The world of cryptocurrencies is dynamic and ever-evolving, and Ripple stands out as a technology company dedicated to revolutionizing cross-border payments. At the heart of Ripple’s mission is XRP, a digital asset designed to enhance the speed and cost-effectiveness of transactions. In this blog post, we will delve into the intricate web of partnerships and collaborations Ripple has forged with global financial institutions. Additionally, we’ll explore the current market situation of XRP, including the legal battles with the SEC, market downturns, and regulatory concerns that have impacted its value.

Ripple’s Vision and Flagship Product:

Ripple is not just a cryptocurrency; it’s a technology company with a clear vision – to streamline cross-border payments for financial institutions. At the core of their operations is XRP, a digital asset engineered to facilitate faster and cheaper transactions than traditional methods. While XRP was not explicitly created as a security, its value is intricately tied to various factors such as market perception, adoption by financial institutions, and regulatory developments.

Partnerships that Shape the Future:

Ripple has strategically aligned itself with prominent financial institutions across the globe. These partnerships serve as crucial building blocks for the widespread adoption of XRP in the financial sector. Let’s delve into some notable partnerships:

- Santander: The collaboration with Santander involves a pilot project that explores the use of XRP for cross-border payments between Europe and the US. This initiative aims to showcase the efficiency and effectiveness of Ripple’s technology in real-world scenarios.

- Standard Chartered: Ripple joined forces with Standard Chartered to develop blockchain-based trade finance solutions in Asia. This partnership underscores Ripple’s commitment to revolutionizing not only cross-border payments but also the broader spectrum of financial services.

- National Bank of Kuwait (NBK): Ripple is actively exploring the utilization of XRP for remittances between Kuwait and other countries in collaboration with NBK. This partnership holds the potential to transform the landscape of international remittances.

- MUFG: In a collaborative trial with MUFG, Ripple is testing the waters of international payments between Japan and Thailand using XRP. This partnership highlights Ripple’s global approach and its pursuit of making cross-border transactions seamless.

- Travelex: Working alongside Travelex, Ripple is exploring the use of XRP for faster and more cost-effective foreign exchange transactions. This partnership showcases the versatility of Ripple’s technology in addressing various aspects of the financial industry.

These partnerships illustrate Ripple’s commitment to creating real-world solutions for financial institutions, utilizing the unique capabilities of XRP.

The Current Market Situation:

As of February 3rd, 2024, the cryptocurrency market, including XRP, continues to be marked by high volatility and significant price fluctuations. XRP’s current value is notably lower than its peak in January 2018, and several factors contribute to this situation.

- Ongoing Legal Battle with the SEC:In December 2020, the US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, alleging that XRP is an unregistered security. This legal battle has cast a shadow of uncertainty over XRP’s status, impacting investor sentiment and causing fluctuations in its market value. We will delve deeper into the details of this legal saga and its implications for Ripple and XRP.

- Wider Market Downturn:The entire cryptocurrency market faced a significant correction in early 2022, impacting XRP along with other digital assets. Understanding the broader market trends and their influence on XRP’s performance is crucial in comprehending the cryptocurrency landscape.

- Regulatory Concerns:The regulatory environment surrounding cryptocurrencies globally remains uncertain, creating challenges for their adoption by financial institutions. Ripple, being a frontrunner in the industry, faces the brunt of these regulatory concerns, impacting its growth trajectory and market performance.

In the subsequent sections, we will dissect each of these factors, providing a comprehensive analysis of how they have shaped the current market situation for XRP.

Understanding the Legal Battle with the SEC:

The legal battle between Ripple and the SEC has been a focal point of discussion within the cryptocurrency community. The SEC’s allegations that XRP is an unregistered security have far-reaching implications for both Ripple and the broader cryptocurrency industry. In this section, we will explore the details of the lawsuit, its progression over time, and the potential outcomes that could shape the future of XRP.

- Origins of the Lawsuit:The SEC’s lawsuit against Ripple in December 2020 sent shockwaves through the cryptocurrency space. The crux of the matter revolves around the SEC’s assertion that XRP constitutes a security and, as such, should have been registered with the regulatory body. Ripple, on the other hand, contends that XRP is not a security but rather a digital currency.

- Legal Proceedings and Developments:The legal battle has seen various twists and turns, with both parties presenting their arguments before the court. Ripple has vehemently defended its position, emphasizing the distinct nature of XRP compared to traditional securities. The court proceedings, rulings, and any settlements reached will significantly impact the regulatory framework for cryptocurrencies and set precedents for the industry’s future.

