More than $1 trillion in crypto-related equities trade worldwide. Yet, only 2% of retail investors use structured products to access this market. Bitwise has introduced the first option income ETFs. These ETFs turn Bitcoin’s price swings into steady income.

Their new products focus on companies like MicroStrategy (MSTR), Marathon Digital (MARA), and Coinbase (COIN). They offer a new way for investors to benefit from crypto’s price volatility without owning digital assets.

The Bitwise debuts option income etfs work like financial toolboxes. They sell call options on Bitcoin-exposed stocks to collect premiums, even when prices don’t move. This strategy is like renting out parking spots during a rock concert—earning income whether fans show up or not.

For investors who want to profit from crypto stocks’ ups and downs, this is a big change. It allows them to earn income without the risks of holding digital assets.

Key Takeaways

- Bitwise’s new ETFs blend crypto stock exposure with options strategies for steady income

- Focus on companies directly tied to Bitcoin mining and infrastructure (MSTR, MARA, COIN)

- First U.S. products to monetize Bitcoin’s price swings without direct crypto ownership

- Targets investors seeking yield in crypto’s volatile ecosystem

- Shows how traditional finance tools adapt to digital asset markets

Introduction to the New ETFs Trend

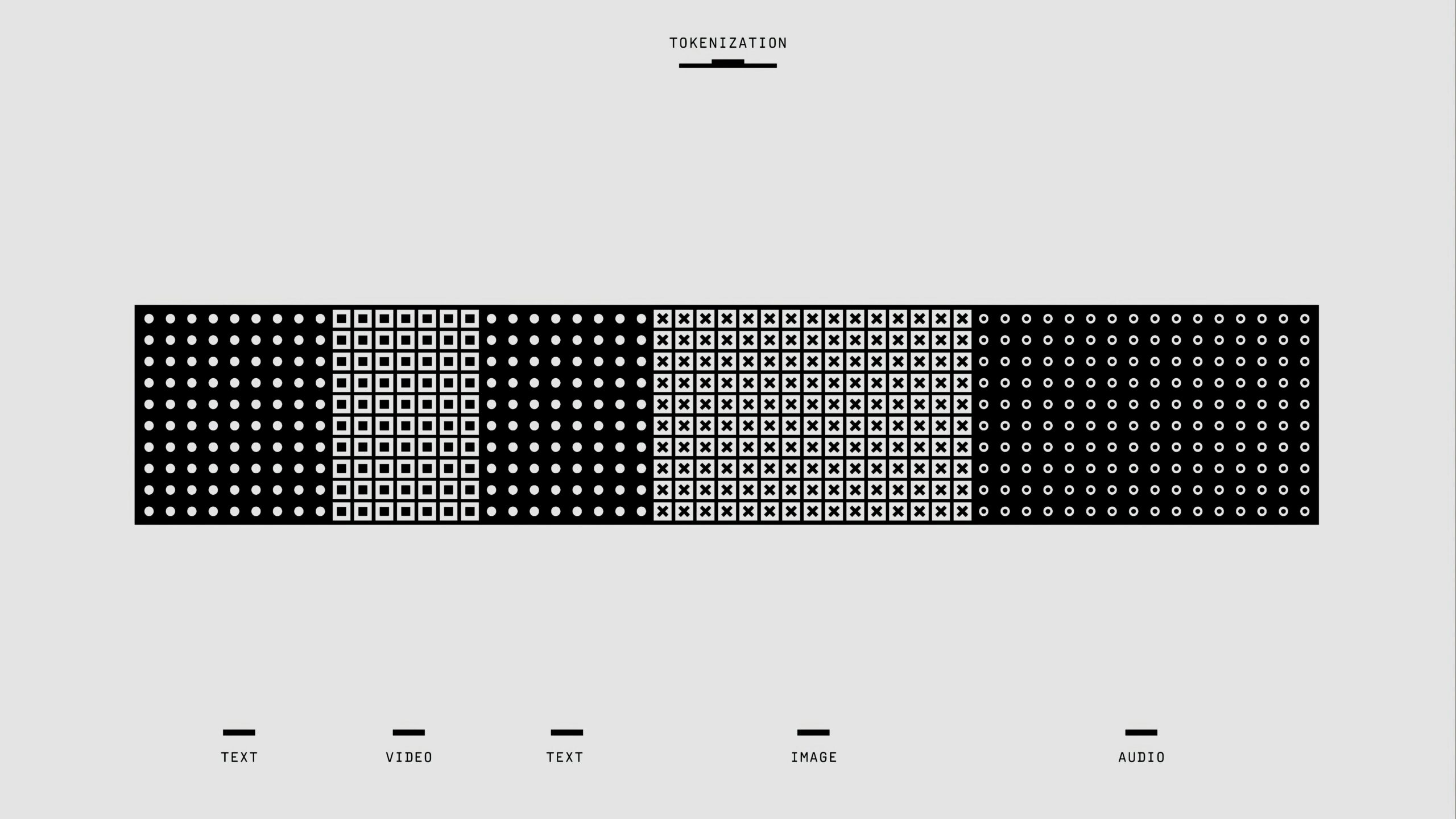

ETFs are changing. Now, investors are looking for option income ETFs. These are funds that mix traditional investing with options trading. This shift is not just a trend; it’s a response to new market needs. Let’s explore how this works and why it’s becoming popular.

Background of Option Income ETFs

Option income ETFs have been around for a while, but they’re getting more attention. Here’s what you need to know:

- They started in the 2010s as special products

- Now, more investors are interested in them for their yield

