The digital asset landscape is experiencing a notable shift. Recent data reveals a 5.3% drop in weekly transactions, bringing the total to $100.9 million. This change highlights a broader trend in the crypto space.

Bitcoin-based transactions have seen a significant 30% decrease. This decline reflects the current volatility in the market. Analysts suggest this could signal a move away from speculative trading towards more practical applications.

Understanding these trends is crucial for anyone involved in the digital asset world. We’re here to help you navigate these changes with confidence and clarity.

Key Takeaways

- Weekly transactions dropped by 5.3%, totaling $100.9 million.

- Bitcoin-based transactions fell by 30% amid market volatility.

- Recent data suggests a shift towards utility-focused trends.

- Market conditions are prompting a move away from speculative trading.

- Stay informed to navigate these changes effectively.

Market Overview of NFT Trends

Recent shifts in the digital asset arena are reshaping how we view transactions. The global nft market is experiencing changes that are worth noting. According to Statista and CryptoPresales, revenues are projected to fall by $75 million in 2025. This highlights a broader trend in the market.

Global Sales and Revenue Projections

Industry reports indicate an expected 11% decline in revenue by 2025. This contrasts with rising crypto token prices, which have not translated into higher sale volumes. The volume of transactions has dropped significantly, reflecting a shift in buyer behavior.

“The decline in revenue is a clear signal that the market is maturing. Investors are now focusing on utility rather than speculation.”

Here’s a breakdown of recent trends:

| Year |

Revenue (in millions) |

Active Wallets |

| 2023 |

$316 |

950,000 |

| 2025 (Projected) |

$241 |

491,000 |

User Growth and Active Wallet Analysis

New user growth has stagnated, with active wallet numbers dropping by over 50% compared to previous highs. This decline is a key datum for understanding the current state of the nft market. The number of active traders has also decreased, signaling a cautious approach from investors.

Key factors influencing this trend include:

- Rising crypto token prices without corresponding sale growth.

- A shift in focus from speculative trading to practical applications.

- Declining transaction activity, particularly in the last week.

These dynamics are shaping the future direction of the market. Staying informed is crucial for navigating these changes effectively.

NFT sales decline, Bitcoin NFT slump, cryptocurrency market trends, NFT market d

The world of blockchain-based assets is facing new challenges. Recent data from Decrypt and Chainalysis reveals a significant drop in nft transaction volumes. Weekly activity has decreased by 5.3%, bringing the total to $100.9 million.

Bitcoin-based collectibles have been hit hardest, with a 30% drop in activity. This decline reflects broader volatility in the crypto market. Analysts suggest this could signal a shift in engagement patterns.

Blockchain data supports these trends. Active addresses have fallen by 88% in some cases. This reduction in activity highlights a cautious approach from traders and collectors alike.

Comparing cryptocurrency trends with nft-specific data reveals both correlation and divergence. While crypto token prices have risen, nft sale volumes have not followed suit. This disconnect underscores the unique challenges facing the nft marketplace.

Reduced engagement and market inertia could impact future initiatives. Projects may need to focus on utility and practical applications to regain momentum. Staying informed is key to navigating these changes effectively.

Investor Insights and Market Volatility

Investors are navigating a shifting landscape as volatility reshapes strategies. Recent data shows a significant pullback in activity, with reports indicating a near 62% collapse last year. This has prompted both institutional and retail investors to rethink their approaches.

Institutional and Retail Investor Reactions

Institutional investors are focusing on long-term value rather than short-term gains. Retail investors, on the other hand, are becoming more cautious. Both groups are reducing their exposure to high-risk assets.

This shift is evident in the declining transaction volumes across major platforms. The activity on these platforms has dropped significantly, reflecting a broader trend of reduced engagement.

Economic Impact and Market Analytics

Market reports highlight the economic impact of this downturn. The volume of transactions has fallen sharply, affecting both buyer and seller dynamics. Here’s a breakdown of recent trends:

| Year |

Transaction Volume (in billions) |

Active Users |

| 2022 |

$13.7 |

1.2 million |

| 2023 |

$5.3 |

491,000 |

Despite the challenges, there are opportunities for well-informed investors. Understanding the trends and focusing on practical applications can help navigate this volatile period. Staying informed is key to making the right decisions.

