USDT Backing in Question as Tether Faces Borrowing Allegations

The $104 billion stablecoin that powers much of the cryptocurrency market is facing serious questions about what actually backs it. Recent allegations suggest Tether’s USDT may be entangled in a precarious trading scheme involving firms like Abraxas, Cumberland, and Wintermute—who allegedly borrow funds to acquire USDT, convert it to cryptocurrencies, and sell these assets back for dollars in a cycle dependent on rising crypto prices. With Tether’s co-founder reportedly controlling over $150 billion in USDT and plans to relocate headquarters to El Salvador (a country without U.S. extradition), the crypto community is on edge.

As global regulators intensify scrutiny of stablecoins, Tether’s historical resistance to comprehensive audits raises red flags. The company has relied on periodic attestations rather than full audits—a practice widely criticized for lacking transparency. If these allegations prove true, the implications could be devastating: margin calls, forced liquidations, and liquidity shortages across exchanges and DeFi protocols that heavily depend on USDT. With USDT central to countless trading pairs, any disruption could limit access to large segments of the crypto market, potentially triggering a cascade of failures throughout the ecosystem.

In this deep dive, we’ll examine the alleged trading scheme behind Tether, explore the regulatory concerns and transparency issues, assess potential market risks, analyze the global regulatory response, and consider future scenarios for both Tether and the broader crypto ecosystem.

The Alleged Trading Scheme Behind Tether

How Abraxas, Cumberland, and Wintermute reportedly borrow funds to acquire USDT

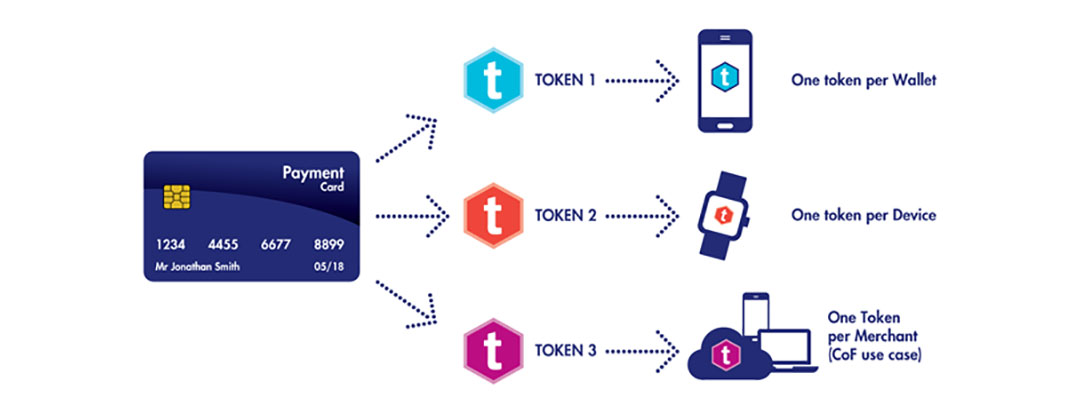

At the center of the controversy surrounding Tether (USDT) is an alleged trading scheme involving major cryptocurrency market makers Abraxas, Cumberland, and Wintermute. According to available information, these firms reportedly engage in borrowing practices to acquire USDT without full backing in traditional currency. This arrangement has raised significant questions about the true nature of USDT’s reserves and its market stability.

These trading entities are alleged to participate in a scheme where they borrow funds to purchase newly minted USDT directly from Tether Limited Inc. Unlike traditional financial instruments that require full collateralization, reports suggest that these market makers may not be providing full dollar-for-dollar backing when acquiring USDT, creating potential gaps in the stablecoin’s reserve system.

The conversion cycle: USDT to cryptocurrencies and back to dollars

The cycle reportedly operates through a complex conversion process that potentially manipulates cryptocurrency markets. Once these market makers acquire USDT, they reportedly convert these tokens into Bitcoin and other cryptocurrencies on various exchanges. This conversion process creates artificial demand that can drive up cryptocurrency prices.