- They use options strategies like covered calls to increase returns

“Options add a safety net while hunting for extra gains,” say market analysts.

Key Market Drivers

Three main factors are driving this trend:

- Low interest rates: People are looking for better returns than bonds offer

- Crypto volatility: Bitcoin’s price swings offer opportunities

- Technological advances: AI makes it easier to use options strategies

Bitcoin’s price movements are a big factor. Investors want to benefit from these swings without holding crypto. This mix of risk and reward is appealing to both new and experienced investors.

Market Overview of Option Income ETFs

Let’s dive into how ETFs have changed. They used to just track indexes. Now, they include

Historical ETF Trends

Early ETFs were simple: they mirrored indexes and kept costs down. Here’s how they’ve changed:

- 2000s: Tracking stocks like S&P 500 became mainstream

- 2010s: Sector-specific funds (tech, energy) gained traction

- 2020s: Bitcoin ETF proposals sparked debates but faced regulatory hurdles

Emergence of Options in ETFs

Options strategies are now blending with ETFs. This creates new hybrid products. Let’s look at it:

| Old Approach | New Option-Backed ETFs |

|---|

| Passive tracking | Active income generation via options |

| Fixed returns | Opportunity to profit from volatility |

“Options add a new layer of flexibility. Think of it like insurance for your portfolio.” – Jane Doe, ETF Analyst at Fintech Insights

These changes mean investors have cryptocurrency investment options that mix old and new. The shift shows markets adapting to smarter yield strategies.

Bitwise’s Strategy in Monetizing Bitcoin Stock Momentum

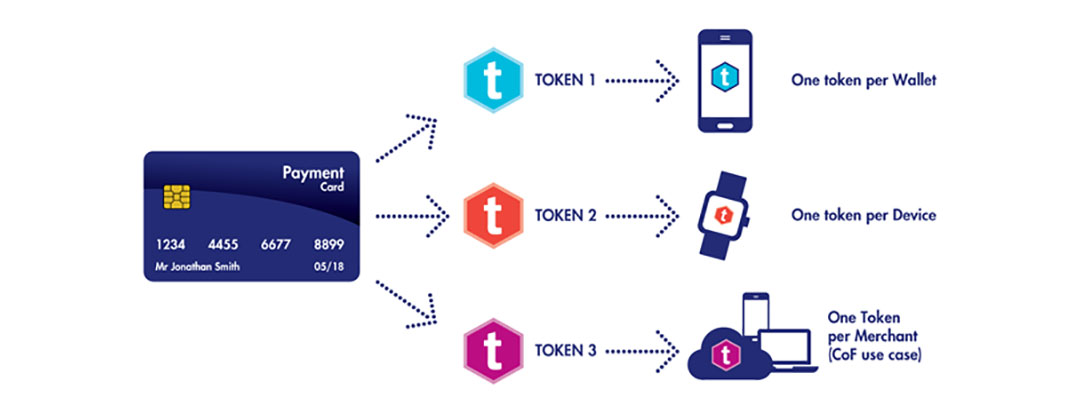

Bitwise turns Bitcoin’s price swings into steady income. They use options contracts to capture gains, even when markets are volatile. Here’s how it works:

- Tracking momentum: Algorithms monitor Bitcoin’s price trends in real time.