Innovative Shifts: From Speculation to Utility in NFTs

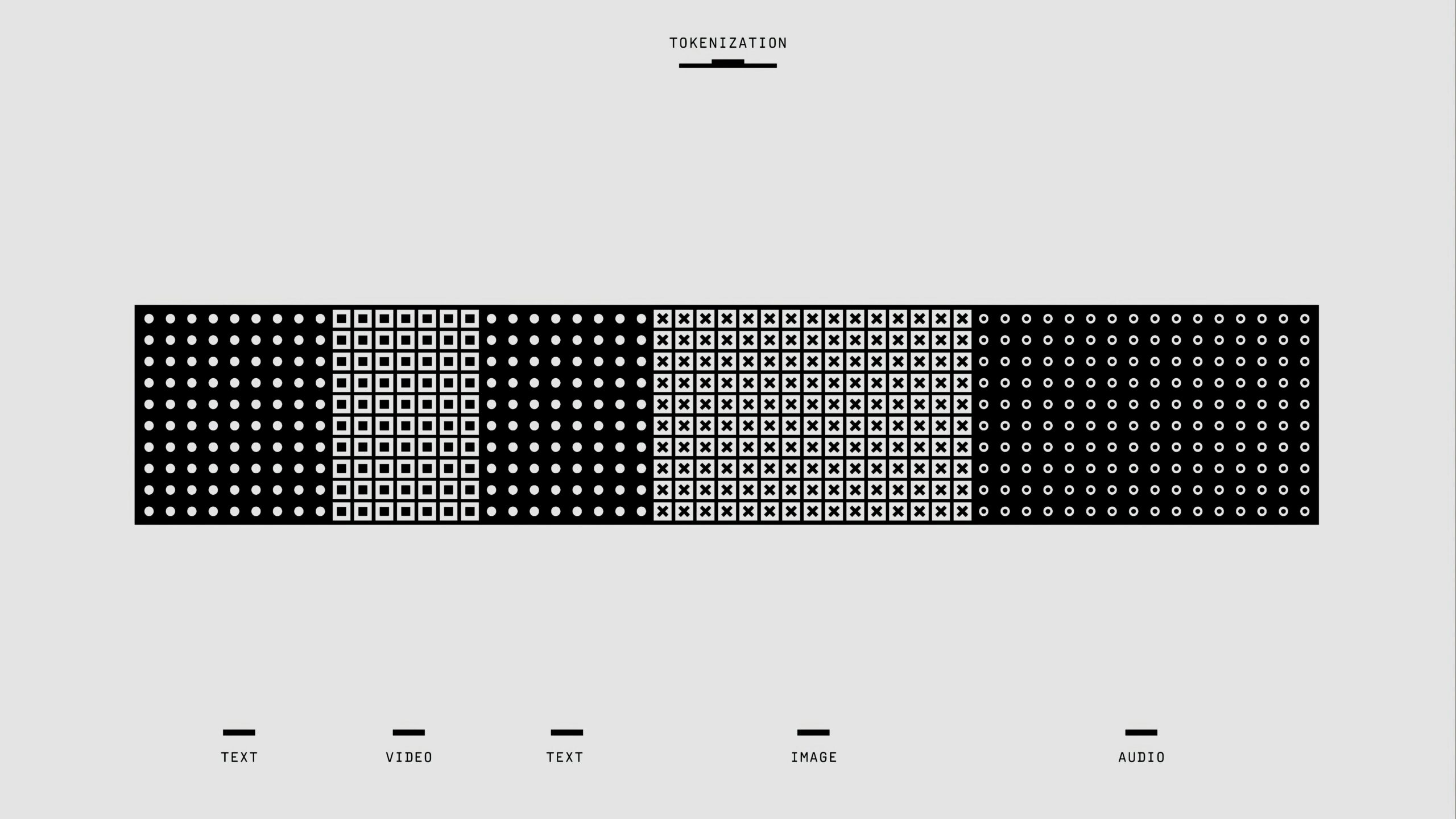

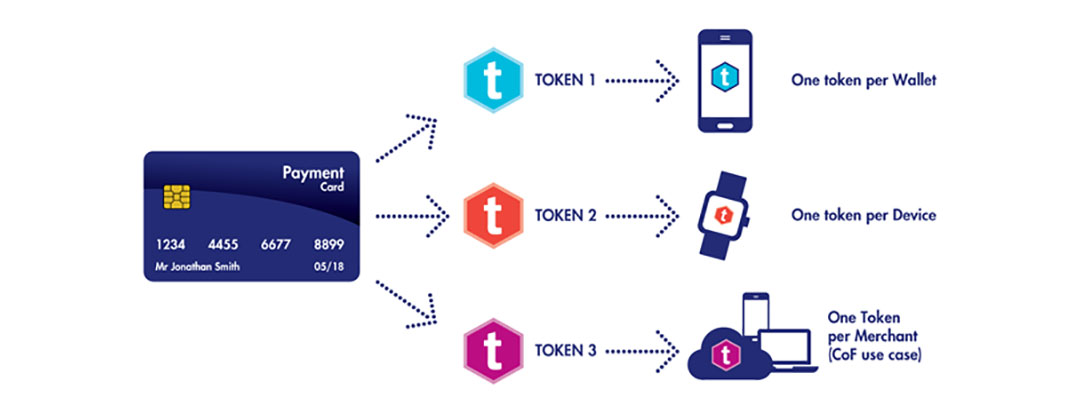

The evolution of digital tokens is reshaping their role in the modern ecosystem. What began as speculative assets are now transforming into functional tools with real-world applications. This shift is driven by the need for practical utility and long-term value.

