. However, it’s crucial to note that SOL token holders will retain their governance rights, allowing them to keep a voice in the ecosystem despite the acquisition.

This combination of ownership and preserved token governance rights demonstrates a thoughtful approach in balancing corporate control with community involvement—a critical aspect of decentralized finance that ensures the longevity of blockchain networks. The significance here lies in how traditional companies can integrate decentralized principles into their operations without alienating existing stakeholders.

Market Reactions: Stocks and Tokens in Flux

The announcement of the acquisition and subsequent rebranding has elicited strong reactions from the market. Notably, the price of Solana’s native token, SOL, saw an impressive surge of 18% on the news of the acquisition. This spike indicates that investors are optimistic about what the future holds, not just for Solana, but also for Janover itself.

Meanwhile, shares of Janover, which continue to trade under the ticker JNVR for the time being, experienced some volatility as markets responded to this radical pivot. Such drastic changes in a company’s direction often prompt mixed feelings among investors, yielding sharp fluctuations in stock prices as stakeholders digest the implications. However, the company has seen an increase of over 824% year-to-date, showing that investor confidence in Janover’s transition is strong.

Why This Matters: Navigating New Waters

Institutional Validation of Crypto

Janover’s bold move to acquire a top-5 blockchain signifies a growing institutional acceptance of cryptocurrency and blockchain technologies. Publicly-traded companies venturing into the crypto space helps legitimize these digital assets in the eyes of traditional finance. Given that Janover now occupies both the world of conventional finance and cutting-edge technology, the company may set a precedent for others in the industry to follow.