As outlined in the reference materials, this cycle may resemble characteristics of a Ponzi scheme, where newly minted USDT enters the market, is used to purchase cryptocurrencies (particularly Bitcoin), which then artificially inflates prices. The market makers can then convert these appreciated assets back to dollars, potentially at a profit, while leaving retail investors holding potentially overvalued digital assets.

Market dependency: Reliance on rising crypto prices and USDT demand

This alleged scheme creates a dangerous dependency on two critical factors: continuously rising cryptocurrency prices and sustained demand for USDT. As long as cryptocurrency prices trend upward and demand for USDT remains strong, the cycle can continue operating. However, this creates significant market vulnerabilities.

With over $114 billion in market capitalization and commanding approximately 70% of the stablecoin market, USDT’s influence on the broader cryptocurrency ecosystem cannot be overstated. The sustainability of this model depends entirely on market confidence in both USDT and cryptocurrencies as a whole. If confidence in Tether’s reserves were to falter, it could potentially trigger a liquidity crisis across the entire cryptocurrency market.

The interconnectedness between Tether and cryptocurrency prices creates a precarious situation where any disruption in this cycle could lead to significant market sell-offs and broader economic consequences, especially given cryptocurrency’s increasing integration with traditional financial systems.

With these alleged trading schemes raising serious questions about USDT’s foundational stability, we must next examine the regulatory concerns and transparency issues that have plagued Tether for years. These regulatory challenges have become increasingly pressing as authorities worldwide begin to recognize the potential systemic risks posed by stablecoins operating without proper oversight.

Regulatory Concerns and Transparency Issues

Now that we’ve examined the alleged trading scheme behind Tether, it’s crucial to understand the regulatory concerns and transparency issues surrounding this influential stablecoin.

A. Tether’s potential relocation to El Salvador: Implications for oversight

Tether has recently announced plans to relocate its operations to El Salvador, seeking to establish a legal foundation under the country’s regulatory framework for Digital Assets Service Providers (DASPs). This strategic move involves registering two entities—Tether NA El Salvador S.A. de C.V. and Tether International El Salvador S.A. de C.V.—with the National Commission of Digital Assets (CNAD). Both entities have been authorized for activities including digital asset exchange, trading platform operation, risk evaluation, investment product management, and digital asset custody.

El Salvador’s regulatory environment appears favorable for stablecoin issuers, though questions remain about how this relocation might affect oversight of Tether’s operations in other jurisdictions where USDT circulates. The registration process involves a two-stage licensing procedure, potentially offering Tether more regulatory flexibility than in other regions.

B. Concentration of control: Arkham’s findings about Giancarlo Devasini

Recent investigations have raised concerns about the concentration of control within Tether’s governance structure. Findings related to Giancarlo Devasini, a key figure in Tether’s operations, have sparked debate among investors and experts about the potential risks associated with centralized control over such an influential stablecoin. This concentration of power raises questions about decision-making processes and accountability within the organization that issues the market’s largest stablecoin.

C. Resistance to comprehensive audits and preference for attestations

Despite USDT’s substantial influence within the cryptocurrency market, Tether has demonstrated resistance to comprehensive third-party audits of its reserves. This lack of transparency has become a central concern among market participants and regulators alike. Instead of full audits, Tether has relied on attestations, which provide more limited assurance regarding the backing of its stablecoin.

El Salvador’s regulations do require stablecoin issuers to maintain a one-to-one ratio of International Reserve Assets with specific liquidity requirements. Additionally, registered stablecoin issuers must provide audited financial disclosures. However, as of now, Tether has not registered any stablecoin offerings in El Salvador, and its companies are not listed as authorized issuers of USDT in the country.

With these transparency concerns in mind, next, we’ll examine the potential market risks and vulnerabilities that could emerge from Tether’s current practices and position within the crypto ecosystem.

Potential Market Risks and Vulnerabilities

Having examined the regulatory concerns surrounding Tether, it’s crucial to understand the potential market risks that could materialize if allegations about USDT’s backing prove true.

