The world is on the cusp of a financial revolution, driven by innovations in cross-border payments, crypto-liquidity, and the emergence of Central Bank Digital Currencies (CBDCs). These three forces are converging to create a landscape of faster, cheaper, and more accessible financial transactions across borders. This blog delves into the heart of these advancements, exploring their potential to reshape the way we send, receive, and manage money internationally.

1. Cross-Border Payments: Breaking Down the Walls

Sending money across borders has long been a cumbersome and costly affair. Traditional methods, like wire transfers, often involve hefty fees, lengthy settlement times, and a labyrinth of intermediaries. This complexity disproportionately affects individuals and businesses in developing economies, who rely heavily on remittances and international trade.

Enter Ripple, a company at the forefront of cross-border payment disruption. Their On-Demand Liquidity (ODL) solution leverages XRP, their native digital asset, to bridge the gap between fiat currencies. Instead of pre-funding accounts in various countries, ODL uses XRP as an intermediary, settling transactions in seconds with minimal fees. This revolutionary technology has the potential to slash costs by up to 70% and reduce settlement times from days to mere seconds.

2. Crypto-Liquidity: Fueling the Digital Revolution

Cryptocurrencies have captured the imagination of the world with their promise of decentralization and financial freedom. However, managing liquidity in the crypto space can be a challenge, especially for institutional investors and businesses. Ripple’s Liquidity Hub addresses this issue by creating a global network of liquidity providers, aggregating offerings from exchanges, market makers, and OTC desks. This one-stop shop simplifies sourcing liquidity, reduces administrative tasks, and optimizes pricing across asset pairs, making crypto-asset trading and cross-border payments more seamless and efficient.

3. Central Bank Digital Currencies: Reimagining Money

Central banks are entering the digital currency arena, issuing their own CBDCs to address the limitations of traditional cash. Ripple offers a comprehensive CBDC platform, allowing central banks to tailor the issuance and management of their digital currencies to their specific needs. The platform boasts robust security, scalability, and interoperability, enabling secure, high-volume transactions and seamless integration with existing financial systems.

The Convergence: A Perfect Storm of Innovation

These three forces are not acting in isolation; their convergence creates a powerful synergy. Imagine a world where cross-border payments using ODL are settled instantly with CBDCs, further reducing costs and complexities. Or picture businesses leveraging the Liquidity Hub to manage their CBDC holdings and seamlessly trade them for other digital assets. The possibilities are endless, paving the way for a more inclusive and interconnected financial ecosystem.

Challenges and Opportunities on the Horizon

While the potential of these innovations is undeniable, challenges remain. Regulatory uncertainty surrounding cryptocurrencies and CBDCs can create hurdles for wider adoption. Additionally, ensuring equitable access and financial literacy will be crucial to bridge the digital divide and prevent further marginalization.

However, the opportunities outweigh the challenges. The potential for faster, cheaper, and more secure cross-border payments, coupled with the increased accessibility of digital assets, promises to unlock economic growth, boost financial inclusion, and empower individuals and businesses across the globe.

The Road Ahead: Embracing the Future of Finance

As we navigate this dynamic landscape, collaboration and open dialogue between policymakers, financial institutions, and technology providers will be key. By embracing innovation and working towards a common goal of creating a more efficient and inclusive financial system, we can ensure that the revolution in cross-border payments, crypto-liquidity, and CBDCs benefits everyone.

This is just the beginning of an exciting journey. Stay tuned as the story unfolds, and let’s embrace the potential of these powerful forces to reshape the financial world for the better.

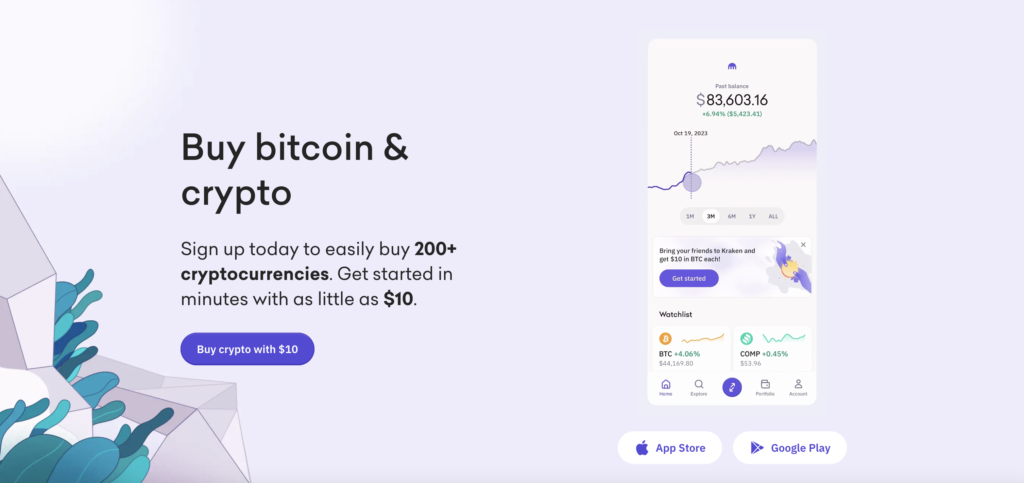

Secure Your Crypto: Complete Your Kraken KYC & AML Verification Today!

Protect your assets and unlock the full power of Kraken with fast and easy Know Your Customer (KYC) and Anti-Money Laundering (AML) verification.

Why verify?

- Enhanced security: KYC/AML safeguards your crypto from unauthorized access and illegal activity.

- Higher limits: Unlock higher deposit, withdrawal, and trading limits for a smoother experience.

- Peace of mind: Trade with confidence knowing your platform adheres to the highest regulatory standards.

Verification is simple:

- Choose your level: Select “Intermediate” or “Pro” verification based on your trading needs.

- Gather documents: Prepare your government-issued ID, proof of address, and other required documents.

- Complete the process: Upload your documents and answer a few questions directly on the Kraken platform.

It’s that easy!

Don’t wait, verify today and experience the full benefits of Kraken:

- Trade over 100 cryptocurrencies and margin trade with up to 5x leverage.

- Stake your crypto and earn passive rewards.

- Send and receive funds globally with ease.

- Access advanced trading tools and features.

Join the millions of satisfied users who trust Kraken with their crypto. Verify now and take control of your financial future!

Click here to start your verification: https://www.kraken.com/

- Verify Now!

- Start Trading

- Learn More about KYC/AML

Remember, verification is not just a requirement, it’s a smart investment in the security and growth of your crypto portfolio.

Let’s build a safer, more transparent future for crypto, together.

P.S. Share this post with your friends and help them experience the power of Kraken!