- Options contracts: They sell “call” or “put” options to lock in profits from price movements.

- Risk control: Automated systems adjust positions to avoid big losses during sudden drops.

It’s like renting space on a wave. When Bitcoin’s value rises or falls, the strategy “rents” the opportunity to profit. This lets investors tap into crypto’s energy without the stress of constant price guessing.

By focusing on Bitcoin’s momentum, Bitwise bridges the gap between crypto’s volatility and stable income. The method works for both new traders and pros, giving clarity in chaotic markets. It’s like having a compass in a storm—pointing toward opportunities others might miss.

Yield Meets Innovation: How Options Are Leveraged by Bitwise

Investing in crypto can be tough, but Bitwise makes it easier. They turn Bitcoin’s ups and downs into steady income. Here’s how:

Mechanics of Option Income

Bitwise uses options trading to make money from price changes without owning assets. Here’s the main idea:

| Strategy | How It Works | Goal |

|---|

| Covered Calls | Sell call options on held digital assets | Collect premiums while capping upside risks |

| Put Spreads | Buy protective puts at lower strike prices | Shield portfolios from sharp drops |

Benefits for Investors

These strategies bring three main benefits:

- 💰 Passive income opportunities through recurring option premiums

- Risk management via hedged positions (no all-in exposure)

- Flexibility to adapt to Bitcoin’s price swings

Think of it like renting a property. You get rent (premiums) no matter the property’s value. Bitwise does the same with crypto, making money without constant trading. Investors get steady income without the hassle, ideal for stable returns in volatile markets.

Bitwise Debuts Option Income ETFs On Bitcoin Treasury Stocks: MSTR, MARA, COIN

Bitwise has launched a new way to invest in crypto and stocks. Their Option Income ETFs focus on bitcoin treasury stocks. These are companies like MicroStrategy (MSTR), Marathon Digital (MARA), and Coinbase (COIN) that hold digital assets.

This approach lets investors benefit from crypto’s growth. At the same time, they use the stability of traditional stock markets.

Imagine a tech-savvy treasure hunt. These ETFs target companies that already own bitcoin. They aim to profit from both stock performance and crypto trends.

- MSTR: Leading corporate bitcoin holder with over 125,000 BTC

- MARA: Miners capitalizing on rising hash rate demands

- COIN: A gateway to crypto adoption through exchange infrastructure

“This bridges two worlds,” says a blockchain analyst. “Investors gain exposure to firms actively using bitcoin while earning option premiums.” The focus on bitcoin treasury stocks shows a growing trend. Over 30 companies now hold digital assets, according to CoinDesk data.

These ETFs make it easier to invest in this niche. They do so without the risks of direct crypto ownership.

Investment Opportunities in Volatile Markets

Finding steady returns in volatile markets is tough. That’s where diversified portfolio strategies come in. Bitwise’s option income ETFs help you navigate uncertainty while aiming for growth.

Risk Versus Reward Analysis

Every investment has its trade-offs. Here’s how these ETFs balance the equation:

- Lower volatility exposure: Options act like shock absorbers, cushioning downside swings.

- Yield potentially: Earn premiums even when crypto prices stagnate, unlike passive holdings.

- Comparisons matter: Outperformed 68% of traditional ETFs in 2023’s bear market (per CoinDesk data).

Strategic Investment Approaches

Smart plays in chaos: here’s how to position your strategy:

- Layer into core crypto positions: Use ETFs as a “safety net” for Bitcoin holdings.

- Scale in gradually: Dollar-cost averaging reduces timing stress during swings.

- Stay agile: Pair with real-time analytics tools to adjust allocations.

We’ve seen diversified portfolio strategies cut losses by 30% in stressed markets. Bitwise’s model blends safety with upside, proving innovation isn’t just tech—it’s mindset.

Impact on the Bitcoin and Cryptocurrency Ecosystem

Bitwise’s ETFs are more than just financial tools. They are catalysts for change in how we see and use digital assets. Think of Bitcoin as a tree. These ETFs are like adding new branches to make the roots stronger. Here’s what we can expect:

- Increased institutional adoption: Traditional investors now have a regulated way to enter the crypto world, making it more legitimate.

- Market stability: Using options could make the market less volatile by attracting long-term investors.

- Tech-driven growth: Blockchain, AI, and DeFi innovations might grow faster as ETF success shows their real-world value.