A. Systemic risks if the alleged borrowing cycle collapses

The cryptocurrency ecosystem has become heavily dependent on USDT, with its market cap exceeding $112 billion. If Tether’s alleged borrowing schemes were to unravel, the consequences could be catastrophic. Similar to the TerraUSD collapse, a USDT failure would trigger a market-wide liquidity crisis. With Tether surpassing even Bitcoin in trading volume since 2019, its destabilization would immediately freeze significant portions of trading activity across exchanges.

The alleged practice of loaning reserve funds (as evidenced by the $850 million loan to Bitfinex revealed in the 2021 New York Attorney General lawsuit) creates a precarious situation where reserve insufficiency could trigger a “bank run” on USDT. This would force massive liquidations across the market as traders scramble to exit positions.

B. Impact of USDT value fluctuations on margin calls and liquidations

Historical evidence shows USDT’s vulnerability to depegging events, such as the 2018 incident when its price briefly fell to $0.88. Even minor fluctuations in USDT’s dollar peg can trigger devastating chain reactions in leveraged positions. Many traders use USDT as collateral for margin trading, meaning any devaluation would immediately trigger margin calls and forced liquidations.

The simultaneous unwinding of leveraged positions would create a cascading effect, potentially driving cryptocurrency prices down dramatically across the board. With USDT acting as the primary liquidity provider in many trading pairs, its instability would magnify market volatility exponentially.

C. Consequences for exchanges and DeFi protocols heavily reliant on USDT

Exchanges like OKX have already begun ceasing USDT trading pairs in certain jurisdictions due to regulatory concerns. If USDT were to collapse, exchanges would face operational disruptions of unprecedented scale, as most rely on USDT for trading pair liquidity.

DeFi protocols that use USDT for stablecoin liquidity pools, collateral for lending, or as part of their treasury management would face existential threats. The loss of confidence would extend beyond Tether to the broader stablecoin sector, potentially triggering widespread withdrawals from other stablecoins as well.

As we consider these market vulnerabilities, it becomes clear why global regulatory bodies are taking increasingly decisive action regarding stablecoins, which we’ll explore in the next section on global regulatory responses.

Global Regulatory Response to Stablecoin Concerns

Having explored the potential market risks and vulnerabilities associated with Tether’s alleged backing issues, we now turn our attention to how regulators worldwide are responding to these growing concerns about stablecoins.

A. Increasing examination of reserve requirements for stablecoins

Global financial authorities have recognized that stablecoins represent a significant integration point between traditional finance and crypto markets. Without proper oversight, the risks of financial contagion could escalate dramatically. Regulatory bodies are increasingly focused on establishing comprehensive, consistent, and risk-based frameworks specifically addressing reserve requirements for stablecoins like USDT.

Current regulatory approaches emphasize the importance of examining stablecoins’ structural characteristics and applications, with heightened scrutiny for systemic arrangements like Tether. The rapid growth of the stablecoin market, now valued over $230 billion with transaction volumes exceeding $20 trillion, has accelerated the urgency for effective reserve verification mechanisms.

B. Potential U.S. legislation mandating stricter audits and transparency

The United States is taking concrete legislative steps to address stablecoin concerns through two significant bills. The Senate’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act has gained bipartisan support, having passed the Senate Banking Committee with an 18-6 majority. In parallel, the House of Representatives is developing similar legislation, with reports indicating about 90% similarity between the chambers’ approaches.

Senator Bill Hagerty, who authored the GENIUS Act, has emphasized establishing clear regulations that would foster digital asset innovation within the U.S. while ensuring foreign competitors meet the same standards. These legislative efforts directly address USDT’s transparency issues by potentially mandating stricter audit requirements for all stablecoin issuers.

C. How regulatory changes could reshape the stablecoin landscape

Despite these positive steps, critics highlight significant shortcomings in the proposed regulatory frameworks. Current legislative approaches may create financial instability due to inadequate safeguards, gaps in national security protections, and a fragmented regulatory environment that could incentivize regulatory arbitrage between states.