Hybrid Model Potential: A Technological Integration

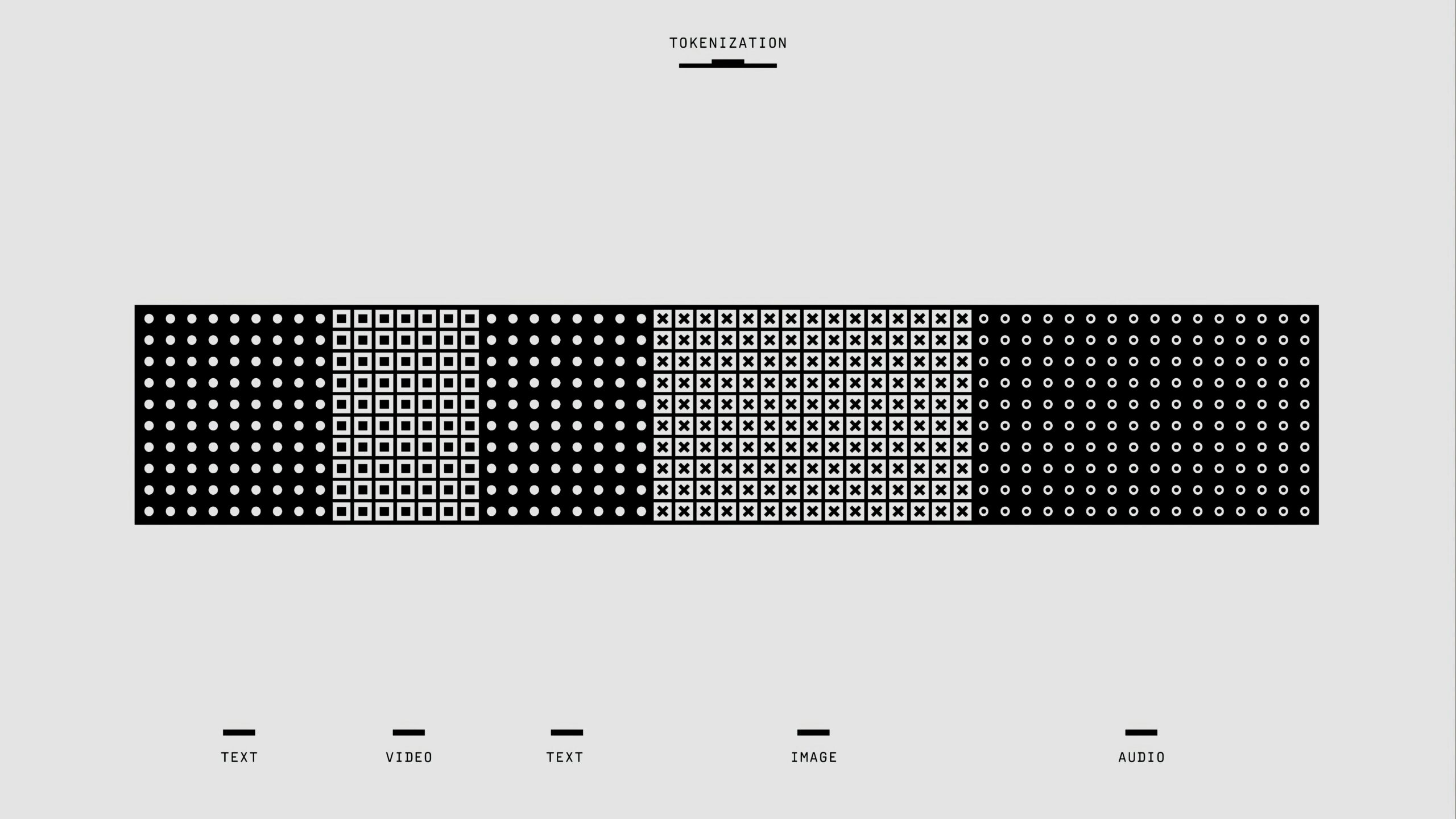

Janover’s plans to incorporate Solana’s lightning-fast transaction speeds—capable of handling approximately 65,000 transactions per second—into its existing fintech platforms presents exciting opportunities for innovation. This integration allows for enhanced functionality, potentially leading to products and services that blend traditional banking with next-generation blockchain solutions. The hybrid model they are developing may offer consumers faster, cheaper, and more transparent financial services.

Regulatory Implications for Public Companies

This acquisition could have far-reaching consequences regarding regulatory matters in the crypto space. The agreement sets a precedent for how public companies manage blockchain acquisitions and participate in the governance of digital assets. As regulators begin to craft guidelines in this rapidly evolving landscape, Janover’s actions could provide a blueprint for compliant operations within traditional markets.

Industry Impact: A Ripple Effect

Pressure on Competitors to Innovate

Existing players like Ripple and Polygon may feel challenged to pursue similar partnerships or acquisitions as traditional firms recognize the opportunities offered by the crypto space. This move could create competitive pressure, inspiring innovation and driving further investment across the sector. It’s a clear indication that businesses can no longer afford to ignore the importance of blockchain technology.

A Wave of Traditional Firms Entering Crypto

The challenges faced during the bear market have presented opportunities for traditional firms to acquire promising blockchain projects at favorable prices. As Janover showcases the potential benefits of integration, we may see a wave of financial institutions venturing into the world of cryptocurrency. The landscape is changing, and this could signal a future where traditional players actively engage within decentralized markets instead of avoiding them.

Monetary Challenges: Balancing Profitability and Decentralization

While Janover’s acquisition of the Solana blockchain is ambitious and potentially rewarding, questions remain about how the firm will navigate the complexities of monetization while maintaining the decentralized ethos that defines blockchain technology. This balancing act will be crucial as they move forward, particularly in a space that is often characterized by volatility and rapid change.

Looking Ahead: The Future of Corporate Blockchain Adoption

A Case Study in Success or a Cautionary Tale?

As Janover integrates Solana’s capabilities into its operations, analysts are curious to see if they can become a successful case study in corporate blockchain adoption or if they will face challenges that could lead to setbacks. The outcome will likely influence how other businesses perceive the intersection of traditional finance and Web3.

Implications for Public Companies Operating Blockchain Networks

The crypto community and traditional finance sectors are both watching closely to see whether Janover’s transition into blockchain technology heralds the beginning of a new era. If successful, this acquisition could pave the way for other public companies to operate their own blockchain networks, fundamentally changing how industries function.

The narrative surrounding Janover’s efforts is not just significant for its immediate stakeholders; it has the potential to reshape perceptions of cryptocurrency in the broader market. Your thoughts on this development could contribute to the ongoing discourse about the future of finance in a digital age.

Conclusion: Embracing a New Era of Financial Innovation

In summary, Janover’s acquisition of Solana and rebranding to DeFi Development Corporation reflects more than just a corporate shift; it marks a notable moment in the ongoing evolution of finance. As established companies seek to harness the power of blockchain technology, the implications are vast and varied.

This bold leap into Web3 opens up discussions about integration, regulation, and the legitimacy of cryptocurrency as a viable asset class. Your insights, whether about the potential benefits or the inherent risks associated with this dramatic pivot, could inform conversations around the future of finance.

You may find yourself wondering how these changes will shape the financial services landscape in the years to come. What does this mean for the average consumer, investor, or crypto enthusiast? As the lines between traditional financial systems and blockchain technology continue to blur, one thing is clear: we are witnessing the dawn of a potentially transformative era.