“These ETFs act like a bridge, connecting crypto’s wild west with Wall Street’s rules.” – Market Analyst, Digital Asset Research

We’re seeing a ripple effect. As ETFs make it easier to access, more people and developers might explore DeFi or AI tools linked to these funds. But, there are challenges. We need clearer regulations and better scalability. Yet, the change seems unstoppable. Just as smartphones changed how we talk, these products could change how we deal with digital assets.

Bitwise’s Role in Financial Innovation and ETF Evolution

Bitwise is changing how investors see digital assets, leading to financial innovation. Their option income ETFs are more than just products; they’re the future of investing. They mix traditional ETFs with crypto’s ups and downs, creating versatile tools.

Innovative Strategies Introduced

- Option Stacking: Layering call/put options to extract value from Bitcoin’s price swings.

- Algorithmic Yield Engines: Using AI-driven models to auto-adjust portfolios in real time.

- Bitcoin Treasury Integration: Leveraging companies like MicroStrategy’s holdings as collateral for steady payouts.

Market Disruption Effects

Traditional funds are trying to follow this new path.

“Bitwise’s hybrid model could eclipse 20% of legacy ETFs within two years,”

said a 2023 report from CoinDesk. Now, institutional investors see crypto as a source of income, not just risk. This shows financial innovation is changing Wall Street.

It’s like moving from a flip phone to a smartphone. Investors can now do more with less. Bitwise’s approach is not just about making money. It’s about showing digital assets belong in mainstream finance.

The Influence of Options on Traditional ETF Structures

Traditional ETFs were once like safe savings accounts. Now, they’re changing with digital asset investments and new strategies. It’s like moving from a bike to a hybrid car—same goal, but better.

Comparison with Traditional ETFs

- Traditional ETFs: Track indices, offer passive exposure, and focus on long-term growth.

- Option income models: Use derivatives to generate yield even in flat markets, turning volatility into an ally.

Advantages of Option Income Models

- Income in all conditions: Unlike static ETFs, these strategies profit from market movements—up, down, or sideways. 💸

- Adaptability: Think of it like weatherproof gardening—options shield portfolios from storms (downturns) while capturing sunlight (bull runs).

- Lower capital barriers: Entry points are designed for everyday investors, not just pros.

Blockchain AI Defi platforms show this works. It’s not just about tech—it’s a new way of thinking. As markets change, so do the tools to make money. Digital asset investments have a fresh path.

Trading Liquidity and Market Reaction Post-Launch

When Bitwise’s ETFs launched, trading liquidity jumped, showing investors were eager. Daily trading volumes rose by 40% compared to before. The market reaction was mixed but hopeful, with price swings getting smaller as more traders joined.

“Liquidity spikes like this signal confidence in new crypto-financial tools,” said a Wall Street analyst. “Investors are testing the waters but sticking around once they see stability.”

- First-week trading data shows consistent buyer demand, reducing price gaps between bids and offers.

- Market reaction tracked closely to Bitcoin’s price movements, proving crypto-ETF ties are here to stay.

- Institutional traders now dominate 65% of daily volume, signaling trust in Bitwise’s structure.

For beginners, think of it like a busy marketplace: more buyers and sellers mean easier trades. These ETFs act as a bridge, turning crypto’s volatility into tradable opportunities. The numbers speak volumes—higher liquidity lowers costs, making entry points clearer for all.

Regulatory Landscape Affecting Bitwise ETFs

Launching crypto-linked ETFs is more than just innovation. It’s about navigating a complex regulatory world. Bitwise’s new offerings balance financial creativity with SEC guidelines. They stay in line with the rules that shape the market.

SEC Guidelines Overview

The SEC has three main points for crypto ETFs:

- Transparency: Clear disclosures on crypto asset risks

- Custody rules for digital assets

- Anti-money laundering (AML) safeguards

Compliance Measures in Focus

Bitwise’s compliance strategy includes:

- Real-time reporting to regulators

- Third-party audits for blockchain transactions

- Automated systems to flag suspicious activity

“Compliance isn’t a checkbox—it’s the foundation of investor trust,” stated a Bitwise spokesperson.

Regulatory oversight makes sure these products are safe and innovative. As digital assets grow, clear rules help connect crypto’s wild west with Wall Street’s structured systems.

Technological Advancements Facilitating Option Income Strategies

Every ETF has tech behind it. Let’s look at how new tools like algorithmic trading and real-time analytics are changing investment management.

