Chainlink’s (LINK) recent price surge has sent shockwaves through the cryptocurrency landscape, leaving many asking: what’s driving the momentum? This isn’t just a fleeting rally; it signifies a potential paradigm shift in the industry, fueled by Chainlink’s unique value proposition and strategic partnerships. Let’s delve deeper into the token’s ascent, analyzing the key factors at play and charting its potential future trajectory.

Breaking Through Barriers: A 22-Month High

On Friday, February 2nd, 2024, the LINK token defied expectations, breaching the $18 barrier and reaching its highest point since April 2022. This 15% surge within 24 hours and 30% gain in a week shattered the three-month consolidation period, marking a potential continuation of the bullish trend initiated in June 2023. This wasn’t just a price fluctuation; it was a statement of growing confidence in Chainlink’s technology and its role within the crypto ecosystem.

The Surge: Unpacking the Key Drivers

Several pivotal factors have propelled LINK’s recent ascent:

1. Bridging the Gap: Oracles and the Real World

Chainlink has emerged as the leading decentralized oracle network, serving as the crucial bridge between blockchains and real-world data. Oracles securely fetch and deliver off-chain information, unlocking a myriad of functionalities for smart contracts. This ability to access real-world data fuels innovation across various sectors, from DeFi and insurance to supply chain management and prediction markets. As the demand for blockchain applications utilizing real-world data intensifies, Chainlink’s role becomes increasingly central, driving investor interest in LINK.

2. Cross-Chain Connectivity: Unifying a Fragmented Landscape

The fragmented nature of the blockchain landscape poses a significant challenge for interoperability. Chainlink offers a solution through its blockchain-agnostic infrastructure, enabling seamless and secure token transfers across different blockchain networks. This cross-chain functionality streamlines transactions, unlocks new investment opportunities, and fosters broader adoption of blockchain technology. As the need for interoperability grows, Chainlink’s position as a cross-chain facilitator strengthens, further supporting the LINK token’s value proposition.

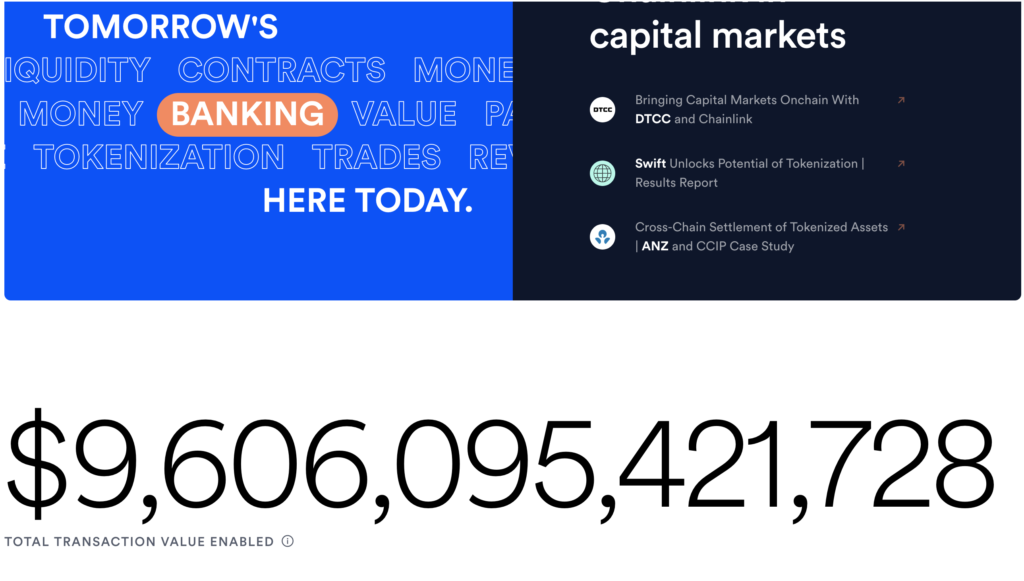

3. Tokenization Revolution: Real-World Assets Meet Blockchain

The tokenization of real-world assets (RWAs) is rapidly gaining traction, transforming traditional assets like gold, stocks, and real estate into digital tokens on blockchains. This unlocks numerous benefits, including increased liquidity, fractional ownership, and global accessibility. Analysts, like K33 Research, see LINK as a “safe bet” to capitalize on this burgeoning RWA tokenization trend. Chainlink’s compatibility with various blockchains and its secure oracle network position it strategically to play a central role in this transformation, leading to increased demand for LINK as the ecosystem expands.

4. Strategic Partnerships: Building a Robust Ecosystem

Chainlink actively cultivates partnerships with leading players across various industries, solidifying its position as a reliable and trusted infrastructure provider. Collaborations with organizations like Google Cloud, SWIFT, and Oracle Corporation demonstrate Chainlink’s commitment to fostering broader adoption and innovation within the blockchain space. These partnerships not only enhance Chainlink’s capabilities but also generate excitement and confidence among investors, propelling the LINK token’s value.