Of particular concern are the insufficient capital and liquidity requirements for stablecoin issuers and inadequate frameworks for issuer failure, as traditional bankruptcy processes don’t align with stablecoins’ immediate redemption needs. Without addressing these weaknesses, the U.S. risks ceding financial influence to global competitors like China’s digital yuan and BRICS nations’ initiatives designed to diminish dollar dominance.

The regulatory response must balance speed with thoroughness to ensure dollar-pegged stablecoins maintain trust while supporting U.S. financial leadership in the digital economy. With these regulatory developments in motion, we must now consider potential future scenarios for Tether and the broader cryptocurrency ecosystem.

Future Scenarios for Tether and the Crypto Ecosystem

Now that we’ve explored the global regulatory response to stablecoin concerns, it’s important to consider what lies ahead for Tether and the broader cryptocurrency ecosystem.

Paths to restore confidence: Full audits and clearer reserve breakdowns

To rebuild trust in the USDT stablecoin, Tether must address transparency issues through comprehensive audits and detailed reserve disclosures. The lack of clarity regarding Tether’s backing has fueled ongoing controversy. Looking at competitors like USD Coin (USDC), which provides monthly attestations ensuring reserves match circulating tokens, Tether could adopt similar practices to restore market confidence. Full audits conducted by reputable third-party firms would provide necessary validation of Tether’s claims about its reserve composition and could significantly mitigate regulatory concerns.

Potential shift towards alternative stablecoins like USDC or BUSD

The market is already witnessing a gradual migration toward more transparent stablecoin alternatives. USDC, launched by Circle and Coinbase in 2018, has grown to become the second-largest stablecoin with a market capitalization exceeding $25 billion, largely due to its regulatory compliance and transparency. Binance USD (BUSD), created through a partnership between Binance and Paxos, emphasizes regulatory compliance and boasts deep integration within the Binance ecosystem. If Tether fails to address its transparency issues, we could see an accelerated shift toward these alternatives, potentially reshaping the stablecoin landscape.

Long-term implications for DeFi innovation and crypto market structure

Tether’s challenges could fundamentally alter the cryptocurrency market structure. As the largest stablecoin with a market cap of $139.28 billion, USDT currently plays a crucial role in facilitating liquidity. Any significant disruption could impact trading pairs and liquidity on exchanges, potentially leading to increased transaction fees and investor hesitancy.

For decentralized finance (DeFi), platforms like Aave and Compound may offer alternative financial services that reduce reliance on single stablecoins. However, this transition may not be seamless. The potential fallout could extend beyond trading, affecting individuals in hyperinflationary economies who rely on stablecoins for financial stability.

The future of the stablecoin ecosystem hinges on the ability to navigate these challenges while maintaining consistent value in an increasingly regulated environment. For the broader crypto market, diversification away from Tether dependency represents both a challenge and an opportunity for innovation in creating more transparent, compliant stablecoin solutions.

The allegations surrounding Tether’s backing and lending practices present significant challenges for the cryptocurrency ecosystem. With questions about the trading schemes involving Abraxas, Cumberland, and Wintermute, as well as concerns about reserve quality and regulatory evasion, stakeholders across the digital asset space face uncertainty about USDT’s stability. Global regulators are intensifying their scrutiny of stablecoins, potentially leading to stricter reserve requirements and mandatory audits that could reshape the stablecoin landscape.

As the crypto community awaits clarity, Tether faces a critical decision: increase transparency through comprehensive independent audits or risk losing market confidence. The outcome will have far-reaching implications beyond Tether itself, potentially triggering shifts toward alternative stablecoins, fragmenting liquidity, or prompting regulatory measures that could impact DeFi innovation. For investors and market participants, diversifying stablecoin exposure and closely monitoring developments in this evolving situation may be the most prudent approach in navigating this period of heightened uncertainty.