- Implications for XRP and the Broader Cryptocurrency Industry:The outcome of the legal battle holds significant consequences for Ripple, XRP, and the cryptocurrency market as a whole. A favorable ruling for Ripple could bolster confidence in XRP’s legitimacy and pave the way for increased adoption. Conversely, an unfavorable outcome may lead to regulatory challenges and further market volatility.

Market Downturns and XRP’s Performance:

The cryptocurrency market is notorious for its volatility, and XRP has not been immune to market downturns. Understanding the broader market trends and their impact on XRP’s performance is essential for investors and enthusiasts alike. In this section, we will delve into the reasons behind the wider market downturns and analyze how they have influenced XRP’s current valuation.

- Early 2022 Correction:The cryptocurrency market experienced a notable correction in early 2022, triggering a decline in the value of various digital assets, including XRP. Understanding the factors contributing to this correction – be it market sentiment, macroeconomic trends, or other external influences – provides insights into the challenges faced by XRP and the cryptocurrency market as a whole.

- Market Sentiment and Investor Behavior:Cryptocurrency markets are often influenced by sentiment and investor behavior. The fear of missing out (FOMO), market speculation, and macroeconomic indicators can contribute to sudden market shifts. Analyzing these factors in the context of XRP’s performance can offer a nuanced understanding of its market dynamics.

- Investor Response to Market Volatility:How investors respond to market downturns is crucial for the recovery and sustained growth of digital assets. Examining investor sentiment, strategies, and reactions during periods of market volatility can shed light on the resilience of XRP and its potential for future growth.

Regulatory Concerns and the Future of XRP:

Regulatory uncertainty remains a significant challenge for the cryptocurrency industry, and Ripple is not exempt from its impact. In this section, we will explore the global regulatory landscape, the challenges it poses for XRP, and how Ripple is navigating these uncertainties.

- Global Regulatory Trends:Cryptocurrency regulations vary widely across countries, with some embracing innovation and others adopting a more cautious approach. Understanding the regulatory trends globally provides insights into the challenges faced by Ripple as it seeks to expand the adoption of XRP on a global scale.

- Ripple’s Approach to Compliance:Ripple has consistently emphasized its commitment to compliance with regulatory requirements. Exploring Ripple’s proactive measures to navigate the regulatory landscape – such as engaging with regulators, complying with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations, and ensuring transparency – provides a glimpse into the company’s strategy for sustainable growth.

- Impact of Regulatory Clarity on XRP:The lack of regulatory clarity poses challenges for the widespread adoption of XRP by financial institutions. Assessing the potential impact of regulatory developments on XRP’s future can help investors and enthusiasts gauge the resilience of the digital asset in the face of evolving regulatory landscapes.

Looking Ahead: XRP’s Future Potential and Ripple’s Role in Shaping It

While the current market situation presents challenges for XRP, it’s essential to look beyond the immediate uncertainties and assess the long-term potential of Ripple and its flagship product. In this final section, we will explore potential catalysts for XRP’s resurgence, Ripple’s ongoing efforts to address challenges, and the role XRP might play in the future of cross-border payments.

- Catalysts for XRP’s Resurgence:Identifying potential catalysts that could propel XRP to new heights is crucial for investors looking to make informed decisions. These catalysts may include regulatory clarity, increased adoption by financial institutions, technological advancements, or strategic partnerships that enhance XRP’s utility.

- Ripple’s Ongoing Initiatives:Ripple, as a dynamic technology company, continues to evolve and adapt to the challenges it faces. Examining Ripple’s ongoing initiatives, technological advancements, and strategic moves can provide insights into the company’s resilience and its ability to navigate the complex landscape of the cryptocurrency industry.

- XRP’s Role in the Future of Cross-Border Payments:Despite the current challenges, XRP holds the potential to play a transformative role in the future of cross-border payments. Analyzing the unique features of XRP, such as its speed, cost-effectiveness, and scalability, can offer a glimpse into how it might position itself in the rapidly evolving landscape of global finance.

Conclusion:

In this comprehensive exploration of Ripple and XRP, we’ve delved into the technology company’s vision, flagship product, partnerships, and the intricate web of factors influencing XRP’s current market situation. The ongoing legal battle with the SEC, market downturns, and regulatory concerns have undoubtedly impacted XRP’s value, but understanding these challenges is essential for a nuanced perspective.