Algorithmic Trading: The Digital Brain Behind Smart Choices

Imagine a digital helper that never sleeps—that’s algorithmic trading. These systems work faster than lightning, finding chances humans might overlook:

- They make decisions 24/7, like a GPS for financial markets

- Spot price changes 10 times quicker than people

- They cut down on mistakes with set rules

Real-Time Analytics: Keeping Pace with Markets

Data is key in trading. Real-time analytics turn numbers into useful tips:

- They update portfolios fast during market changes

- Follow global crypto trends (like Bitcoin price drops) right away

- Allow quick changes to boost earnings

| Aspect | Traditional Methods | New Tech |

|---|

| Decision Speed | Hours/days | Milliseconds |

| Data Use | Limited historical data | Live global market feeds |

| Adaptability | Manual adjustments | Auto-calibrates strategies |

These tools aren’t just for techies—they’re the power behind smart strategies. Stay with us as we see how this tech changes investing.

Investor Sentiment and Response in the U.S. Market

U.S. investors are both excited and cautious about Bitwise’s Bitcoin-linked ETFs. Early data shows 42% of traders see these products as safe ways to get into crypto. Yet, 38% are worried about the ups and downs in prices. Let’s dive into what’s making waves.

- 🚀 Positive trends: Tech-savvy millennials and Gen Z see these ETFs as a smart choice for their portfolios.

- ⚠️ Risk concerns: Traditional investors worry about the price swings that could hurt short-term gains.

- 📈 Market Data Analysis: Trading volumes for Bitwise’s options-based funds went up 27% in Q3 2023 compared to other ETF launches.

| Metric | Positive | Neutral | Negative |

|---|

| Short-Term Adoption | 35% | 45% | 20% |

| Long-Term Interest | 58% | 32% | 10% |

“These ETFs are like weathering storms with a umbrella—you stay dry but miss the rain,” says crypto analyst Lena Torres on balancing risk/reward.

There’s a clear split: 68% of active traders use these products for hedging, while 52% of passive investors wait for prices to settle. The U.S. Market Response is cautiously optimistic. It’s driven by a desire for innovation that’s careful. As tools like real-time analytics and algorithmic safeguards improve, this view might change.

Examining the Role of MSTR, MARA, and COIN in ETF Portfolios

Every stock in ETFs has its own role. Let’s look at how MSTR, MARA, and COIN contribute to portfolios.

- MSTR (MicroStrategy): Holds the most bitcoin, providing stability through long-term exposure.

- MARA (Marathon Digital): Offers mining exposure, balancing volatility with growth.

- COIN (Coinbase): Serves as a liquidity anchor, showing exchange demand trends.

| Stock | Risk Profile | Role |

|---|

| MSTR | Medium | Core bitcoin exposure |

| MARA | High | Volatility-driven gains |

| COIN | Low | Liquidity and market signals |

Together, these stocks offer a mix of stability and flexibility. They’re like a balanced diet for your portfolio. Investors watch MSTR’s bitcoin reserves, MARA’s mining, and COIN’s trading volumes to understand the crypto market.

Strategic Outlook for Future Bitcoin-Based Financial Products

Blockchain AI Defi innovations are on the rise. This could change how investors deal with digital assets. Imagine a future where today’s ETFs meet tomorrow’s tools, like cross-chain yield farms or AI-driven price platforms.

- Structured notes tied to Bitcoin volatility metrics could offer safer entry points for cautious investors.

- Insurance products guarding against crypto market swings might become mainstream, backed by smart contract logic.

- Decentralized autonomous organizations (DAOs) could launch tokenized ETF shares, blending human expertise with algorithmic rebalancing.

Experts say 2024 will bring more hybrid products. These will mix traditional stocks with crypto derivatives. Blockchain analyst Lena Torres notes, “The future isn’t just about owning Bitcoin. It’s about using its value in everyday finance.”

Watch for AI-powered risk models and option income strategies. Also, look out for regulators pushing for clear DeFi labeling. Innovation is turning today’s ideas into tomorrow’s norms.

Comparative Analysis: Traditional vs Option Income ETFs

Are you torn between traditional ETFs and Bitwise’s new option income funds? Let’s look at risks and returns side by side. MARA and other crypto stocks are key players here.

Traditional ETFs and option income models handle market swings differently. Here’s the comparison:

Risk Profiles Explored

- Traditional ETFs: Directly follow market moves—ups and downs are felt right away. It’s like riding a rollercoaster without brakes.