Examples of Key Partnerships:

- Google Cloud: This partnership integrates Chainlink oracles with Google Cloud Platform, enabling developers to build dApps with access to secure and reliable off-chain data.

- SWIFT: The collaboration aims to bridge the gap between traditional finance and decentralized finance (DeFi) by utilizing Chainlink oracles to connect SWIFT’s global payments network with blockchain applications.

- Oracle Corporation: This partnership leverages Chainlink oracles to integrate blockchain data into Oracle Cloud Infrastructure, expanding the reach of blockchain technology to enterprise use cases.

5. Influx of New Money: Open Interest on the Rise

The growing confidence in Chainlink is reflected in the increasing open interest in LINK futures contracts. Open interest represents the total number of outstanding contracts, signifying an influx of new money into the market. This surge, coupled with the rising price, indicates a strong underlying buying pressure and reinforces the bullish sentiment surrounding LINK.

Navigating the Future: Where Does LINK Go From Here?

While the future remains uncertain, several factors suggest sustained momentum for LINK:

Continued Demand for Decentralized Oracles: As blockchain technology matures and ventures into more complex applications, the need for secure and reliable oracles will only grow. Chainlink’s established position as a leader in this space, coupled with its continuous development and strategic partnerships, positions it well to capture this growing demand.

Expanding Use Cases: Decentralized oracles have the potential to revolutionize various industries beyond finance. Supply chain management, healthcare, and even voting systems can leverage oracles to enhance transparency, security, and efficiency. Chainlink’s adaptability and focus on building a robust ecosystem position it to become the go-to oracle solution for these diverse use cases, further driving demand for LINK.

Regulatory Landscape: As regulatory frameworks for blockchain and cryptocurrencies evolve, the demand for compliant oracle solutions will increase. Chainlink’s proactive approach to regulatory compliance, demonstrated by its collaboration with SWIFT and its focus on data security, positions it favorably in this evolving landscape, potentially attracting institutional investors and boosting the appeal of LINK.

Technological Advancements: Chainlink is actively pushing the boundaries of oracle technology, exploring advancements in areas like secure multi-party computation (MPC) and verifiable computation (VC). These innovations aim to enhance scalability, security, and privacy within the oracle network, solidifying Chainlink’s competitive edge and potentially attracting further investment in LINK.

Community and Governance: Chainlink boasts a vibrant and engaged community of developers and stakeholders. The recent launch of the Chainlink staking program further incentivizes community participation and governance, fostering a decentralized and sustainable ecosystem. This strong community foundation can attract developers and users, contributing to the long-term growth of the Chainlink network and the value of LINK.

Challenges and Considerations:

Despite the bullish outlook, challenges remain:

- Competition: While Chainlink is a leader, competitors like Band Protocol and DIA Network are vying for market share. Continuous innovation and strategic partnerships will be crucial for Chainlink to maintain its lead.

- Scalability: As the demand for oracles increases, scalability remains a concern. Chainlink’s ongoing efforts to develop layer-2 solutions and optimize its network are essential for handling larger transaction volumes.

- Regulatory Uncertainty: Evolving regulatory landscapes introduce uncertainty for the entire blockchain industry, including oracles. Adaptability and compliance will be key for Chainlink to navigate these regulatory hurdles.

Conclusion:

Chainlink’s LINK token has experienced a significant surge, fueled by its critical role as a decentralized oracle network, strategic partnerships, and the growing demand for real-world data integration in blockchain applications. However, the future remains dynamic. Recognizing the ongoing challenges and staying abreast of technological advancements will be crucial for Chainlink to maintain its momentum and solidify its position as the leading oracle solution. Ultimately, the success of LINK will hinge on Chainlink’s ability to adapt, innovate, and deliver on its promise of connecting blockchains with the real world in a secure and reliable manner.

Grab the LINK While it’s Hot: Invest, Trade, & Learn About Chainlink on Kraken!

For Investors:

- Ready to capitalize on the LINK token surge? Buy LINK on Kraken and join the growing oracle revolution!

- Don’t miss out! Invest in LINK and gain exposure to the future of decentralized data and cross-chain connectivity.

- Diversify your portfolio with LINK. Kraken offers secure and seamless trading for this promising asset.

For Traders:

- Take advantage of LINK’s volatility! Trade LINK on Kraken with advanced charting tools and margin trading options.

- Hedge your bets and leverage price movements with LINK futures contracts on Kraken.

- Stay ahead of the curve with real-time market data and expert insights on LINK.

For the Crypto Curious:

- Learn more about Chainlink and LINK! Explore our educational resources and dive deeper into the world of decentralized oracles.

- Join the conversation! Discuss Chainlink and LINK with our vibrant community of crypto enthusiasts.

- Start your crypto journey with LINK! Kraken offers a user-friendly platform to buy, sell, and trade this exciting asset.

Remember to tailor the call to action to your specific audience and their interests.