In the emerging world of cryptocurrency and blockchain technology, self-custody refers to the practice of holding your own private keys to access your digital assets, rather than relying on a third party like an exchange. Self-custody is essential for anyone who wants full control and security over their cryptocurrency investments. Here are some key reasons why you should self-custody your crypto:

You Have Full Control

When you self-custody your crypto, you and only you have access to your private keys. This gives you full control over your funds. You don’t have to worry about an exchange restricting access to your account or locking you out. You don’t have to go through customer support or verify your identity to access your own money. The funds are yours to control as you wish.

You Have Better Security

Exchanges and other third-party services are frequent targets for hackers. Billions have been lost from exchange hacks over the years. When you self-custody, you avoid this risk completely. As long as you keep your private keys safe and don’t lose them, your funds cannot be stolen or locked away from you. No one can freeze your account since you don’t rely on any intermediary.

You Avoid Counterparty Risk

When you keep crypto at an exchange or platform, there is always the risk that the company itself could go bankrupt or abscond with customer funds. This has happened many times before. With self-custody, there is no counterparty who could go bust. It’s just you and your crypto. This avoids a major risk factor.

You Can Use DeFi Easily

Decentralized finance (DeFi) offers attractive yields and use cases for crypto users. However, most DeFi platforms won’t work with funds held on an exchange. To properly use DeFi, you need to have self-custodied wallet address that can interact directly with smart contracts. Keeping custody yourself opens up the world of DeFi.

You Can Participate in Airdrops

Crypto airdrops are free distributions of new tokens, usually done as a promotional activity by blockchain projects. To be eligible for airdrops, you typically need to hold some amount of a certain cryptocurrency in a non-custodial wallet that you control. If your crypto is sitting on an exchange, you could miss out on free tokens.

You Contribute to Decentralization

The more people that self-custody their crypto, the more decentralized and resilient a blockchain network becomes. If the majority of coins are held at exchanges, it increases systemic risk and the chance of manipulation. Individuals holding their own keys spread out power and increase the network’s decentralization.

You Have Privacy

When crypto is self-custodied, your holdings and transactions are not tied back to your real-world identity. Exchanges collect KYC information and can track your activity. With a self-custodied wallet, you have more privacy and anonymity with your crypto endeavors. Your identity is not linked publicly on-chain.

You Can Pass on Your Wealth

With a self-custodied wallet, your heirs and beneficiaries can inherit your crypto funds if something were to happen to you. You can leave behind your seed phrase or instructions for accessing your private keys. Your crypto wealth can live on beyond your lifetime and get passed down. It is more difficult to ensure this when relying on an exchange’s custody.

You Get Better UX

Managing your own wallets gives you exposure to how crypto truly works. You learn more about safe storage, transactions, dapps, NFTs, and other aspects of Web3. The learning experience creates more knowledgeable crypto users who get comfortable with the technology.

Overall, self-custody aligns with the ethos of cryptocurrency – securing your own financial sovereignty. It’s the best way to fully leverage crypto’s benefits. The responsibility can seem intimidating at first but the rewards are worth it. Now let’s go over the various wallet options for self-custody of crypto assets.

Types of Crypto Wallets for Self-Custody

Here are the primary types of wallets that give you control over your crypto private keys:

Hardware Wallet

This is a physical device that stores private keys electronically and facilitates crypto transactions. Leading options are Trezor, Ledger, and KeepKey. Hardware wallets offer top-notch security by keeping keys offline in cold storage. They provide recovery seed phrases in case you lose the device. Hardware wallets make self-custody easy even for beginners. The main drawbacks are the cost to purchase the device and limited support for less popular cryptos.

Mobile Wallet

Mobile crypto wallets run as smartphone apps and are convenient for daily use. They allow you to manage holdings, send/receive crypto, interact with dApps, and more. They use device encryption and seed phrases to secure keys. Leading mobile wallets include Trust Wallet, Coinbase Wallet, MetaMask Mobile, etc. The main risk is that mobile devices can be lost, stolen, or broken – losing wallet access.

Desktop Wallet

This type of wallet runs on your laptop or desktop PC. They provide robust functionality paired with better security than mobile wallets. Leading options are Atomic Wallet, Exodus, Electrum, and Coinbase Wallet browser extension. The drawback is you must secure your computer properly and back up the wallet files. But overall, desktop wallets offer a solid self-custody option.