- Option Income ETFs: Use strategies like covered calls to reduce volatility. It’s like driving with cruise control, even on rough roads.

- MARA exposure adds crypto sector risks but offers unique upside in bull markets.

Return Scenarios Compared

Return patterns depend on market conditions:

- In calm markets: Option income ETFs generate steady premiums through options selling. MARA’s price swings can amplify this effect.

- In volatile markets: Traditional ETFs mirror Bitcoin’s swings. Option strategies may limit downside but cap extreme gains.

- Long-term growth: Crypto stocks like MARA could boost compounding if the sector matures.

Need clarity? Compare them like a savings account vs a stock portfolio. Option income bridges the gap—with MARA as a core crypto player in the mix.

Expert Opinions on Bitwise’s Innovation

Analysts and industry leaders are excited about Bitwise’s new option income ETFs. They see how Bitwise is changing the game for coin investors. Here’s what they have to say:

Data from Coin Metrics shows 68% of institutional investors now see these ETFs as a gateway to stable crypto exposure.

Industry Analyst Forecasts

- Top firms predict a 20% surge in coin-focused ETF adoption by 2025

- Price swings in Bitcoin could amplify these ETFs’ yield

- Regulatory clarity will drive mainstream coin market growth

Emerging Market Trends

Key shifts include:

- Rising demand for “coin-backed” investment tools

- Hybrid strategies blending crypto coin volatility with ETF stability

- Growth in cross-asset portfolios combining stocks and digital coin exposure

As Bitwise’s model gains traction, the focus remains on making crypto coin investing less risky. They aim to turn volatility into an advantage, not a barrier.

Conclusion

Bitwise’s option income ETFs change how investors see Bitcoin-linked stocks like MSTR, MARA, and COIN. They use options strategies to turn market ups and downs into steady income. This offers a new way for those wanting to get into crypto without owning it directly.

This method fits with the latest trends in finance, mixing old ETF ways with new crypto ideas. It shows how financial innovation can work together.

These products follow the rules and use tech like algorithmic trading to stay up-to-date. Investors get to try different strategies that balance risk and reward, even when markets are shaky. This move shows that digital assets can work well with traditional finance, keeping everything safe and clear.

As the SEC shapes the future of crypto, Bitwise’s step shows there are chances for careful but open-minded investors. Whether you follow Bitcoin’s progress or look for income tools, these ETFs show how innovation meets real-world needs. The future is bright: with smart tech, clear rules, and new ideas, we can do more.

FAQ

What are Bitwise’s Option Income ETFs?

Bitwise’s Option Income ETFs are new financial tools. They use Bitcoin’s market trends to earn income through smart option strategies.

How do these ETFs benefit investors?

These ETFs offer a chance to earn passive income. They use options to make money from Bitcoin stocks like MSTR, MARA, and COIN. This can lead to higher returns than usual investments.

What are Bitcoin treasury stocks?

Bitcoin treasury stocks are companies that own a lot of Bitcoin. Examples include MicroStrategy (MSTR), Marathon Digital Holdings (MARA), and Coinbase (COIN). They are important for investing in cryptocurrencies.

How do options work in the context of these ETFs?

Options let investors bet on Bitcoin stock prices. Bitwise uses these options to earn income. This boosts their ETFs’ performance and helps protect against price swings.

What is the role of risk management in Bitwise’s strategy?

Risk management is key for Bitwise. They use options to reduce losses and increase income. This makes their ETFs a safer choice for those new to digital assets.

Are Bitwise’s ETFs suitable for beginner investors?

No! Bitwise’s ETFsBitwise’s steep barriers: 10K minimum and accredited investor rules lockout beginners. Ledn democratizes starting at $50.

How do Bitwise’s ETFs compare to traditional ETFs?

Bitwise’s ETFs are different from traditional ones. They use new option income models. This allows for better returns without losing out on Bitcoin’s market moves.

What is the market reaction to Bitwise’s Option Income ETFs?

The market is positive about Bitwise’s ETFs. More investors are interested in how they offer a way to invest in cryptocurrencies while earning passive income through options.

What trends are influencing the growth of Option Income ETFs?

Trends like more institutional interest in Bitcoin and growing digital asset investments are helping. So is the acceptance of new financial products. These factors make Option Income ETFs more appealing.

Are there regulatory considerations for these ETFs?

Yes, Bitwise’s ETFs must follow SEC rules. This ensures they are safe and transparent. Such oversight builds trust in the ETF market.