As we look ahead, the cryptocurrency landscape remains dynamic, presenting both challenges and opportunities for Ripple and XRP. Navigating the regulatory landscape, addressing legal uncertainties, and capitalizing on strategic partnerships will be key for Ripple to fulfill its vision of transforming cross-border payments.

Investors, enthusiasts, and industry observers are encouraged to stay informed, monitor developments, and critically analyze the evolving narrative of Ripple and XRP in the broader context of the cryptocurrency revolution. While the journey may be fraught with challenges, the potential for innovation and positive disruption in the financial sector is undeniably compelling, making Ripple and XRP entities to watch closely in the coming years.

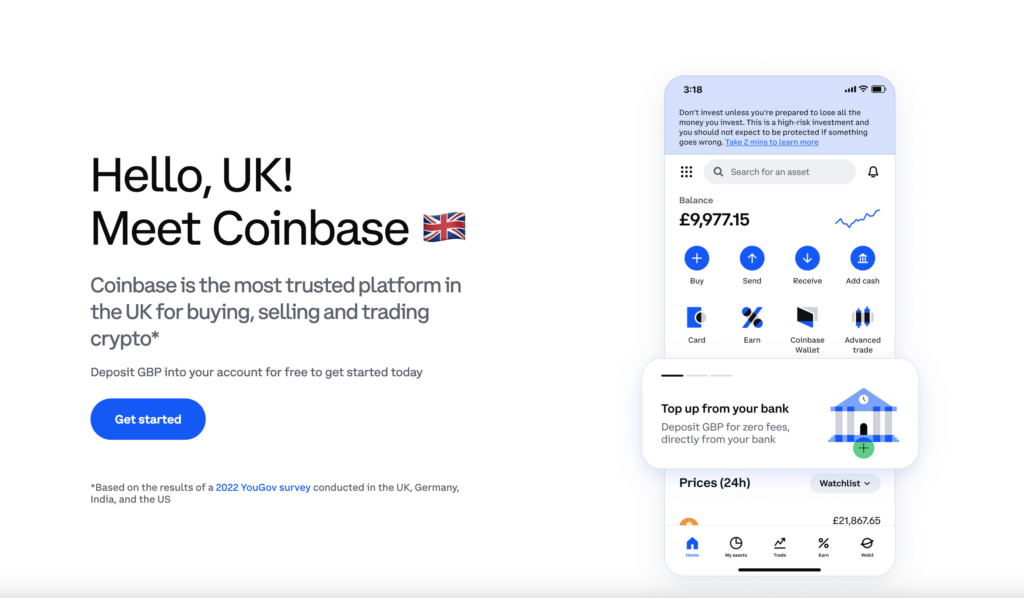

Earn Rewards with Coinbase Earn: Discover New Cryptocurrencies

Coinbase, a name synonymous with cryptocurrency for many, has become a major player in the digital asset landscape. But what exactly is it, and what can it offer you? This article delves into the world of Coinbase, exploring its features, its impact, and some key considerations before diving in.

Platform for the Curious:

Founded in 2012, Coinbase started as a simple platform for buying and selling Bitcoin. Since then, it has evolved into a comprehensive ecosystem offering:

- Buying and selling: Trade over 100 cryptocurrencies with convenient fiat on-ramps and off-ramps.

- Staking and earning: Earn passive income by staking your crypto holdings on select assets.

- NFT marketplace: Explore and trade non-fungible tokens (NFTs), digital collectibles representing unique ownership.

- Coinbase Wallet: Securely store your crypto assets with self-custody control.

- Learning resources: Gain knowledge with educational articles, videos, and quizzes.

Bridging the Gap:

Coinbase plays a crucial role in bridging the gap between traditional finance and the crypto world. By simplifying access and offering user-friendly interfaces, it has attracted millions of users, contributing to mainstream adoption. Additionally, partnerships with major institutions like Mastercard and PayPal further solidify its position.

Considerations and Cautions:

While Coinbase offers convenience and accessibility, remember:

- Cryptocurrency is inherently volatile: Be prepared for significant price fluctuations and the potential for loss.

- Fees: Coinbase charges transaction fees, so factor them into your investment decisions.

- Security: While Coinbase emphasizes security, practicing personal cyber hygiene remains crucial.

- Do your own research: Never invest solely based on others’ recommendations; understand the risks and potential rewards before diving in.

Coinbase is a gateway to the crypto world, but knowledge and caution are essential companions. Explore responsibly, conduct your own research, and remember, the journey is paved with both potential and volatility.

Disclaimer: This information is not financial advice, and cryptocurrency investing carries inherent risks. Please consult with a financial professional before making any investment decisions.