Paper Wallet

As the name suggests, this is a physical document with your crypto private keys printed out. It allows you to entirely avoid digital storage for your sensitive information. Creating paper wallets involves generating a keypair offline and printing the private and public keys onto paper. You then fund the public key and store the paper wallet somewhere very secure. Paper wallets are meant for long-term storage of crypto.

Software Wallet

A software wallet is one that you access primarily through a website via browser, or by downloading software onto your computer. Examples are the Coinbase Wallet website interface, MyEtherWallet, and the original Bitcoin Core software. This wallet style provides solid functionality but requires diligence to protect your computer and backup files properly.

Security Keys

Crypto security keys are dedicated devices used to secure your Web3 accounts and sign transactions. They provide an added layer of protection on top of your wallet. Leading options are made by YubiKey, SoloKeys, and OnlyKey. These keys use FIDO authentication to verify it’s really you trying to access your crypto account. They prevent remote hacking.

Multisig Wallet

Multisig stands for multi-signature, referring to wallets secured through multiple private keys. This could entail multiple devices, multiple parties, or a combination. Multisig provides redundancy so that if you lose one key, you don’t lose access to your crypto. Multisig is excellent for self-custody security but requires more technical expertise.

That covers the major types of wallets that allow you to self-custody your crypto holdings. Each has its own strengths and trade-offs. Consider which one best fits your specific needs and use case. The most secure approach is to use a combination of wallets to benefit from their different protections. Storing your private keys yourself is a big responsibility but the control and security it provides makes it worth the effort. Mastering self-custody is a key step to getting the most from the world of crypto.

In conclusion

Self-custody of your digital assets enables full control, better security, avoidance of counterparty risk, participation in DeFi and airdrops, privacy benefits, and the ability to pass on your wealth. The main types of crypto wallets for self-custody are hardware wallets, mobile wallets, desktop wallets, paper wallets, software wallets, security keys, and multisig wallets. Each has its own advantages and disadvantages to consider. While self-custody comes with responsibility, it aligns with the ethos of cryptocurrency and allows you to fully leverage the benefits of this new technology. Mastering wallet management is essential to get the most from crypto.

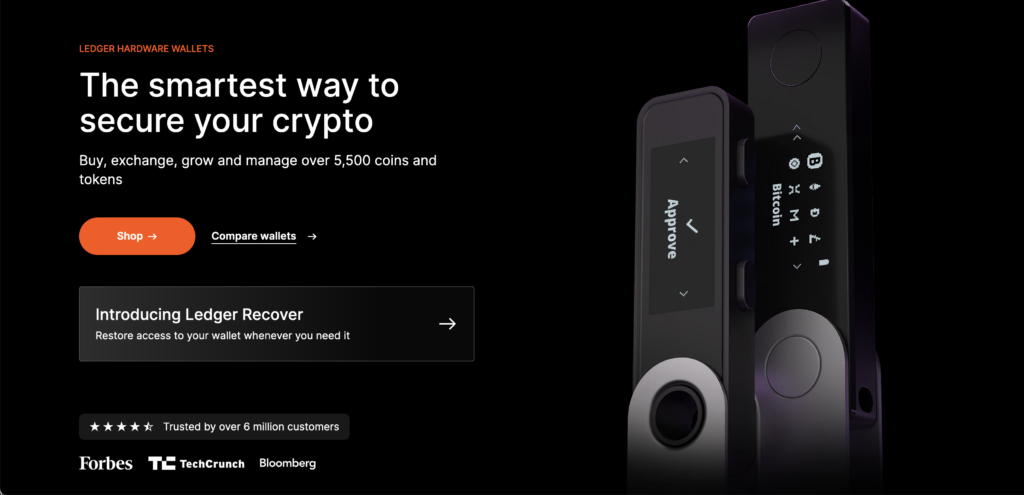

True Crypto Self-Custody with Ledger Nano

Tired of worrying about the security of your crypto assets on exchanges? Looking for the simplest way to self-custody your digital wealth? The solution is Ledger Nano.

Ledger hardware wallets enable complete control of your private keys in a convenient, user-friendly device. Nano models offer robust security through secure chips and backup recovery phrases. Just set up your Ledger, follow the intuitive interface, and store your crypto safely offline.

Regain peace of mind knowing your crypto is fully under your control. Avoid trading limitations and participate in exciting DeFi opportunities. Set up your crypto inheritance plan by backing up your recovery phrase.

Don’t wait until it’s too late – act now to secure your digital assets with Ledger. Visit Ledger.com and get your Nano device today for just XX USD. Give yourself the gift of true crypto self-sovereignty. The power is now in your hands with Ledger!