From Real Estate to Art: How Tokenization is Democratizing Investments”

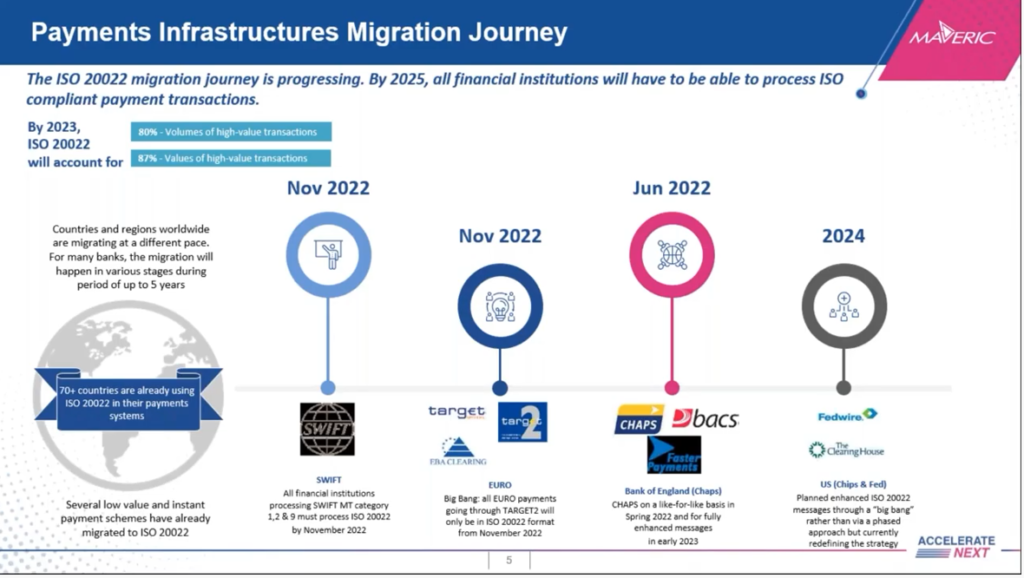

The Potential for Tokenization to Revolutionize the Global Financial System Introduction In the ever-evolving landscape of global finance, few innovations hold as much transformative potential as tokenization. This process involves converting physical and digital assets into digital tokens on a blockchain, promising to revolutionize the way we conduct financial transactions. By enabling features such as […]

From Real Estate to Art: How Tokenization is Democratizing Investments” Read More »