Emerging Use Cases and the Role of SBTs

One of the most exciting developments is the rise of Soulbound Tokens (SBTs). These tokens are designed to represent non-transferable assets like educational credentials or professional certifications. They add a layer of trust and authenticity to the digital ecosystem.

Gaming and the metaverse are also leveraging tokens in innovative ways. Players can now own, trade, and monetize in-game assets, creating a thriving economy. Digital real estate is another area where tokens are making a significant impact, enabling fractional ownership and increased liquidity.

Transforming Token Value Beyond Art

While art-based collections like Bored Ape Yacht Club have dominated the spotlight, their value has seen fluctuations. However, their influence remains strong, paving the way for new collections to explore utility-driven models.

Tokens are now being used to build sustainable ecosystems. For example, they can represent ownership in physical assets or serve as access keys to exclusive platforms. This growth in utility is reshaping how we perceive and interact with digital assets.

| Use Case |

Example |

Impact |

| Gaming |

Axie Infinity |

Player-owned economies |

| Digital Real Estate |

Decentraland |

Fractional ownership |

| Education |

SBTs for credentials |

Enhanced trust |

As the ecosystem evolves, the focus is shifting from short-term gains to long-term value. This transition is essential for the sustainable growth of the token economy. By embracing utility-driven models, we can unlock the full potential of these digital tools.

Opportunities Amid Market Challenges

Amidst fluctuating conditions, the digital asset space offers unique opportunities for savvy investors. While challenges persist, innovative tools and strategies can turn volatility into profits. This section explores how to navigate these conditions effectively.

Navigating Bitcoin Ordinals and New Collections

Bitcoin Ordinals and emerging collections present fresh avenues for trading. These assets allow investors to diversify their portfolios and explore new use cases. With the right approach, they can yield significant returns even in uncertain times.

Recent trends show a drop in activity for older collections, but newer ones are gaining traction. Platforms like OpenSea and Decentraland are adapting to these shifts, offering better tools for sellers and buyers alike.

Leveraging Exclusive Tools and Rewards with BYDFi

BYDFi stands out as a platform that turns challenges into opportunities. It provides exclusive rewards and real-time insights to help investors stay ahead. By leveraging these tools, users can navigate market volatility with confidence.

Here’s how BYDFi supports investors:

- Early access to innovative trading tools.

- Exclusive rewards for active engagement.

- Real-time analytics to make informed decisions.

| Platform |

Key Feature |

Benefit |

| BYDFi |

Exclusive Rewards |

Maximize returns |

| OpenSea |

Adaptive Tools |

Enhance trading experience |

| Decentraland |

Virtual Real Estate |

Explore new marketplace opportunities |

In a year marked by challenges, platforms like BYDFi are proving to be game-changers. By focusing on utility and innovation, they’re reshaping the crypto landscape. Now is the time to explore these opportunities and secure your place in the evolving digital economy.

Conclusion

The digital asset space is evolving rapidly, presenting both challenges and opportunities. Recent shifts in activity highlight the importance of staying informed and agile. While transaction volumes have seen a drop, emerging technologies are paving the way for future growth.

Innovative use cases, such as utility-driven token models, are reshaping the ecosystem. These changes offer new avenues for investors to explore, turning current volatility into long-term profitability.

Now is the time to leverage platforms like BYDFi to stay ahead. Use referral code jvIn7g to unlock exclusive insights and rewards. Join us in navigating this dynamic marketplace and turning today’s challenges into tomorrow’s success.

FAQ

Why did weekly digital asset transactions drop by 5.3%?

The decline is attributed to broader market volatility, impacting buyer confidence and reducing overall activity in the ecosystem.

How did Bitcoin-related transactions perform recently?

Bitcoin-related transactions saw a significant 30% drop, reflecting reduced engagement and shifting investor focus toward other assets.

What are the key trends in the global digital asset space?

Current trends include a focus on utility-driven assets, the rise of new collections, and increased interest in blockchain-based rewards and tools.

How are institutional investors reacting to market changes?

Institutional investors are cautiously navigating the landscape, focusing on long-term value and exploring innovative use cases beyond speculative trading.

What opportunities exist in the current market environment?

Opportunities include leveraging exclusive platforms like BYDFi, exploring emerging collections, and capitalizing on tools designed to enhance user engagement and rewards.

How is the value of digital assets evolving beyond art?

The value is shifting toward utility, with assets being used in gaming, identity verification, and other practical applications, transforming their role in the ecosystem.

Source Links