Why Is Bitcoin Rising or Stable During Stock Market Crashes? Key Drivers Explained.

- April 5, 2025

- 0

As stocks tumble, Bitcoin holds steady or even climbs. Learn the reasons why Bitcoin is a reliable digital asset in times of market volatility.

As stocks tumble, Bitcoin holds steady or even climbs. Learn the reasons why Bitcoin is a reliable digital asset in times of market volatility.

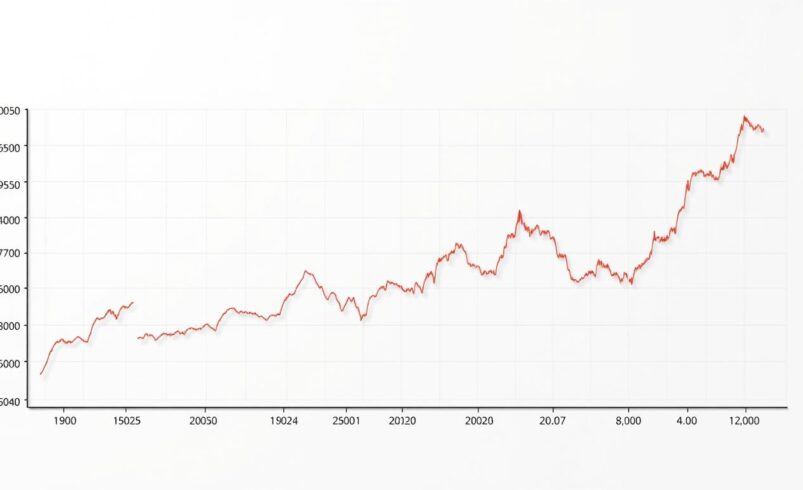

Why does Bitcoin stay steady or even go up when stocks fall? Investors often look to Bitcoin as a safe place when markets crash. Bitcoin hitting $100,000 shows it can be a safe-haven asset. This guide explains how Bitcoin’s design and global use make it stand out during tough times.

We’ll look at how Bitcoin’s limited supply and decentralized network differ from traditional markets. Whether it’s a crash or a correction, knowing these changes helps investors find chances. Let’s find out why Bitcoin goes against stock market trends and what it means for your plans.

Market crashes aren’t random. Let’s look at what drives stock market volatility. Forces like sudden policy changes and global events change how investors act. Here’s how it happens:

| Trigger | Impact | Example |

|---|---|---|

| Media Coverage | Fear-driven selling | 2020 pandemic headlines |

| Over-leveraged Positions | Margin calls and liquidations | 2008 housing crisis |

| Declining Trading Volumes | Liquidity shortages | 2015 China stock plunge |

Three main factors make markets unstable:

People react differently when markets drop:

Understanding these patterns helps us navigate uncertainty. Next, we’ll see why Bitcoin acts differently during stock market volatility.

Bitcoin’s ability to stay strong during stock market crashes isn’t luck. It’s because of its design. Let’s explore why its bitcoin price stability stands out when traditional markets shake.

| Event | Bitcoin Performance | Stock Market |

|---|---|---|

| 2020 Crash | Recovered 150% within 12 months | S&P 500 took 18 months to rebound |

| Oct 2021 Downturn | 10% gain while S&P fell 5% | Traditional assets faced prolonged declines |

“Bitcoin’s code is its constitution—it doesn’t panic when Wall Street does.”

Companies like Enlivex and Hoth Therapeutics now hold Bitcoin as treasury reserves. MicroStrategy’s $20B Bitcoin purchases even boosted their stock value by 400%. These moves show institutional confidence in its store-of-value. While volatility remains, its unique traits let it zigzag differently from stocks—proving digital assets aren’t just wild rides anymore.

Understanding cryptocurrency trends means looking beyond short-term price changes. Let’s explore the key factors that make Bitcoin strong and growing.

Bitcoin’s strength comes from its blockchain technology. It’s like a digital fortress, thanks to its strong security and decentralized networks. Upgrades like the Lightning Network make it faster and more scalable, drawing in users and developers.

“Bitcoin thrives where trust in traditional systems fades.”

When stocks are shaky, investors often turn to Bitcoin as a safe haven. Growing institutional adoption, from ETFs to corporate holdings, drives this trend. Watching cryptocurrency trends shows a pattern: more businesses accept crypto, and media coverage increases during market ups and downs.

These forces make Bitcoin a hybrid: a tech innovation and a cultural movement. As adoption grows, so does its role in changing finance. Keep an eye on how these drivers shape the next phase of cryptocurrency trends.

Building a strong portfolio is more than just picking the right assets. It’s about smart planning. Let’s explore how investment diversification strategy can shield your wealth during market ups and downs.

“Diversification is not a one-time move—it’s an ongoing journey.”

| Strategy | Why It Works |

|---|---|

| Monthly crypto rebalancing | Automates discipline and reduces emotional decisions |

| Layer 2 protocols | Cuts fees while expanding blockchain accessibility |

Think of your portfolio like a toolbox. Bitcoin is the hammer, but you also need screwdrivers (stablecoins) and pliers (DeFi platforms). Mixing old and new assets helps your strategy adapt as markets change. Small, consistent steps today can turn uncertainty into opportunity.

Understanding Bitcoin’s link to traditional markets begins with market correlation analysis. We’ll explore how these assets move and sometimes differ. This will be based on real data and proven methods.

Bitcoin’s bond with stocks has changed over time. Here’s what the numbers show:

Experts use tools like correlation coefficients and regression models to track these shifts. Here’s how it works:

| Period | Bitcoin vs. S&P500 | Key Insight |

|---|---|---|

| 2017–2018 | 0.65 correlation | Tech boom linked assets |

| 2020 | -0.20 correlation | Bitcoin decoupled as a crisis hedge |

| 2022 | 0.45 correlation | Inflation’s cross-market impact |

These patterns aren’t random—they’re clues for smarter decisions. Dive into market correlation analysis to spot opportunities others miss.

Regulations are like traffic lights for crypto’s journey. They guide or halt innovation, shaping financial market behavior. Let’s explore how U.S. and global rules influence Bitcoin’s path.

Key U.S. actions directly impact crypto’s trajectory. Recent SEC rulings on ETFs and compliance rules create market uncertainty or stability:

These shifts directly affect financial market behavior, pushing investors to monitor legal clarity closely.

International policies create a patchwork of opportunities and barriers. Compare how regions approach crypto:

| Region | Policy Example | Impact |

|---|---|---|

| EU | MiCA framework | Standardizes but delays mass adoption |

| El Salvador | Bitcoin as legal tender | Boosts local use but raises geopolitical risks |

| China | Miner crackdowns | Shifts hash rate to other countries |

“Regulations aren’t just rules—they’re roadmaps for innovation’s speed limits.” – Chris Brummer, Georgetown Law

Whether through bans or frameworks, policies act as invisible hands guiding crypto’s role in global financial market behavior. Stay tuned as rules redefine this digital asset race.

When looking at bitcoin vs stocks performance, technical tools reveal hidden trends. Traders use volume, RSI, and momentum indicators to see Bitcoin’s stability. These tools help understand how Bitcoin behaves compared to stocks.

“Technical analysis is key in cryptocurrency markets, like Bitcoin, because of their unique traits.”

Volume trends are important too: high trading volume during Bitcoin upswings often signals stronger trends than low-volume corrections. Unlike stocks, crypto lacks traditional volume data, making these tools critical for spotting Bitcoin’s stability. Pairing Fibonacci retracements with Ichimoku clouds reveals support levels shifts. Traders combine these methods to gauge Bitcoin’s resilience compared to stocks during dips.

Mastering these tools helps spot when Bitcoin outperforms stocks during dips or aligns with broader market trends. The right mix of technicals and real-time data keeps investors ahead of the curve. 📊

When markets shake, emotions take over. Fear, uncertainty, and hope make decisions faster than charts or data. Let’s explore how minds, not just algorithms, drive crypto and stock trends.

“The two enemies of investors are fear and impatience.” – Warren Buffett

We’ve seen this cycle repeat: FUD drives short-term moves, but disciplined investors stick to long-term goals. Stay informed, stay calm, and let data—not emotions—lead your strategy.

Bitcoin’s moves during stock market ups and downs are not random. They are influenced by key factors we’ve looked at. The blockchain’s decentralized tech acts as a safety net when markets shake.

Today, investors see crypto as more than a passing trend. It’s a way to manage risks and spread out investments.

Market crashes show the flaws in systems that rely on one central point. Bitcoin’s fixed supply and growing global use offer stability. When stocks plummet, people turn to digital assets, boosting Bitcoin’s value.

This isn’t just guesswork. It’s supported by data showing Bitcoin’s opposite trend to stocks in 2023’s downturns.

Smart investors mix crypto with traditional assets. They use tools like technical analysis and sentiment tracking to make informed choices. Volatility is a given, but being ready turns it into a chance. Stay updated, diversify, and use blockchain’s openness to get through any storm.

Bitcoin’s path is like the internet’s rise. Its calm in crises shows a big change in finance. Whether you’re new or experienced, knowing these patterns builds trust. The future is decentralized, and that’s something to hold onto.

Bitcoin often goes up when stocks fall because it’s not tied to any country’s economy. Smart investors buy it when it’s cheap. This is different from how people react in the stock market.

Volatility in stocks comes from quick changes in supply and demand, big economic events, and fear. Things like government policies and global crises make these changes worse.

When stocks crash, many investors panic and sell. But, seasoned Bitcoin traders see it as a chance to buy more. This can make Bitcoin’s price stable or even go up.

Bitcoin’s success comes from its strong tech, growing popularity, and more people using it. These factors help it keep its value, even when the market is down.

Spreading investments across different types and using dollar-cost averaging can help. These strategies help investors deal with market ups and downs better.

Bitcoin often moves differently than stocks during tough times. Experts study trends and use stats to understand these differences better.

Rules and policies greatly affect how people think about and invest in cryptocurrencies. Changes in laws can change how people feel about Bitcoin.

Analysts look at trading volume, RSI signals, and patterns to understand Bitcoin’s price. This helps them spot when prices might change or stay the same.

Fear, doubt, and uncertainty can lead to quick, bad decisions. But, staying calm and optimistic helps investors do better in volatile times.